Duke Energy 2013 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

130

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

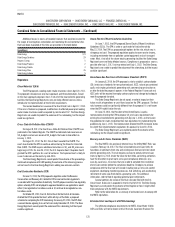

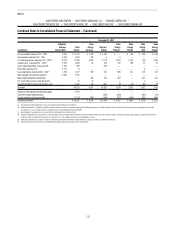

The following table presents future minimum lease payments under

capital leases.

December 31, 2013

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

2014 $ 171 $ 6 $ 47 $ 20 $ 26 $ 9 $ 5

2015 167 6 47 20 27 7 4

2016 169 6 47 21 26 6 4

2017 166 6 46 21 26 3 2

2018 176 6 45 21 25 3 2

Thereafter 1,453 25 475 261 213 2 28

Minimum annual

payments 2,302 55 707 364 343 30 45

Less amount

representing

interest (786) (27) (454) (275) (179) (3) (30)

Total $ 1,516 $ 28 $ 253 $ 89 $ 164 $ 27 $ 15

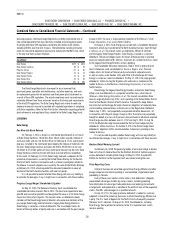

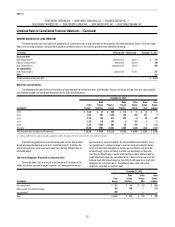

6. DEBT AND CREDIT FACILITIES

SUMMARY OF DEBT AND RELATED TERMS

The following tables summarize outstanding debt.

December 31, 2013

(in millions)

Weighted

Average

Interest Rate

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Unsecured debt, maturing 2014 - 2073 5.18 % $ 13,550 $ 1,157 $ 4,150 $ — $ 150 $ 805 $ 744

Secured debt, maturing 2014 - 2037 2.69 % 2,559 400 305 305 — — —

First mortgage bonds, maturing 2015 - 2043(a) 4.90 % 17,831 6,161 8,450 4,125 4,325 900 2,319

Capital leases, maturing 2014 - 2051(b) 5.23 % 1,516 30 327 148 179 27 20

Other debt, maturing 2027 4.77 % 8 — — — — 8 —

Tax-exempt bonds, maturing 2014 - 2041(c) 1.28 % 2,356 395 910 669 241 479 573

Notes payable and commercial paper(d) 1.02 % 1,289 — — — — — —

Money pool/intercompany borrowings — 300 1,213 462 181 43 150

Fair value hedge carrying value adjustment 9 9 — — — — —

Unamortized debt discount and premium, net(e) 1,977 (16) (27) (12) (9) (31) (10)

Total debt 41,095 8,436 15,328 5,697 5,067 2,231 3,796

Short-term notes payable and commercial paper (839) — — — — — —

Short-term money pool borrowings — — (1,213) (462) (181) (43) —

Current maturities of long-term debt (2,104) (47) (485) (174) (11) (47) (5)

Total long-term debt(f) $ 38,152 $ 8,389 $ 13,630 $ 5,061 $ 4,875 $ 2,141 $ 3,791

(a) Substantially all electric utility xed assets are mortgaged under mortgage bond indentures.

(b) Duke Energy includes $144 million and $838 million of capital lease purchase accounting adjustments related to Duke Energy Progress and Duke Energy Florida, respectively, related to power purchase agreements that are not

accounted for as leases in their nancial statements because of grandfathering provisions in GAAP.

(c) Substantially all tax-exempt bonds are secured by rst mortgage bonds or letters of credit.

(d) Includes $450 million that was classied as Long-term Debt on the Consolidated Balance Sheets due to the existence of long-term credit facilities that back-stop these commercial paper balances, along with Duke Energy’s

ability and intent to renance these balances on a long-term basis. The weighted-average days to maturity were 49 days.

(e) Duke Energy includes $2,067 million in purchase accounting adjustments related to the merger with Progress Energy. See Note 2 for additional information.

(f) Includes $1,966 million for Duke Energy, $400 million for Duke Energy Carolinas and $300 million for Progress Energy and Duke Energy Progress related to consolidated VIEs.