Telus 2011 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

120 . TELUS 2011 ANNUAL REPORT

During 2011, the Company’s strategy, which was unchanged from

2010, included maintaining the financial policy set out in the following

schedule. The Company believes that its financial policies and guidelines,

which are reviewed annually, are currently at the optimal level and, by

maintaining credit ratings in the range of BBB+ to A–, or the equivalent,

provide reasonable access to capital.

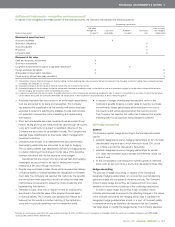

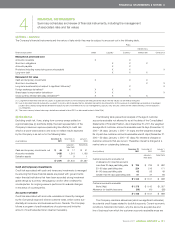

As at, or twelve-month periods ended, December 31 ($ in millions) Policy 2 0 11 2010

(adjusted –

Note 25(c))

Components of debt and coverage ratios

Net debt(1) $ß6,959 $ß6,869

EBITDA – excluding restructuring costs(2) $ß3,813 $ß3,730

Net interest cost(3) $ 377 $ 522

Debt ratio

Net debt to EBITDA – excluding restructuring costs 1.5–2.0 1.8 1.8

Coverage ratios

Earnings coverage(4) 5.1 3.6

EBITDA – excluding restructuring costs interest coverage(5) 10.1 7.1

Other measures

Dividend payout ratio of adjusted net earnings(6) 64% 64%

Dividend payout ratio 62% 64%

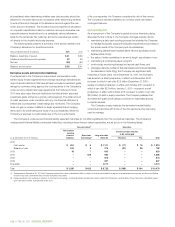

(1) Net debt is calculated as follows:

2 0 11 2010

Long-term debt (Note 20) $ß6,574 $ß6,056

Debt issuance costs netted against long-term debt 27 28

Derivative liabilities, net – 404

Accumulated other comprehensive income amounts

arising from financial instruments used to manage

interest rate and currency risks associated with

U.S. dollar denominated debt (excluding tax effects) – (2)

Cash and temporary investments, net (46) (17)

Short-term borrowings 404 400

Net debt $ß6,959 $ß6,869

(2) EBITDA – excluding restructuring costs is calculated as follows:

2 0 11 2010

(adjusted –

Note 25(c))

EBITDA (Note 5) $ß3,778 $ß3,650

Restructuring costs (Note 19(b)) 35 80

EBITDA – excluding restructuring costs $ß3,813 $ß3,730

(3) Net interest cost is defined as financing costs before gains on redemption and

repayment of debt, calculated on a twelve-month trailing basis (losses recorded

on the redemption of long-term debt, if any, are included in net interest cost).

(4) Earnings coverage is defined as net income before interest expense on long-term

debt and income tax expense, divided by interest expense on long-term debt

(including losses recorded on the redemption of long-term debt, if any).

(5) EBITDA – excluding restructuring costs interest coverage is defined as EBITDA –

excluding restructuring costs divided by net interest cost. This measure is substantially

the same as the coverage ratio covenant in the Company’s credit facilities.

(6) Adjusted net earnings attributable to Common Shares and Non-Voting Shares is

calculated as follows:

2 0 11 2010

(adjusted –

Note 25(c))

Net income attributable to Common Shares

and Non-Voting Shares $ß1,219 $ß1,048

Income tax-related adjustments (21) (30)

Loss on redemption of long-term debt,

net of income taxes – 37

Gain on 51% Transactel (Barbados) Inc. interest

re-measured at acquisition-date fair value

and subsequent adjustment to contingent

consideration, net of income taxes (12) –

Impacts of share options with the net-cash

settlement feature, net of income taxes (14) (7)

Adjusted net earnings attributable to

Common Shares and Non-Voting Shares $ß1,172 $ß1,048

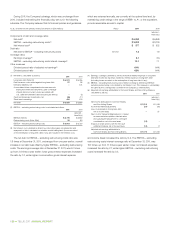

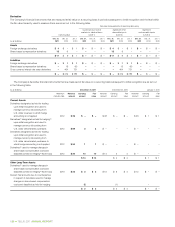

The net debt to EBITDA – excluding restructuring costs ratio was

1.8 times at December 31, 2011, unchanged from one year earlier; a small

increase in net debt was offset by higher EBITDA – excluding restructuring

costs. The earnings coverage ratio at December 31, 2011, was 5.1 times,

up from 3.6 times a year earlier; lower gross interest expenses increased

the ratio by 1.3, while higher income before gross interest expense

and income taxes increased the ratio by 0.2. The EBITDA – excluding

restructuring costs interest coverage ratio at December 31, 2011, was

10.1 times, up from 7.1 times a year earlier; lower net interest expenses

increased the ratio by 2.7, while higher EBITDA – excluding restructuring

costs increased the ratio by 0.3.