Duke Energy 2013 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

PART II

• A $436 million increase in quarterly dividends primarily due to an

increase in common shares outstanding, resulting from the merger with

Progress Energy and an increase in dividends per share from $0.765 to

$0.78 in the third quarter of 2013. The total annual dividend per share

was $3.09 in 2013 compared to $3.03 in 2012 and

• A $185 million decrease in proceeds from net issuances of notes

payable and commercial paper, primarily due to changes in short-term

working capital needs.

For the year ended December 31, 2012 compared to 2011, the variance

was driven primarily by:

• A $620 million decrease in net issuances of long-term debt, primarily

due to the timing of issuances and redemptions between years and

• A $420 million increase in quarterly dividends primarily due to an

increase in common shares outstanding, resulting from the merger with

Progress Energy and an increase in dividends per share from $0.75 to

$0.765 in the third quarter of 2012. The total annual dividend per share

was $3.03 in 2012 compared to $2.97 in 2011;

These decreases in cash provided were partially offset by:

• A $70 million increase in proceeds from net issuances of notes payable

and commercial paper, primarily due to the PremierNotes program, net

of paydown of commercial paper.

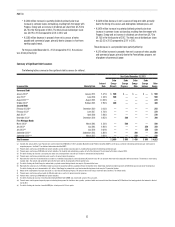

Summary of Significant Debt Issuances

The following tables summarize the significant debt issuances (in millions).

Year Ended December 31, 2013

Issuance Date Maturity Date

Interest

Rate

Duke

Energy

(Parent)

Duke

Energy

Progress

Duke

Energy

Ohio

Duke

Energy

Indiana

Duke

Energy

Unsecured Debt

January 2013(a) January 2073 5.125 % $ 500 $ — $ — $ — $ 500

June 2013(b) June 2018 2.100 % 500 — — — 500

August 2013(c)(d) August 2023 11.000 % — — — — 220

October 2013(e) October 2023 3.950 % 400 — — — 400

Secured Debt

February 2013(f)(g) December 2030 2.043 % — — — — 203

February 2013(f) June 2037 4.740 % — — — — 220

April 2013(h) April 2026 5.456 % — — — — 230

December 2013(i) December 2016 0.852 % — 300 — — 300

First Mortgage Bonds

March 2013(j) March 2043 4.100 % — 500 — — 500

July 2013(k) July 2043 4.900 % — — — 350 350

July 2013(k)(l) July 2016 0.619 % — — — 150 150

September 2013(m) September 2023 3.800 % — — 300 — 300

September 2013(m)(n) March 2015 0.400 % — — 150 — 150

Total Issuances $ 1,400 $ 800 $ 450 $ 500 $ 4,023

(a) Callable after January 2018 at par. Proceeds were used to redeem the $300 million 7.10% Cumulative Quarterly Income Preferred Securities (QUIPS) and to repay a portion of outstanding commercial paper and for general

corporate purposes. See Note 17 for additional information about the QUIPS.

(b) Proceeds were used to repay $250 million of current maturities and for general corporate purposes, including the repayment of outstanding commercial paper.

(c) Proceeds were used to repay $200 million of current maturities. The maturity date included above applies to half of the instrument. The remaining half matures in August 2018.

(d) The debt is floating rate based on a consumer price index and an overnight funds rate in Brazil. The debt is denominated in Brazilian Real.

(e) Proceeds were used to repay commercial paper as well as for general corporate purposes.

(f) Represents the conversion of construction loans related to a renewable energy project issued in December 2012 to term loans. No cash proceeds were received in conjunction with the conversion. The term loans have varying

maturity dates. The maturity date presented represents the latest date for all components of the respective loans.

(g) The debt is floating rate. Duke Energy has entered into a pay fixed-receive floating interest rate swap for 95 percent of the loans.

(h) Represents the conversion of a $190 million bridge loan issued in conjunction with the acquisition of Ibener in December 2012. Duke Energy received incremental proceeds of $40 million upon conversion of the bridge loan.

The debt is floating rate and is denominated in U.S. dollars. Duke Energy has entered into a pay fixed-receive floating interest rate swap for 75 percent of the loan.

(i) Relates to the securitization of accounts receivable at a subsidiary of Duke Energy Progress; the proceeds were used to repay short-term debt. See Note 17 for further details.

(j) Proceeds were used to repay notes payable to affiliated companies as well as for general corporate purposes.

(k) Proceeds were used to repay $400 million of current maturities.

(l) The debt is floating rate based on 3-month London Interbank Offered Rate (LIBOR) and a fixed credit spread of 35 basis points.

(m) Proceeds were used for general corporate purposes including the repayment of short-term notes payable, a portion of which was incurred to fund the retirement of $250 million of first mortgage bonds that matured in the first

half of 2013.

(n) The debt is floating rate based on 3-month LIBOR plus a fixed spread of 14 basis points.