Duke Energy 2013 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

134

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

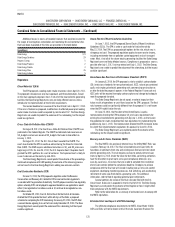

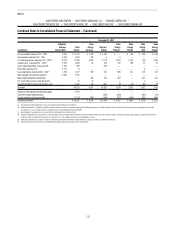

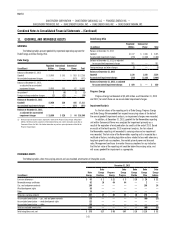

Year Ended December 31, 2012

Issuance Date Maturity Date

Interest

Rate

Duke

Energy

(Parent)

Duke

Energy

Carolinas

Progress

Energy

(Parent)

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Indiana

Duke

Energy

Unsecured Debt

March 2012(a) April 2022 3.15 % $ — $ — $ 450 $ — $ — $ — $ 450

August 2012(b) August 2017 1.63 % 700 ————— 700

August 2012(b) August 2022 3.05 % 500 ————— 500

Secured Debt

April 2012(c) September 2024 2.64 % 330 ————— 330

December 2012(d) March 2013 2.77 % 203 ————— 203

December 2012(d) March 2013 4.74 % 220 ————— 220

December 2012(e) June 2013 1.01 % 190 ————— 190

December 2012(e) December 2025 1.56 % 200 ————— 200

First Mortgage Bonds

March 2012(f) March 2042 4.20 % — — — — — 250 250

May 2012(g) May 2022 2.80 % — — — 500 — — 500

May 2012(g) May 2042 4.10 % — — — 500 — — 500

September 2012(h) September 2042 4.00 % — 650 ———— 650

November 2012(i) November 2015 0.65 % — — — — 250 — 250

November 2012(i) November 2042 3.85 % — — — — 400 — 400

Total Issuances $ 2,343 $ 650 $ 450 $ 1,000 $ 650 $ 250 $ 5,343

(a) Proceeds were used to repay current maturities of $450 million.

(b) Proceeds were used to repay current maturities of $500 million, as well as for general corporate purposes, including the repayment of commercial paper.

(c) Proceeds were used to reimburse construction costs for DS Cornerstone, LLC joint venture wind projects. Debt was subsequently deconsolidated upon execution of a joint venture. See Note 17 for further details.

(d) Proceeds were used to fund the existing Los Vientos wind power portfolio.

(e) Debt issuances were executed in connection with the acquisition of Ibener. Both loans were collateralized with cash deposits equal to 101 percent of the loan amounts. See Note 2 for further details.

(f) Proceeds were used to repay a portion of outstanding short-term debt.

(g) Proceeds were used to repay current maturities of $500 million, a portion of outstanding commercial paper and notes payable to afliated companies.

(h) Proceeds were used to repay current maturities of $420 million, as well as for general corporate purposes, including the funding of capital expenditures.

(i) Proceeds will be used to repay current maturities of $425 million, as well as for general corporate purposes.

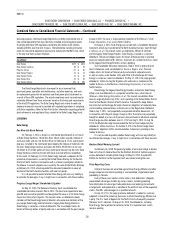

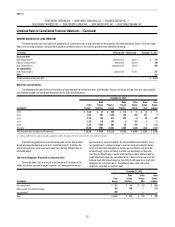

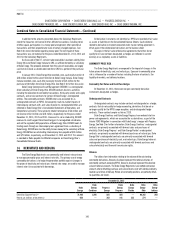

AVAILABLE CREDIT FACILITIES

Duke Energy has a master credit facility with a capacity of $6 billion

through December 2018. The Subsidiary Registrants, excluding Progress Energy

each have borrowing capacity under the master credit facility up to specied

sublimits for each borrower. Duke Energy has the unilateral ability at any time

to increase or decrease the borrowing sublimits of each borrower, subject to a

maximum sublimit for each borrower. The amount available under the master

credit facility has been reduced to backstop the issuances of commercial paper,

certain letters of credit and variable-rate demand tax-exempt bonds that may

be put to the Duke Energy Registrants at the option of the holder. The table

below includes the current borrowing sublimits and available capacity under the

master credit facility.

December 31, 2013

(in millions)

Duke

Energy

Duke

Energy

(Parent)

Duke

Energy

Carolinas

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Facility size(a) $ 6,000 $ 2,250 $ 1,000 $ 750 $ 650 $ 650 $ 700

Reduction to backstop issuances

Notes payable and commercial paper(b) (450) — (300) — — — (150)

Outstanding letters of credit (62) (55) (4) (2) (1) — —

Tax-exempt bonds (240) — (75) — — (84) (81)

Available capacity $ 5,248 $ 2,195 $ 621 $ 748 $ 649 $ 566 $ 469

(a) Represents the sublimit of each borrower at December 31, 2013. The Duke Energy Ohio sublimit includes $100 million for Duke Energy Kentucky.

(b) Duke Energy issued $450 million of commercial paper and loaned the proceeds through the money pool to Duke Energy Carolinas and Duke Energy Indiana. The balances are classied as long-term borrowings within

Long-term Debt in Duke Energy Carolinas’ and Duke Energy Indiana’s Condensed Consolidated Balance Sheets.