Duke Energy 2013 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

PART II

2013 FINANCIAL RESULTS

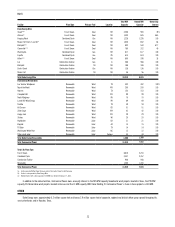

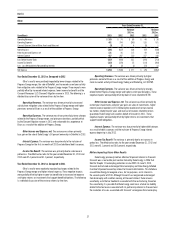

The following table summarizes adjusted earnings and net income

attributable to Duke Energy for the years ended December 31, 2013, 2012

and 2011.

Years Ended December 31,

2013 2012 2011

(in millions,

except per

share amounts) Amount

Per

diluted

share Amount

Per

diluted

share Amount

Per

diluted

share

Adjusted

earnings(a) $

3,071 $

4.35 $ 2,483 $ 4.32 $ 1,943 $ 4.38

Net income

attributable to

Duke Energy $

2,665 $

3.76 $ 1,768 $ 3.07 $ 1,706 $ 3.83

(a) See Results of Operations below for Duke Energy’s definition of adjusted earnings as well as a

reconciliation of this non-GAAP financial measure to net income attributable to Duke Energy.

Adjusted earnings increased from 2012 to 2013 primarily due to the

inclusion of a full year of Progress Energy results in 2013, the impact of the

revised rates, net of higher depreciation and amortization expense and lower

allowance for funds used during construction (AFUDC). Adjusted earnings

increased from 2011 to 2012 primarily due to the inclusion of Progress Energy’s

results beginning July 2012, and the impact of the 2011 Duke Energy Carolina’s

rate cases.

See “Results of Operations” below for a detailed discussion of the

consolidated results of operations, as well as a detailed discussion of financial

results for each of Duke Energy’s reportable business segments, as well as

Other.

2013 AREAS OF FOCUS AND ACCOMPLISHMENTS

In 2013, Duke Energy was focused on completing the fleet modernization

program, achieving constructive outcomes in its rate cases, resolving key

issues – including the future Crystal River Unit 3 nuclear station, improving

nuclear fleet performance, and realizing merger integration plans.

Completing the Fleet Modernization Program

During 2013, Duke Energy completed its $9 billion fleet modernization

program. This program added approximately 6,600 MW of new combined-cycle

natural gas and state-of-the-art coal capacity in North Carolina, South Carolina

and Indiana. This new generation will replace up to 6,700 MW of older coal and

oil plants, already retired or scheduled for retirement by 2015. The Edwardsport

IGCC and Sutton combined-cycle natural gas plant in Wilmington, North Carolina,

were placed in commercial service in June and November, respectively.

At Edwardsport, Duke Energy has been testing, tuning and optimizing the

unit. All major technology systems have been validated. Performance testing

was delayed in January by extreme weather, which also caused some equipment

issues that are being resolved. The Edwardsport IGCC project is expected to

achieve its full operational capabilities later this year and to be completed within

the revised cost estimate of $3.5 billion.

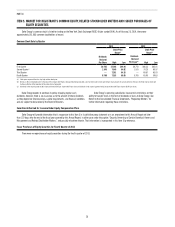

Achieving Constructive Outcomes in Rate Cases

Duke Energy reached constructive regulatory outcomes in all five of its

general rate cases to recover investments made to modernize its fleet. When

fully implemented, the base rate cases will add approximately $600 million

in annualized revenues, while keeping customers’ retail priced below national

averages.

Resolving Key Issues

Duke Energy also made the decision to retire Crystal River Unit 3, resolved

insurance claims with its insurance provider, Nuclear Electric Insurance Limited

(NEIL), and obtained approval from the FPSC of a comprehensive settlement.

This settlement agreement addressed cost recovery of the nuclear unit, Crystal

River 1 and 2 coal units, and the proposed Levy Nuclear Station (Levy). The

settlement agreement also provides for new generation in the latter half of this

decade to meet customer demand.

Improving Nuclear Fleet Performance

In 2013, Duke Energy’s nuclear fleet achieved a capacity factor of

92.8 percent, the 15th consecutive year with a capacity factor over 90 percent.

Duke Energy has made targeted investments at nuclear stations to bring the

entire fleet to consistent level of excellent performance. In particular, the

Robinson Nuclear Station (Robinson) completed a record continuous run of

531 days before beginning a scheduled refueling outage in September. This

complemented the record of continuous runs achieved at Oconee Nuclear Station

Unit 2 and Unit 3.

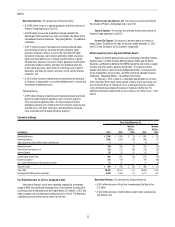

Realizing Merger Integration Plans

Duke Energy expects to exceed its original targets for fuel and joint-

dispatch savings, which benefit customers in North Carolina and South Carolina.

Through 2013, Duke Energy has recorded approximately $190 million of

cumulative fuel and joint-dispatch savings since the merger closed. In addition,

approximately 65 percent of the total guaranteed savings of $687 million have

been contractually locked-in or generated.

Duke Energy is also realizing cost synergies by eliminating duplicative

functions and has exceeded the original target of five to seven percent in

non-fuel operating and maintenance savings. Duke Energy is on pace to deliver

about nine percent, or approximately $550 million, of non-fuel operating and

maintenance expense in 2014.

2014 OBJECTIVES

Duke Energy is dedicated to the energy experience that customers value

and trust. Duke Energy strives for leadership and excellence that benefit

customers, shareholders and employees. Objectives for 2014 are:

• Continue to grow a zero-injury culture and deliver top-decile safety results,

• Develop and engage employees,

• Deliver new value by improving the customer experience and advancing

more flexible regulatory models,

• Establish a rigorous process for managing business and financial

performance to deliver customer value at a competitive price,

• Successfully complete 2014 integration milestones and continue

innovative use of technology to deliver value,

• Achieve 2014 financial goals, including delivering adjusted diluted EPS

guidance range of $4.45 - $4.60, and advance viable future growth

opportunities for regulated and nonregulated businesses, and

• Serve as a respected leading voice in helping to shape national and

state energy policies.

Due to the forward-looking nature of the adjusted diluted EPS range, information

to reconcile this non-GAAP financial measure to the most directly comparable

GAAP financial measure is not available at this time, as Duke Energy is unable

to forecast all special items, the mark-to-market impacts of economic hedges

in the Commercial Power segment, or any amounts that may be reported as

discontinued operations or extraordinary items for future periods.