Duke Energy 2013 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

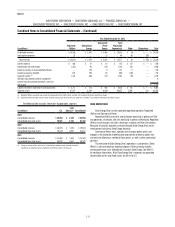

future cash ows, selection of discount rates and cost escalation rates, among

other factors. These estimates are subject to change. Depreciation expense is

adjusted prospectively for any changes to the carrying amount of the associated

asset. The Duke Energy Registrants receive amounts to fund the cost of the

asset retirement obligation for regulated operations through a combination of

regulated revenues and NDTF. As a result, the net of amounts recovered in

regulated revenues, earnings on the NDTF, accretion expense and depreciation

of the associated asset is deferred as a regulatory asset or liability.

Obligations for nuclear decommissioning are based on site-specic cost

studies. Duke Energy Carolinas and Duke Energy Progress assume prompt

dismantlement of the nuclear facilities after operations are ceased. Duke Energy

Florida assumes Crystal River Nuclear Station – Unit 3 (Crystal River Unit 3) will

be placed into a safe storage conguration until eventual dismantlement begins

in approximately 60 years. Duke Energy Carolinas, Duke Energy Progress and

Duke Energy Florida also assume that spent fuel will be stored on site until such

time that it can be transferred to a U.S. Department of Energy (DOE) facility.

See Note 9 for further information.

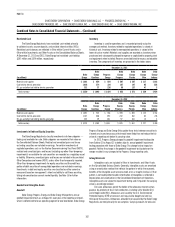

Revenue Recognition and Unbilled Revenue

Revenues on sales of electricity and gas are recognized when service is

provided. Unbilled revenues are recognized by applying customer billing rates to

the estimated volumes of energy delivered but not yet billed. Unbilled revenues

can vary signicantly from period to period as a result of seasonality, weather,

customer usage patterns and meter reading schedules.

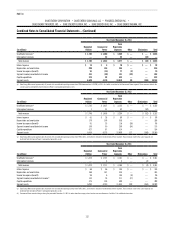

Unbilled revenues are included within Receivables and Restricted

receivables of variable interest entities on the Consolidated Balance Sheets as

shown in the following table.

December 31,

(in millions) 2013 2012

Duke Energy $ 937 $ 920

Duke Energy Carolinas 323 315

Progress Energy 189 187

Duke Energy Progress 120 112

Duke Energy Florida 69 74

Duke Energy Ohio 55 47

Duke Energy Indiana 5 3

Additionally, Duke Energy Ohio and Duke Energy Indiana sell, on a

revolving basis, nearly all of their retail and wholesale accounts receivable,

including receivables for unbilled revenues, to an afliate, Cinergy Receivables

Company, LLC (CRC) and account for the transfers of receivables as sales.

Accordingly, the receivables sold are not reected on the Consolidated Balance

Sheets of Duke Energy Ohio and Duke Energy Indiana. See Note 17 for further

information. These receivables for unbilled revenues are shown in the table

below.

December 31,

(in millions) 2013 2012

Duke Energy Ohio $89 $90

Duke Energy Indiana 144 132

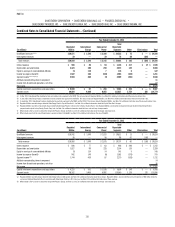

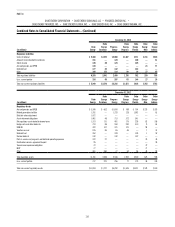

Allowance for Doubtful Accounts

Allowances for doubtful accounts are presented in the following table.

December 31,

(in millions) 2013 2012 2011

Allowance for Doubtful Accounts

Duke Energy $ 30 $ 34 $ 35

Duke Energy Carolinas 3 3 3

Progress Energy 14 16 27

Duke Energy Progress 10 9 9

Duke Energy Florida 4 7 18

Duke Energy Ohio 2 2 16

Duke Energy Indiana 1 1 1

Allowance for Doubtful Accounts — VIEs

Duke Energy $ 43 $ 44 $ 40

Duke Energy Carolinas 6 6 6

Derivatives and Hedging

Derivative and non-derivative instruments may be used in connection

with commodity price, interest rate and foreign currency risk management

activities, including swaps, futures, forwards and options. All derivative

instruments except those that qualify for the normal purchase/normal sale

(NPNS) exception are recorded on the Consolidated Balance Sheets at their

fair value. Qualifying derivative instruments may be designated as either cash

ow hedges or fair value hedges. Other derivative instruments (undesignated

contracts) either have not been designated or do not qualify as hedges. The

effective portion of the change in the fair value of cash ow hedges is recorded

in AOCI. The effective portion of the change in the fair value of a fair value hedge

is offset in net income by changes in the hedged item. For activity subject to

regulatory accounting, gains and losses on derivative contracts are reected as

regulatory assets or liabilities and not as other comprehensive income or current

period income. As a result, changes in fair value of these derivatives have no

immediate earnings impact.

Formal documentation, including transaction type and risk management

strategy, is maintained for all contracts accounted for as a hedge. At inception

and at least every three months thereafter, the hedge contract is assessed to

see if it is highly effective in offsetting changes in cash ows or fair values of

hedged items.

See Note 14 for further information.

Captive Insurance Reserves

Duke Energy has captive insurance subsidiaries that provide coverage,

on an indemnity basis, to the Subsidiary Registrants as well as certain third

parties, on a limited basis, for various business risks and losses, such as

property, workers’ compensation and general liability. Liabilities include

provisions for estimated losses incurred but not yet reported (IBNR), as well as

estimated provisions for known claims. IBNR reserve estimates are primarily

based upon historical loss experience, industry data and other actuarial

assumptions. Reserve estimates are adjusted in future periods as actual losses

differ from experience.