Duke Energy 2013 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART I

14

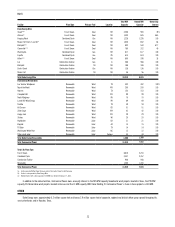

REGULATED UTILITIES

Regulated Utilities transmits and distributes electricity in Ohio. Regulated

Utilities also generates, transmits and distributes electricity in Kentucky.

Regulated Utilities also transports and sells natural gas in Ohio and Kentucky.

Duke Energy Ohio applies regulatory accounting to substantially all of the

operations in its Regulated Utilities operating segment.

Duke Energy Ohio’s Regulated Utilities service area covers 3,000 square

miles and supplies electric service to 830,000 residential, commercial and

industrial customers and provides regulated transmission and distribution

services for natural gas to 500,000 customers. See Item 2, “Properties” for

further discussion of Duke Energy Ohio’s Regulated Utilities generating facilities.

COMMERCIAL POWER

Commercial Power owns, operates and manages power plants and

engages in the wholesale marketing and procurement of electric power, fuel

and emission allowances related to these plants, as well as other contractual

positions. Commercial Power’s generation operations consist primarily of

coal-fired and gas-fired nonregulated generation assets located in the Midwest

region of the United States. The asset portfolio has a diversified fuel mix

with baseload and mid-merit coal-fired units as well as combined cycle and

peaking natural gas-fired units. Generation from the coal-fired and gas-fired

assets is dispatched into the PJM wholesale market. These assets earn energy

and capacity revenue at market prices. See Item 2, “Properties”, for further

discussion of Duke Energy Ohio’s Commercial Power generating facilities.

On February 17, 2014, Duke Energy Ohio announced that it had initiated

a process to exit its nonregulated Midwest generation business. Considering

a marketing period of several months and potential regulatory approvals,

Duke Energy Ohio expects to dispose of the nonregulated Midwest generation

business by early to mid-2015. In the first quarter of 2014, Duke Energy Ohio

will reclassify approximately $3.5 billion carrying value of its Midwest generation

business to assets held for sale and expects to record an estimated pretax

impairment charge of $1 billion to $2 billion to reduce the carrying value to

estimated sales proceeds less cost to sell.

Duke Energy Ohio is a PJM FRR entity through May 31, 2015. As an FRR

entity, Duke Energy Ohio is required to self-supply capacity for the Duke Energy

Ohio load zone.

See Note 4 to the Consolidated Financial Statements, “Regulatory

Matters,” for further discussion related to regulatory filings.

In 2013, 2012, and 2011 Duke Energy Ohio earned approximately

37 percent, 36 percent, and 24 percent, respectively, of its consolidated

operating revenues from PJM. These revenues relate to the sale of capacity and

electricity from all of Duke Energy Ohio’s nonregulated generation assets in 2013

and 2012 and its gas-fired nonregulated generation assets in 2011.

DUKE ENERGY INDIANA

Duke Energy Indiana generates, transmits and distributes electricity in

portions of Indiana. Duke Energy Indiana’s service area covers 23,000 square

miles and supplies electric service to 800,000 residential, commercial and

industrial customers. See Item 2, “Properties” for further discussion of Duke

Energy Indiana’s generating facilities, transmission and distribution. Duke Energy

Indiana is subject to the regulatory provisions of the IURC and FERC.

Substantially all of Duke Energy Indiana’s operations are regulated and

qualify for regulatory accounting. Duke Energy Indiana operates one reportable

business segment, Regulated Utility. For additional information regarding

this business segment, including financial information, see Note 3 to the

Consolidated Financial Statements, “Business Segments.”

ITEM 1A. RISK FACTORS

In addition to other disclosures within this Form 10-K, including

Management’s Discussion and Analysis – Matters Impacting Future Results

for each registrant in Item 7, and other documents filed with the SEC from time

to time, the following factors should be considered in evaluating Duke Energy

and its subsidiaries. Such factors could affect actual results of operations and

cause results to differ substantially from those currently expected or sought.

Unless otherwise indicated, risk factors discussed below generally relate to

risks associated with all of the Duke Energy Registrants. Risks identified at the

Subsidiary Registrant level are generally applicable to Duke Energy.

REGULATORY, LEGISLATIVE AND LEGAL RISKS

The Duke Energy Registrants’ regulated electric revenues, earnings and

results are dependent on state legislation and regulation that affect

electric generation, transmission, distribution and related activities, which

may limit their ability to recover costs.

The Duke Energy Registrants’ regulated utility businesses are regulated

on a cost-of-service/rate-of-return basis subject to statutes and regulatory

commission rules and procedures of North Carolina, South Carolina, Florida,

Ohio, Indiana and Kentucky. If the Duke Energy Registrants’ regulated utility

earnings exceed the returns established by the state utility commissions,

retail electric rates may be subject to review and possible reduction by the

commissions, which may decrease the Duke Energy Registrants’ future earnings.

Additionally, if regulatory bodies do not allow recovery of costs incurred in

providing service on a timely basis, the Duke Energy Registrants’ future earnings

could be negatively impacted.

If legislative and regulatory structures were to evolve in such a way that

the Duke Energy Registrants’ exclusive rights to serve their regulated customers

were eroded, their future earnings could be negatively impacted.

Deregulation or restructuring in the electric industry may result in

increased competition and unrecovered costs that could adversely affect

the Duke Energy Registrants’ financial position, results of operations or

cash flows and their utility businesses.

Increased competition resulting from deregulation or restructuring legislation

could have a significant adverse impact on the Duke Energy Registrants’ results of

operations, financial position, or cash flows. Retail competition and the unbundling

of regulated electric service could have a significant adverse financial impact

on the Duke Energy Registrants due to an impairment of assets, a loss of retail

customers, lower profit margins or increased costs of capital. The Duke Energy

Registrants cannot predict the extent and timing of entry by additional competitors

into the electric markets. The Duke Energy Registrants cannot predict if or when

they will be subject to changes in legislation or regulation, nor can they predict the

impact of these changes on their financial position, results of operations or cash

flows.

The Duke Energy Registrants’ businesses are subject to extensive federal

regulation that will affect their operations and costs.

The Duke Energy Registrants are subject to regulation by FERC, NRC, EPA

and various other federal agencies. Regulation affects almost every aspect of the

Duke Energy Registrants’ businesses, including, among other things, their ability

to: take fundamental business management actions; determine the terms and

rates of transmission and distribution services; make acquisitions; issue equity

or debt securities; engage in transactions with other subsidiaries and affiliates;

and pay dividends upstream to the Duke Energy Registrants. Changes to federal