Duke Energy 2013 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

173

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

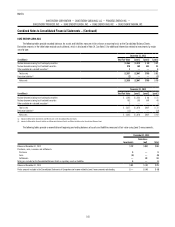

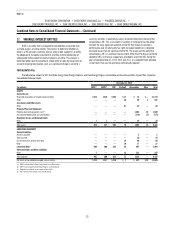

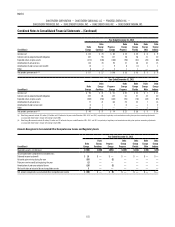

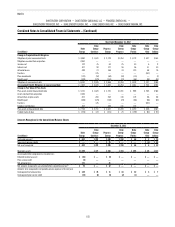

December 31, 2012

(in millions) DERF(a) CRC CinCapV Renewables Other Total

ASSETS

Current Assets

Restricted receivables of variable interest entities $ 637 $ 534 $ 15 $ 16 $ (1) $1,201

Other — — 4 133 2 139

Investments and Other Assets

Other — — 62 14 2 78

Property, Plant and Equipment

Property, plant and equipment, cost(b) — — — 1,543 15 1,558

Accumulated depreciation and amortization — — — (98) (5) (103)

Regulatory Assets and Deferred Debits

Other — — — 40 — 40

Total assets 637 534 81 1,648 13 2,913

LIABILITIES AND EQUITY

Current Liabilities

Accounts payable — — — 1 — 1

Notes payable and commercial paper — 312 — — — 312

Taxes accrued — — — 62 — 62

Current maturities of long-term debt — — 13 459 — 472

Other — — 4 25 — 29

Long-term Debt(c) 300 — 48 504 — 852

Deferred Credits and Other Liabilities

Deferred income taxes — — — 154 — 154

Asset retirement obligation — — — 23 — 23

Other — — 10 39 — 49

Total liabilities 300 312 75 1,267 — 1,954

Net assets of consolidated variable interest entities $ 337 $ 222 $ 6 $ 381 $ 13 $ 959

(a) DERF is consolidated by Duke Energy Carolinas and Duke Energy.

(b) Restricted as collateral for non-recourse debt of VIEs.

(c) Non-recourse to the general assets of Duke Energy.

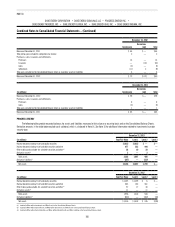

The obligations of these VIEs are non-recourse to Duke Energy, Duke Energy Carolinas and Duke Energy Progress. These entities have no requirement to provide

liquidity to purchase assets of, or guarantee performance of these VIEs unless noted in the following paragraphs.

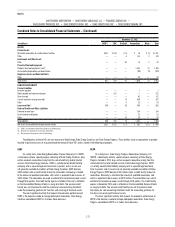

DERF

On a daily basis, Duke Energy Receivables Finance Company, LLC (DERF),

a bankruptcy remote, special purpose subsidiary of Duke Energy Carolinas, buys

certain accounts receivable arising from the sale of electricity and/or related

services from Duke Energy Carolinas. DERF is a wholly owned limited liability

company with a separate legal existence from its parent, and its assets are

not generally available to creditors of Duke Energy Carolinas. DERF borrows

$400 million under a credit facility to buy the receivables. Borrowing is limited

to the amount of qualified receivables sold, which is expected to be in excess of

$400 million. The receivables are used as collateral for commercial paper issued

through third parties. The credit facility expires in October 2016 and is reflected

on the Consolidated Balance Sheets as Long-term Debt. The secured credit

facility was not structured to meet the criteria for sale accounting treatment

under the accounting guidance for transfers and servicing of financial assets.

The most significant activity that impacts the economic performance of

DERF is the decisions made to manage delinquent receivables. Duke Energy

Carolinas consolidates DERF as it makes those decisions.

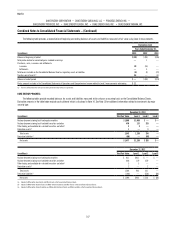

DEPR

On a daily basis, Duke Energy Progress Receivables Company, LLC

(DEPR), a bankruptcy remote, special purpose subsidiary of Duke Energy

Progress formed in 2013, buys certain accounts receivable arising from the

sale of electricity and/or related services from Duke Energy Progress. DEPR

is a wholly owned limited liability company with a separate legal existence

from its parent, and its assets are not generally available to creditors of Duke

Energy Progress. DEPR borrows $300 million under a credit facility to buy the

receivables. Borrowing is limited to the amount of qualified receivables sold,

which is expected to be in excess of $300 million. The receivables are used as

collateral for commercial paper issued through third parties. The credit facility

expires in December 2016 and is reflected on the Consolidated Balance Sheets

as Long-term Debt. The secured credit facility was not structured to meet

the criteria for sale accounting treatment under the accounting guidance for

transfers and servicing of financial assets.

The most significant activity that impacts the economic performance of

DEPR is the decisions made to manage delinquent receivables. Duke Energy

Progress consolidates DEPR as it makes those decisions.