Duke Energy 2013 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

PART II

commodity instruments such as electricity, coal and natural gas forward

contracts to mitigate the effect of such fluctuations on operations. These

instruments are also used to optimize the value of the nonregulated generation

portfolio. Duke Energy’s primary use of energy commodity derivatives is to hedge

the generation portfolio against exposure to the prices of power and fuel.

The majority of instruments used to manage Duke Energy’s commodity

price exposure are either not designated as hedges or do not qualify for hedge

accounting. These instruments are referred to as undesignated contracts.

Mark-to-market changes for undesignated contracts entered into by regulated

businesses are reflected as regulatory assets or liabilities on the Consolidated

Balance Sheets. Undesignated contracts entered into by unregulated businesses

are marked-to-market each period, with changes in the fair value of the

derivative instruments reflected in earnings.

Duke Energy may also enter into other contracts that qualify for the NPNS

exception. When a contract meets the criteria to qualify as an NPNS, Duke

Energy applies such exception. Income recognition and realization related to

NPNS contracts generally coincide with the physical delivery of the commodity.

For contracts qualifying for the NPNS exception, no recognition of the contract’s

fair value in the Consolidated Financial Statements is required until settlement of

the contract as long as the transaction remains probable of occurring.

GENERATION PORTFOLIO RISKS

Duke Energy is primarily exposed to market price fluctuations of wholesale

power, natural gas, and coal prices in the Regulated Utilities and Commercial

Power segments. The Duke Energy Registrants optimize the value of their

wholesale and nonregulated generation portfolios. The portfolios include

generation assets, fuel, and emission allowances. Modeled forecasts of future

generation output and fuel requirements are based on forward power and fuel

markets. The component pieces of the portfolio are bought and sold based on

models and forecasts of generation in order to manage the economic value

of the portfolio in accordance with the strategies of the business units. For

the Regulated Utilities segment, the generation portfolio not utilized to serve

retail operations or committed load is subject to commodity price fluctuations.

However, the impact on the Consolidated Statements of Operations is partially

offset by mechanisms in these regulated jurisdictions that result in the sharing

of net profits from these activities with retail customers. The Commercial Power

nonregulated generation portfolio dispatches all of its electricity into unregulated

markets on a day-ahead and real-time basis and receives wholesale energy

margins and capacity revenues from PJM. Commercial Power has economically

hedged its forecasted coal-fired generation and a significant portion of its

forecasted gas-fired generation for 2014. Commercial Power also has long-term

economic hedges in place for a portion of expected coal and gas generation

through 2017 and 2018, respectively. Capacity revenues are 100 percent fixed

in PJM through May 2017. International Energy generally hedges its expected

generation using long-term bilateral power sales contracts when favorable

market conditions exist and it is subject to wholesale commodity price risks

for electricity not sold under such contracts. International Energy dispatches

electricity not sold under long-term bilateral contracts into unregulated markets

and receives wholesale energy margins and capacity revenues from national

system operators. Derivative contracts executed to manage generation portfolio

risks for delivery periods beyond 2014 are also exposed to changes in fair value

due to market price fluctuations of wholesale power, fuel oil and coal. See

“Sensitivity Analysis for Generation Portfolio and Derivative Price Risks” below,

for more information regarding the effect of changes in commodity prices on

Duke Energy’s net income.

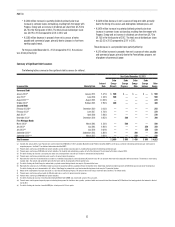

SENSITIVITY ANALYSIS FOR GENERATION PORTFOLIO AND DERIVATIVE

PRICE RISKS

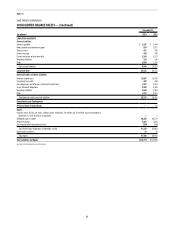

The table below summarizes the estimated effect of commodity price

changes on Duke Energy’s pretax net income, based on a sensitivity analysis

performed for the nonregulated generation portfolio. Forecasted exposure to

commodity price risk for the Regulated Utilities segment is not anticipated to

have a material adverse effect on Duke Energy’s results of operations in 2014.

The following commodity price sensitivity calculations consider existing

hedge positions and estimated production levels, as indicated in the table below,

but do not consider other potential effects that might result from such changes in

commodity prices.

Summary of Sensitivity Analysis for Generation Portfolio and Derivative Price Risks (in millions)

Generation Portfolio

Risks for 2014

As of December 31,(a)

Sensitivities for Derivatives

Beyond 2014

As of December 31,(b)

Potential effect on pretax net income assuming a 10% price change in 2013 2012 2013 2012

Forward wholesale power prices (per MWh) $11 $34 $158 $ 103

Forward coal prices (per ton) 411 ——

Gas prices (per MMBtu) 621 ——

(a) Amounts related to forward wholesale prices represent the potential impact of commodity price changes on forecasted economic generation which has not been contracted or hedged. Amounts related to forward coal prices

and forward gas prices represent the potential impact of commodity price changes on fuel needed to achieve such economic generation. Amounts exclude the impact of mark-to-market changes on undesignated contracts

relating to periods in excess of one year from the respective date.

(b) Amounts represent sensitivities related to derivative contracts executed to manage generation portfolio risks for periods beyond 2013. Amounts exclude the potential impact of commodity price changes on forecasted

economic generation and fuel needed to achieve such forecasted generation.

Interest Rate Risk

Duke Energy is exposed to risk resulting from changes in interest rates as

a result of its issuance of variable and fixed-rate debt and commercial paper.

Duke Energy manages interest rate exposure by limiting variable-rate exposures

to a percentage of total debt and by monitoring the effects of market changes

in interest rates. Duke Energy also enters into financial derivative instruments,

which may include instruments such as, but not limited to, interest rate swaps,

swaptions and U.S. Treasury lock agreements to manage and mitigate interest

rate risk exposure. See Notes 1, 6, 14, and 16 to the Consolidated Financial

Statements, “Summary of Significant Accounting Policies,” “Debt and Credit

Facilities,” “Derivatives and Hedging,” and “Fair Value Measurements.”

The paragraph below summarizes the potential effect of interest rate

changes on the Duke Energy Registrants’ pretax net income, based on a

sensitivity analysis performed as of December 31, 2013 and December 31,

2012.

At December 31, 2013, Duke Energy had no notional amounts of fixed-

to-floating hedges outstanding and no pre-issuance hedges outstanding. The

weighted average interest rate on $5,677 million of long-term and short-term

variable interest rate exposure that has not been hedged at December 31, 2013

was 1.45 percent.

These amounts were estimated by considering the impact of the

hypothetical interest rates on variable-rate securities outstanding, adjusted for

interest rate hedges, short-term and long-term investments, cash and cash