Duke Energy 2013 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

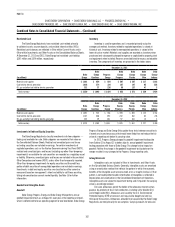

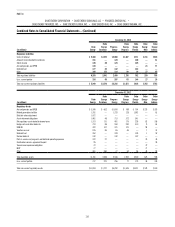

Purchase Price

Total consideration transferred was based on the closing price of Duke

Energy common shares on July 2, 2012, and was calculated as shown in the

following table.

(dollars in millions, except per share amounts; shares in thousands)

Progress Energy common shares outstanding at July 2, 2012 296,116

Exchange ratio 0.87083

Duke Energy common shares issued for Progress Energy common

shares outstanding

257,867

Closing price of Duke Energy common shares on July 2, 2012 $ 69.84

Purchase price for common stock $ 18,009

Fair value of outstanding earned stock compensation awards 62

Total purchase price $ 18,071

Progress Energy’s stock-based compensation awards, including

performance shares and restricted stock, were replaced with Duke Energy

awards upon consummation of the merger. In accordance with accounting

guidance for business combinations, a portion of the fair value of these awards

is included in the purchase price as it represents consideration transferred in

the merger.

Purchase Price Allocation

Fair value of assets acquired and liabilities assumed was determined

based on signicant estimates and assumptions, including Level 3 inputs,

which are judgmental in nature. Estimates and assumptions include the

projected timing and amount of future cash ows, discount rates reecting risk

inherent in future cash ows, and future market prices.

Additionally the February 5, 2013 announcement of the decision to

retire Crystal River Unit 3 reects additional information related to facts and

circumstances existing as of the acquisition date. See Note 4 for additional

information related to Crystal River Unit 3. As such, Duke Energy presents

assets acquired and liabilities assumed as if the retirement of Crystal River

Unit 3 occurred on the acquisition date.

The majority of Progress Energy’s operations are subject to the rate-

setting authority of the FERC, NCUC, PSCSC, and FPSC and are accounted

for pursuant to U.S. GAAP, including the accounting guidance for regulated

operations. Rate-setting and cost recovery provisions currently in place for

Progress Energy’s regulated operations provide revenues derived from costs,

including a return on investment of assets and liabilities included in rate base.

Except for long-term debt, asset retirement obligations, capital leases, pension

and other post-retirement benets (OPEB) plans, and the wholesale portion of

Crystal River Unit 3, fair values of tangible and intangible assets and liabilities

subject to these rate-setting provisions approximate their carrying values.

Accordingly, assets acquired and liabilities assumed and pro forma nancial

information do not reect any net adjustments related to these amounts. The

difference between fair value and pre-merger carrying amounts for long-term

debt, asset retirement obligations, capital leases and pension and OPEB plans

for regulated operations were recorded as Regulatory assets.

The excess of purchase price over estimated fair values of assets

acquired and liabilities assumed was recognized as goodwill at the acquisition

date. The goodwill reects the value paid primarily for long-term potential

for enhanced access to capital as a result of increased scale and diversity,

opportunities for synergies, and an improved risk prole. Goodwill resulting from

the merger was allocated entirely to the Regulated Utilities segment. None of

the goodwill recognized is deductible for income tax purposes, and as such, no

deferred taxes have been recorded related to goodwill.

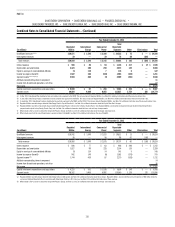

The completed purchase price allocation is presented in the following

table.

(in millions)

Current assets $ 3,204

Property, plant and equipment 23,141

Goodwill 12,469

Other long-term assets 9,990

Total assets 48,804

Current liabilities, including current maturities of long-term debt 3,593

Long-term liabilities, preferred stock and noncontrolling interests 10,394

Long-term debt 16,746

Total liabilities and preferred stock 30,733

Total purchase price $ 18,071

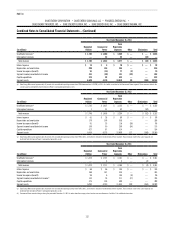

The purchase price allocation in the table above reects renements

made to preliminary fair values of assets acquired and liabilities assumed as

of December 31, 2012. These renements include adjustments associated

with the retirement of Crystal River Unit 3. The changes resulted in an increase

to Goodwill of $2 million, an increase to the fair value of Current liabilities,

including current maturities of long-term debt of $12 million, a decrease to

Property, plant and equipment of $138 million, a decrease to Other long-term

assets of $4 million and a decrease to Long-term liabilities, preferred stock

and noncontrolling interests of $152 million. These renements had no impact

on the amortization of purchase accounting adjustments recorded to earnings

during the year ended December 31, 2013, or for the six months ended

December 31, 2012.

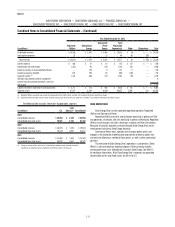

Pro Forma Financial Information

The following unaudited pro forma nancial information reects the

consolidated results of operations of Duke Energy and the amortization of

purchase price adjustments assuming the merger had taken place on January 1,

2011. The unaudited pro forma nancial information has been presented for

illustrative purposes only and is not necessarily indicative of the consolidated

results of operations that would have been achieved or future consolidated

results of operations of Duke Energy.

Non-recurring merger consummation, integration and other costs incurred

by Duke Energy and Progress Energy during the period have been excluded

from pro forma earnings presented below. After-tax non-recurring merger

consummation, integration and other costs incurred by both Duke Energy and

Progress Energy were $413 million and $85 million for the years ended 2012

and 2011, respectively. The pro forma nancial information also excludes

potential future cost savings or non-recurring charges related to the merger.

Years Ended December 31,

(in millions, except per share amounts) 2012 2011

Revenues $ 23,976 $ 23,445

Net Income Attributable to Duke Energy Corporation 2,417 2,397

Basic and Diluted Earnings Per Share 3.43 3.41