Telus 2011 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2011 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

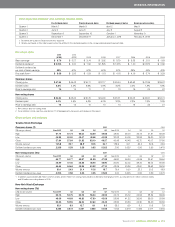

TELUS 2011 ANNUAL REPORT . 165

FINANCIAL STATEMENTS & NOTES: 25

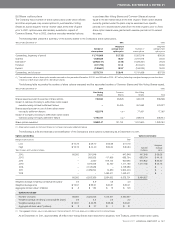

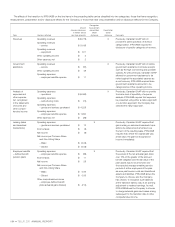

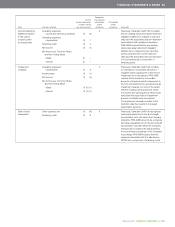

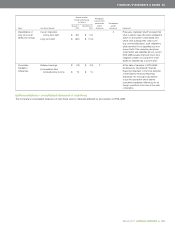

Topic

Recognition,

Amount measurement,

(increase (decrease), presentation Presentation

in millions except and/or and/or

Line items affected per share amounts) disclosure disclosure

Comments

Decommissioning

liabilities included

in the cost of

property, plant

and equipment

Operating expenses X

– goods and services purchased $ (4)

Operating expenses

– depreciation $ß 1

Financing costs $ß 4

Net income $ (1)

Net income per Common Share

and Non-Voting Share

– Basic $ß –

– Diluted $ß –

Previously, Canadian GAAP did not adjust

the pre-existing discounted asset retirement

obligation balance for changes in discount

rates and the associated discount accretion

was included with operations expenses.

IFRS-IASB requires that the pre-existing

discounted asset retirement obligation

balance be re-measured every reporting

period using the then current discount

rates and the associated discount accretion

is to be included as a component of

financing costs.

Impairment

of assets

Operating expenses X

– depreciation $ß 5

Income taxes $ (1)

Net income $ (4)

Net income per Common Share

and Non-Voting Share

– Basic $ß (0.01)

– Diluted $ß (0.01)

Previously, Canadian GAAP did not allow

for increases in recoverable amounts of

impaired assets subsequent to the time of

impairment to be recognized. IFRS-IASB

requires that increases in recoverable

amounts of impaired assets subsequent to

the time of impairment be recognized as an

impairment reversal, but only to the extent

that the resulting carrying amount would

not exceed the carrying amount that would

have been the result had an impairment

amount not initially been recognized.

The impair ment reversal recorded at the

transition date thus results in increased

depreciation expense.

Sale of trade

receivables

Other expense, net $ (8) X

Financing costs $ß 8

Previously, Canadian GAAP de-recognized

trade receivables sold to the arm’s-length

securitization trust with which the Company

transacts. IFRS-IASB does not de-recognize

the trade receivables sold to the arm’s-length

securitization trust with which the Company

transacts and considers the sale proceeds

to be short-term borrowings of the Company.

Accordingly, IFRS-IASB requires that the

expenses associated with the sale be pre-

sented

as a component of financing costs.