Duke Energy 2013 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

PART II

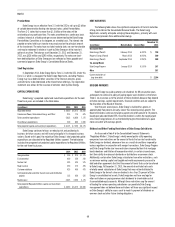

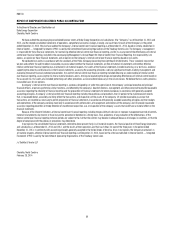

Year Ended December 31, 2012

Issuance Date Maturity Date

Interest

Rate

Duke

Energy

(Parent)

Duke

Energy

Carolinas

Progress

Energy

(Parent)

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Indiana

Duke

Energy

Unsecured Debt

March 2012(a) April 2022 3.15% $ — $ — $450 $ — $ — $ — $ 450

August 2012(b) August 2017 1.63% 700 — — — — — 700

August 2012(b) August 2022 3.05% 500 — — — — — 500

Secured Debt

April 2012(c) September 2024 2.64% 330 — — — — — 330

December 2012(d) March 2013 2.77% 203 — — — — — 203

December 2012(d) March 2013 4.74% 220 — — — — — 220

December 2012(e) June 2013 1.01% 190 — — — — — 190

December 2012(e) December 2025 1.56% 200 — — — — — 200

First Mortgage Bonds

March 2012(f) March 2042 4.20% — — — — — 250 250

May 2012(g) May 2022 2.80% — — — 500 — — 500

May 2012(g) May 2042 4.10% — — — 500 — — 500

September 2012(h) September 2042 4.00% — 650 — — — — 650

November 2012(i) November 2015 0.65% — — — — 250 — 250

November 2012(i) November 2042 3.85% — — — — 400 — 400

Total Issuances $2,343 $ 650 $450 $1,000 $650 $250 $5,343

(a) Proceeds were used to repay current maturities of $450 million.

(b) Proceeds were used to repay current maturities of $500 million, as well as for general corporate purposes, including the repayment of commercial paper.

(c) Proceeds were used to reimburse construction costs for DS Cornerstone, LLC joint venture wind projects. Debt was subsequently deconsolidated upon execution of a joint venture. See Note 17 for further details.

(d) Proceeds were used to fund the existing Los Vientos wind power portfolio.

(e) Debt issuances were executed in connection with the acquisition of Ibener. Both loans were collateralized with cash deposits equal to 101 percent of the loan amounts. See Note 2 for further details.

(f) Proceeds were used to repay a portion of outstanding short-term debt.

(g) Proceeds were used to repay current maturities of $500 million, a portion of outstanding commercial paper and notes payable to affiliated companies.

(h) Proceeds were used to repay current maturities of $420 million, as well as for general corporate purposes, including the funding of capital expenditures.

(i) Proceeds will be used to repay current maturities of $425 million, as well as for general corporate purposes.

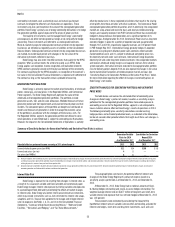

Off-Balance Sheet Arrangements

Duke Energy and certain of its subsidiaries enter into guarantee

arrangements in the normal course of business to facilitate commercial

transactions with third parties. These arrangements include performance

guarantees, stand-by letters of credit, debt guarantees, surety bonds and

indemnifications.

Most of the guarantee arrangements entered into by Duke Energy enhance

the credit standing of certain subsidiaries, non-consolidated entities or less

than wholly owned entities, enabling them to conduct business. As such, these

guarantee arrangements involve elements of performance and credit risk, which

are not always included on the Consolidated Balance Sheets. The possibility

of Duke Energy, either on its own or on behalf of Spectra Energy Capital, LLC

(Spectra Capital) through indemnification agreements entered into as part of

the January 2, 2007 spin-off of Spectra Energy Corp (Spectra Energy), having

to honor its contingencies is largely dependent upon the future operations of

the subsidiaries, investees and other third parties, or the occurrence of certain

future events.

Duke Energy performs ongoing assessments of their respective guarantee

obligations to determine whether any liabilities have been incurred as a result of

potential increased non-performance risk by third parties for which Duke Energy

has issued guarantees.

See Note 7 to the Consolidated Financial Statements, “Guarantees and

Indemnifications,” for further details of the guarantee arrangements.

Issuance of these guarantee arrangements is not required for the majority

of Duke Energy’s operations. Thus, if Duke Energy discontinued issuing these

guarantees, there would not be a material impact to the consolidated results of

operations, cash flows or financial position.

Other than the guarantee arrangements discussed above and normal

operating lease arrangements, Duke Energy does not have any material

off-balance sheet financing entities or structures. For additional information

on these commitments, see Note 5 to the Consolidated Financial Statements,

“Commitments and Contingencies.”