Duke Energy 2013 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

through increasing income taxes payable, reducing income tax refunds

receivable or changing deferred taxes.

Tax-related interest and penalties are recorded in Interest Expense and

Other Income and Expenses, net, in the Consolidated Statements of Operations.

See Note 22 for further information.

Accounting for Renewable Energy Tax Credits and Grants

When Duke Energy elects either an ITC or a cash grant on wind or solar

facilities, it reduces the basis of the property recorded on the Consolidated

Balance Sheets by the amount of the ITC or cash grant and, therefore, the ITC or

grant benet is recognized through reduced depreciation expense. Additionally,

certain tax credits and government grants received provide for initial tax

depreciable base in excess of the book carrying value equal to one half of the

ITC or government grant. Deferred tax benets are recorded as a reduction to

income tax expense in the period that the basis difference is created.

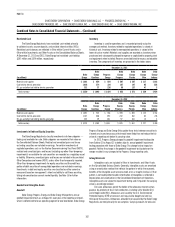

Excise Taxes

Certain excise taxes levied by state or local governments are required to

be paid even if not collected from the customer. These taxes are recognized on a

gross basis. Otherwise, the taxes are accounted for net. Excise taxes accounted

for on a gross basis as Property and other taxes in the Consolidated Statements

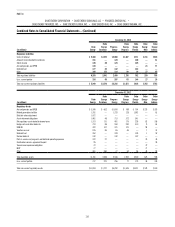

of Operations were as follows.

Years Ended December 31,

(in millions) 2013 2012 2011

Duke Energy $ 602 $ 466 $ 293

Duke Energy Carolinas 164 161 153

Progress Energy 304 317 315

Duke Energy Progress 115 113 110

Duke Energy Florida 189 205 205

Duke Energy Ohio 105 102 109

Duke Energy Indiana 29 33 31

On July 23, 2013, North Carolina House Bill 998 (HB 998) was signed

into law. HB 998 repeals the utility franchise tax effective July 1, 2014. The

utility franchise tax was 3.22 percent gross receipts tax on sales of electricity.

The result of this change in law will be an annual reduction in excise taxes

of approximately $160 million for Duke Energy Carolinas and approximately

$110 million for Duke Energy Progress. HB 998 also increases sales tax on

electricity from 3 percent to 7 percent effective July 1, 2014. HB 998 requires

the NCUC to adjust retail electric rates for the elimination of the utility franchise

tax, changes due to the increase in sales tax on electricity, and the resulting

change in liability of utility companies under the general franchise tax.

Foreign Currency Translation

The local currencies of most of Duke Energy’s foreign operations have

been determined to be their functional currencies. However, certain foreign

operations’ functional currency has been determined to be the U.S. Dollar, based

on an assessment of the economic circumstances of the foreign operation.

Assets and liabilities of foreign operations whose functional currency is not

the U.S. Dollar, are translated into U.S. Dollars at the exchange rates in effect

at period end. Translation adjustments resulting from changes in exchange

rates are included in AOCI. Revenue and expense accounts are translated at

average exchange rates during the year. Gains and losses arising from balances

and transactions denominated in currencies other than the local currency are

included in the results of operations when they occur.

Dividend Restrictions and Unappropriated Retained Earnings

Duke Energy does not have any legal, regulatory or other restrictions on

paying common stock dividends to shareholders. However, as further described

in Note 4, due to conditions established by regulators in conjunction with merger

transaction approvals, Duke Energy Carolinas, Duke Energy Progress, Duke

Energy Ohio and Duke Energy Indiana have restrictions on paying dividends or

otherwise advancing funds to Duke Energy. At December 31, 2013 and 2012, an

insignicant amount of Duke Energy’s consolidated Retained earnings balance

represents undistributed earnings of equity method investments.

NEW ACCOUNTING STANDARDS

The new accounting standards that were adopted for 2013, 2012 and

2011 had no signicant impact on the presentation or results of operations,

cash ows or nancial position of the Duke Energy Registrants. Disclosures

have been enhanced to provide a discussion and tables on derivative contracts

subject to enforceable master netting agreements and a table of quantitative

disclosures about unobservable inputs. See Notes 14 and 16 for further

information.

There are no Accounting Standards Updates that have been issued but not

yet adopted as of December 31, 2013, that are expected to signicantly impact

the presentation or results of operations, cash ows or nancial position or

disclosures of the Duke Energy Registrants.

2. ACQUISITIONS, DISPOSITIONS AND SALES OF OTHER

ASSETS

ACQUISITIONS

The Duke Energy Registrants consolidate assets and liabilities from

acquisitions as of the purchase date, and include earnings from acquisitions in

consolidated earnings after the purchase date.

Merger with Progress Energy

On July 2, 2012, Duke Energy completed its merger with Progress Energy,

a North Carolina corporation engaged in the regulated utility business of

generation, transmission and distribution and sale of electricity in portions of

North Carolina, South Carolina and Florida. As a result of the merger, Progress

Energy became a wholly owned subsidiary of Duke Energy.

The merger between Duke Energy and Progress Energy provides increased

scale and diversity with potentially enhanced access to capital over the long

term and a greater ability to undertake the signicant construction programs

necessary to respond to increasing environmental regulation, plant retirements

and customer demand growth. Duke Energy’s business risk prole is expected

to improve over time due to the increased proportion of the business that is

regulated. Additionally, cost savings, efciencies and other benets are expected

from the combined operations.