Telus 2011 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS 2011 ANNUAL REPORT . 59

MANAGEMENT’S DISCUSSION & ANALYSIS: 5

Trends

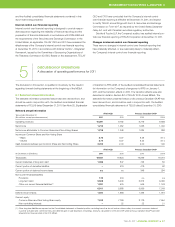

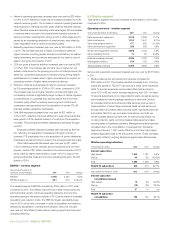

The consolidated revenue trend principally reflects: (i) year-over-year

growth in wireless network revenues generated from a growing subscriber

base and increasing ARPU; (ii) increased wireless equipment revenues;

and (iii) growth in wireline data revenues, which now more than offsets

declining legacy wireline voice and other service and equipment revenues.

Beginning in 2011, newly consolidated Transactel operations and acquired

wireless dealership businesses added revenue of $13 million, $13 million,

$13 million and $11 million, respectively, in the fourth, third, second and

first quarters, while impacts to Net income were insignificant.

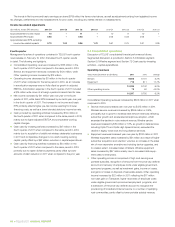

Wireless network revenue reflects growing data revenue (47% growth

in 2011), partly offset by declining voice revenue (a 4.1% decrease in

2011). Data growth reflects increased use of data plans and growth

in data consumption driven by increasing smartphone adoption, as well

as increased roaming revenues. The growing demand for wireless data

may challenge network and spectrum capacity in the future. Year-

over-year growth rates for data ARPU were 35%, 44%, 39% and 35%,

respectively, in the fourth, third, second and first quarters of 2011, and

27%, 21%, 19% and 17%, respectively, for the fourth, third, second

and first quarters of 2010. Recent moderation in the data ARPU growth

trend is a result of competitive pressures on data driving bigger included-

data buckets in rate plans, and an increasing number of unlimited

messaging rate plans, as well as a jump in smartphone adoption and

corresponding increase in usage in the latter part of 2010. Decreasing

voice revenues reflect accelerating declines in voice ARPU, which

decreased year over year in 2011 by 12%, 10%, 9.3% and 5.8%, respec-

tively, for the fourth, third, second and first quarters of 2011. This

reversed

an improving trend in 2010, where year-over-year declines in voice ARPU

were 5.2%, 6.7%, 7.2% and 9.5%, respectively, for the fourth, third, second

and first quarters of 2010. Blended ARPU has increased

year over year

for five consecutive quarters, at 1.0%, 3.0%, 2.5%, 3.7%

and 1.9%,

respectively, for the fourth, third, second and first quarters

of 2011 and

the fourth quarter of 2010, following several years of declines.

Wireless equipment revenues have generally increased year over year

due to higher subscriber acquisition volumes, higher retention volumes

and device upgrade revenues, as well as an increasing proportion of more

expensive smartphones in the sales mix.

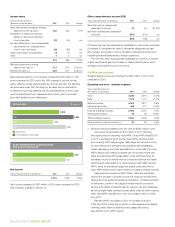

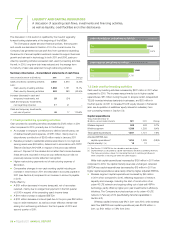

There is significant third and fourth quarter seasonality with respect

to higher wireless subscriber additions, related acquisition costs and

equipment sales, and higher retention costs due to contract renewals.

Wireless EBITDA typically decreases in the fourth quarter as a result

of heightened competitive intensity. Subscriber additions have typically

been lowest in the first quarter. In addition, wireless ARPU has generally

risen sequentially in the second and third quarters, and declined

sequentially in the fourth and first quarters.

The positive wireline revenue trend reflects data revenue growth

resulting from continuing expansion of the TELUS TV subscriber base

(up 62% in 2011) and price increases, as well as growth in enhanced

data, Internet and managed workplace revenues, moderated by ongoing

declines in legacy basic data services. Growth in Internet revenues

includes expansion of the Optik High Speed Internet subscriber base

as a result of bundled offers with Optik TV, as well as rate increases.

A general trend of declining wireline voice revenues and network access

lines (NALs) is due to substitution to wireless and IP-based services,

as well as competition from VoIP service providers (including cable-TV

competitors), resellers and facilities-based competitors. Residential NAL

losses have moderated over the most recent six quarters – positively

impacted by Optik TV and Optik High Speed Internet services and

improved bundled service offers. While business NALs reflected year-

over-year growth in the first two quarters of 2011 due to implementation

of whole sale services, the general trend, as reflected in the third and

fourth quar ters of 2011, is a decline in business NALs due to increased

compe tition in the SMB market, as well as conversion of voice lines to

more efficient IP-based services. The primary cable-TV competitor in

Western Canada increased its promotional activity and incentives to win

back and protect its subscriber base in 2011, which could affect Optik

growth, NAL erosion rates, and costs of acquisition and retention in future.

A sequential increase in residential NAL losses in the fourth quarter of

2011 was due to this increased promotional activity.

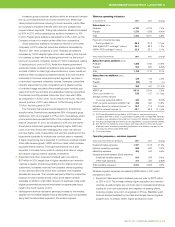

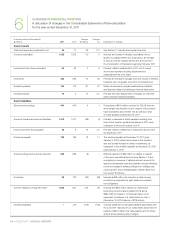

The trend in the Goods and services purchased expense reflects

increasing content and support costs for the growing TELUS Optik TV

subscriber base, increased costs of acquisition and retention for wireless

subscribers, as well as fourth quarter wireless expense seasonality

described above.

Employee benefits expense starting in the second quarter of 2011

reflects increases in full-time equivalent (FTE) staff resulting from the

acqui sition of Transactel and wireless dealership businesses, as well as

targeted hiring to support TV, business and wireless growth, partly offset

by lower employee-related restructuring costs and lower defined benefit

plan expenses. Employee benefits expenses in 2010 reflected decreasing

domestic FTE staff as a result of efficiency initiatives and attrition, partly

offset by compensation increases and increasing international FTE staff

to provide services for business customers and for internal purposes.

The sequential increase in depreciation and amortization expense in

the fourth quarter of 2011 resulted from a $19 million write-down of assets

in a foreign operation that were held for sale at December 31, 2011, as

well as an increase in capital assets to facilitate subscriber growth. The

sequential decrease in depreciation and amortization expenses in the

second quarter of 2010 included a reduced depreciation run rate for TV

set-top boxes resulting from an increase in their estimated useful lives,

and the effect of reduced capital expenditures in the first half of 2010.

Amortization expense in the second quarter of 2010 included a reduction

of approximately $5 million resulting from the recognition of investment

tax credits following determination of eligibility by taxation authorities for

assets capitalized in prior years that were fully amortized.

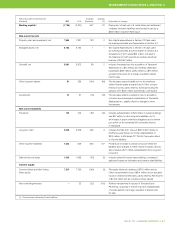

Financing costs for each period shown are net of varying amounts

of interest income, including interest from the settlement of prior years’

income tax-related matters. Quarterly financing costs in 2011 were lower

than in the same periods in 2010 mainly due to lower effective interest

rates as a result of refinancing activities in 2010 and 2011, as well as

the absence of an early redemption charge in 2011. Financing costs

in the third quarter of 2010 included a $15 million charge in respect of

final deter minations for the regulatory deferral account, as well as a

$52 million loss on early redemption of approximately 45% of the then

outstanding principal amount of 8% U.S. dollar Notes and unwinding

of related cross currency interest rate swap agreements. The partial

redemption was financed with a new lower-cost 10-year, $1 billion 5.05%

Note issue.