Duke Energy 2013 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

121

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

the optimal corporate structure is an ongoing evaluation of factors, such as

tax considerations, that may change between now and the transfer date. In

conjunction with the transfer, Duke Energy Ohio’s capital structure will be

restructured to reect appropriate debt and equity ratios for its regulated

operations. The transfer could instead be accomplished within a wholly owned

nonregulated subsidiary of Duke Energy Ohio depending on nal tax structuring

analysis. The FERC approved the application on September 5, 2012. Duke

Energy Ohio agreed to transfer the legacy coal-red and combustion gas turbine

assets on or before December 31, 2014.

Regional Transmission Organization (RTO) Realignment

Duke Energy Ohio including Duke Energy Kentucky, transferred control of

its transmission assets from MISO to PJM, effective December 31, 2011.

On December 22, 2010, the KPSC approved Duke Energy Kentucky’s

request to effect the RTO realignment, subject to a commitment not to seek

double-recovery in a future rate case of the transmission expansion fees that

may be charged by MISO and PJM in the same period or overlapping periods.

On May 25, 2011, the PUCO approved a settlement between Duke Energy

Ohio, Ohio Energy Group, The Ofce of Ohio Consumers’ Counsel and the

PUCO Staff related to Duke Energy Ohio’s recovery of certain costs of the RTO

realignment via a non-bypassable rider. Duke Energy Ohio is allowed to recover

all MISO Transmission Expansion Project (MTEP) costs, including but not limited

to Multi-Value Project (MVP) costs, directly or indirectly charged to Duke Energy

Ohio retail customers. Duke Energy Ohio will not recover any portion of the MISO

exit obligation, PJM integration fees, or internal costs associated with the RTO

realignment, and the rst $121 million of PJM transmission expansion costs

from Ohio retail customers. Duke Energy Ohio also agreed to vigorously defend

against any charges for MVP projects from MISO.

Upon its exit from MISO on December 31, 2011, Duke Energy Ohio

recorded a liability for its exit obligation and share of MTEP costs, excluding

MVP. This liability was recorded within Other in Current liabilities and Other

in Deferred credits and other liabilities on Duke Energy Ohio’s Consolidated

Balance Sheets.

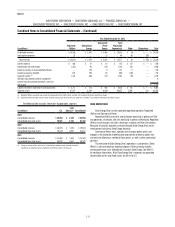

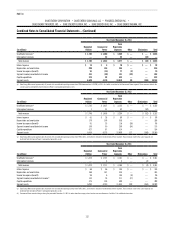

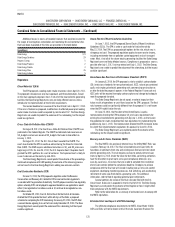

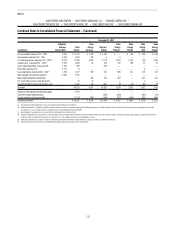

The following table provides a reconciliation of the beginning and ending

balance of Duke Energy Ohio’s recorded obligations related to its withdrawal

from MISO.

(in millions)

Balance at

December 31,

2012

Provision /

Adjustments

Cash

Reductions

Balance at

December 31,

2013(a)

Duke Energy Ohio $97 $ 2 $ (4) $ 95

(a) As of December 31, 2013, $74 million is recorded as a Regulatory asset on Duke Energy Ohio’s

Consolidated Balance Sheets.

MVP. MISO approved 17 MVP proposals prior to Duke Energy Ohio’s exit

from MISO on December 31, 2011. Construction of these projects is expected

to continue through 2020. Costs of these projects, including operating and

maintenance costs, property and income taxes, depreciation and an allowed

return, are allocated and billed to MISO transmission owners.

On December 29, 2011, MISO led a tariff with the FERC providing

for the allocation of MVP costs to a withdrawing owner based on monthly

energy usage. The FERC set for hearing (i) whether MISO’s proposed cost

allocation methodology to transmission owners who withdrew from MISO prior

to January 1, 2012 is consistent with the tariff at the time of their withdrawal

from MISO, and, (ii) if not, what amount of, and methodology for calculating

any MVP cost responsibility should be. On July 16, 2013, a FERC Administrative

Law Judge (ALJ) issued an initial decision. Under this initial decision, Duke

Energy Ohio would be liable for MVP costs. Duke Energy Ohio led exceptions

to the initial decision, requesting the FERC overturn the ALJ’s decision. After

reviewing the initial decision, along with all exceptions and responses led by

the parties, the FERC will issue a nal decision. Duke Energy Ohio fully intends

to appeal to the federal court of appeals if the FERC afrms the ALJ’s decision.

Duke Energy Ohio cannot predict the outcome of these proceedings.

In 2012, MISO estimated Duke Energy Ohio’s MVP obligation over the

period from 2012 to 2071 at $2.7 billion, on an undiscounted basis. The

estimated obligation is subject to great uncertainty including the ultimate cost

of the projects, the annual costs of O&M, taxes and return over the project lives

and the allocation to Duke Energy Ohio.

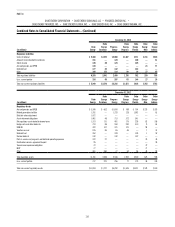

Duke Energy Indiana

Edwardsport IGCC Plant

On November 20, 2007, the IURC granted Duke Energy Indiana a

Certicate of Public Convenience and Necessity (CPCN) for the construction

of a 618 MW IGCC power plant at Duke Energy Indiana’s existing Edwardsport

Generating Station in Knox County, Indiana with a cost estimate of $1.985 billion

assuming timely recovery of nancing costs related to the project. On

January 25, 2008, Duke Energy Indiana received the nal air permit from

the Indiana Department of Environmental Management. The Citizens Action

Coalition of Indiana, Inc., Sierra Club, Inc., Save the Valley, Inc., and Valley

Watch, Inc., all intervenors in the CPCN proceeding (collectively, the Joint

Intervenors), appealed the air permit. A settlement related to the air permit was

reached on August 30, 2013. The air permit was not impacted by the provisions

of the settlement.

Duke Energy Indiana experienced design modications, quantity increases

and scope growth above what was anticipated from the preliminary engineering

design, which increased capital costs for the project. As a result, the projected

cost estimate increased throughout construction of the project and various

revised estimates were led with the IURC. In October 2012, Duke Energy

Indiana revised its latest projected cost estimate to $3.15 billion (excluding

AFUDC).

On December 27, 2012, the IURC approved a settlement agreement

(2012 Edwardsport settlement) related to the cost increase for the construction

of the project, including subdockets before the IURC related to the project. The

Ofce of Utility Consumer Counselor (OUCC), the Duke Energy Indiana Industrial

Group and Nucor Steel-Indiana were parties to the settlement. This settlement

agreement resolved all then pending regulatory issues related to the project. The

settlement agreement, as approved, capped costs to be reected in customer

rates at $2.595 billion, including estimated AFUDC through June 30, 2012.

Duke Energy Indiana is allowed to recover AFUDC after June 30, 2012, until

customer rates are revised, with such recovery decreasing to 85 percent on

AFUDC accrued after November 30, 2012. Duke Energy Indiana also agreed not

to request a retail electric base rate increase prior to March 2013, with rates in

effect no earlier than April 1, 2014.

The IURC modied the 2012 Edwardsport settlement as previously agreed

to by the parties to (i) require Duke Energy Indiana to credit customers for cost

control incentive payments the IURC found to be unwarranted as a result of

delays that arose from project cost overruns and (ii) provide that if Duke Energy

Indiana should recover more than the project costs absorbed by Duke Energy’s

shareholders through litigation, any surplus must be returned to the Duke Energy

Indiana’s ratepayers.