Duke Energy 2013 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

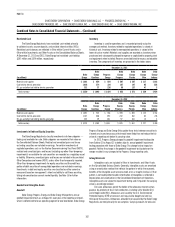

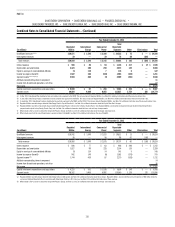

Combined Notes to Consolidated Financial Statements – (Continued)

allowances are based on the cost to acquire the allowances or, in the case

of a business combination, on the fair value assigned in the allocation of the

purchase price of the acquired business.

Renewable energy certicates are used to measure compliance with

renewable energy standards and are held primarily for consumption.

See Note 11 for further information.

Long-Lived Asset Impairments

The Duke Energy Registrants evaluate long-lived assets, excluding

goodwill, for impairment when circumstances indicate the carrying value of

those assets may not be recoverable. An impairment exists when a long-lived

asset’s carrying value exceeds the estimated undiscounted cash ows expected

to result from the use and eventual disposition of the asset. The estimated

cash ows may be based on alternative expected outcomes that are probability

weighted. If the carrying value of the long-lived asset is not recoverable

based on these estimated future undiscounted cash ows, the carrying value

of the asset is written-down to its then-current estimated fair value and an

impairment charge is recognized.

The Duke Energy Registrants assess fair value of long-lived assets

using various methods, including recent comparable third-party sales,

internally developed discounted cash ow analysis and analysis from outside

advisors. Signicant changes in commodity prices, the condition of an asset or

management’s interest in selling the asset are generally viewed as triggering

events to re-assess cash ows. See Note 11 for further information.

Property, Plant and Equipment

Property, plant and equipment are stated at the lower of depreciated

historical cost net of any disallowances or fair value, if impaired. The Duke Energy

Registrants capitalize all construction-related direct labor and material costs,

as well as indirect construction costs such as general engineering, taxes and

nancing costs. See “Allowance for Funds Used During Construction (AFUDC)

and Interest Capitalized” for information on capitalized nancing costs. Costs

of renewals and betterments that extend the useful life of property, plant and

equipment are also capitalized. The cost of repairs, replacements and major

maintenance projects, which do not extend the useful life or increase the expected

output of the asset, are expensed as incurred. Depreciation is generally computed

over the estimated useful life of the asset using the composite straight-line

method. Depreciation studies are conducted periodically to update composite

rates and are approved by state utility commissions and/or the FERC when

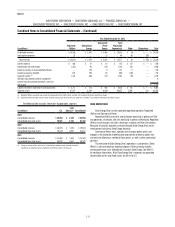

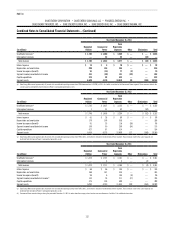

required. The composite weighted-average depreciation rates, excluding nuclear

fuel, are included in the table that follows.

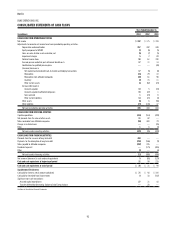

Years Ended December 31,

2013 2012 2011

Duke Energy 2.8

%2.9 %3.2 %

Duke Energy Carolinas 2.8

% 2.8 % 2.6 %

Progress Energy 2.5

% 2.6 % 2.3 %

Duke Energy Progress 2.5

% 2.7 % 2.1 %

Duke Energy Florida 2.4

% 2.5 % 2.4 %

Duke Energy Ohio 3.3 % 3.2 % 3.5 %

Duke Energy Indiana 2.8 % 3.3 % 3.4 %

In general, when the Duke Energy Registrants retire regulated property,

plant and equipment, original cost plus the cost of retirement, less salvage

value, is charged to accumulated depreciation. However, when it becomes

probable a regulated asset will be retired substantially in advance of its original

expected useful life or is abandoned, the cost of the asset and the corresponding

accumulated depreciation is recognized as a separate asset. If the asset is still

in operation, the net amount is classied as Generation facilities to be retired,

net on the Consolidated Balance Sheets. If the asset is no longer operating,

the net amount is classied in Regulatory Assets on the Consolidated Balance

Sheets. The carrying value of the asset is based on historical cost if the

Duke Energy Registrants are allowed to recover the remaining net book value and

a return equal to at least the incremental borrowing rate. If not, an impairment

is recognized to the extent the net book value of the asset exceeds the present

value of future revenues discounted at the incremental borrowing rate.

When the Duke Energy Registrants sell entire regulated operating units,

or retire or sell nonregulated properties, the original cost and accumulated

depreciation and amortization balances are removed from Property, Plant and

Equipment on the Consolidated Balance Sheets. Any gain or loss is recorded in

earnings, unless otherwise required by the applicable regulatory body.

See Note 10 for further information.

Nuclear Fuel

Nuclear fuel is classied as Property, Plant and Equipment on the

Consolidated Balance Sheets. Nuclear fuel in the front-end fuel processing

phase is considered work in progress and not amortized until placed in service.

Amortization of nuclear fuel is included within Fuel used in electric generation

and purchased power – regulated in the Consolidated Statements of Operations.

Amortization is recorded using the units-of-production method.

Allowance for Funds Used During Construction (AFUDC) and Interest

Capitalized

For regulated operations, the debt and equity costs of nancing the

construction of property, plant and equipment are reected as AFUDC and

capitalized as a component of the cost of property, plant and equipment. AFUDC

equity is reported on the Consolidated Statements of Operations as non-cash

income in Other income and expenses, net. AFUDC debt is reported as a non-

cash offset to Interest Expense. After construction is completed, the Duke Energy

Registrants are permitted to recover these costs through their inclusion in rate

base and the corresponding subsequent depreciation or amortization of those

regulated assets.

AFUDC equity, a permanent difference for income taxes, reduces the

effective tax rate when capitalized and increases the effective tax rate when

depreciated or amortized. See Note 22 for additional information.

For nonregulated operations, interest is capitalized during the

construction phase with an offsetting non-cash credit to Interest Expense on the

Consolidated Statements of Operations.

Asset Retirement Obligations

Asset retirement obligations are recognized for legal obligations

associated with the retirement of property, plant and equipment. Substantially

all asset retirement obligations are related to regulated operations. When

recording an asset retirement obligation, the present value of the projected

liability is recognized in the period in which it is incurred, if a reasonable

estimate of fair value can be made. The liability is accreted over time. The

present value of the liability is added to the cost of the associated asset and

depreciated over the remaining life of the asset.

The present value of the initial obligation and subsequent updates are

based on discounted cash ows, which include estimates regarding timing of