Duke Energy 2013 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

PART II

write-off of previously deferred costs related to the vendor not selected

costs for the Crystal River Unit 3 containment repair. These were

partially offset by the prior year reversal of accruals in conjunction with

the placement of Crystal River Unit 3 into extended cold shutdown in

accordance with the 2012 Settlement and higher charges associated

with related settlement matters; and

• A $32 million decrease in impairment charges at Duke Energy Progress

related to the merger with Duke Energy. These charges relate to planned

transmission project costs for which recovery is not expected, and

certain costs associated with mitigation sales pursuant to merger

settlement agreements with the FERC, partially offset by a current year

impairment charge resulting from the decision to suspend the

application for two proposed nuclear units at Harris.

Partially offset by:

• A $212 million increase in impairment and other charges at Duke Energy

Florida. In 2013, Duke Energy Florida recorded charges primarily related

to Crystal River Unit 3 and Levy. In 2012, Duke Energy Florida recorded

impairment and other charges related to the decision to retire Crystal

River Unit 3. See Note 4 to the Consolidated Financial Statements,

“Regulatory Matters,” for additional information; and

• A $138 million increase in depreciation and amortization at Duke Energy

Florida primarily due to higher nuclear cost-recovery amortization

related to Levy and a decrease in the reduction of the cost of removal

component of amortization expense as allowed under the 2012

Settlement.

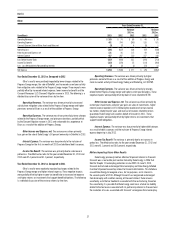

Other Income and Expenses, net. The variance was primarily due to

lower AFUDC equity resulting from to major projects placed in service in late

2012 and the retirement of Crystal River Unit 3.

Interest Expense. The variance was primarily due to the deferral of debt

costs recorded on the retail portion of the retired Crystal River Unit 3 assets,

partially offset by the charge to interest expense on the redemption of Progress

Energy’s 7.10% Cumulative Quarterly Income Preferred Securities (QUIPS) in

January 2013.

Income Tax Expense from Continuing Operations. The variance was

primarily due to an increase in pretax income. The effective tax rates for the

years ended December 31, 2013 and 2012 were 36.2 percent and 32.7 percent,

respectively. The increase in the effective tax rate is primarily due to the impact

of lower AFUDC equity and the Employee Stock Ownership Plan (ESOP) dividend

deduction being recorded at Duke Energy in 2012.

Discontinued Operations, net of tax. The variance was primarily due

to the impact of the U.S. Global, LLC (Global) settlement in 2012. See Note 5 to

the Consolidated Financial Statements, “Commitments and Contingencies,” for

additional information.

Matters Impacting Future Progress Energy Results

An appeal of a recently approved rate case is pending at the North Carolina

Supreme Court. The NCAG and NC WARN dispute the rate of return, capital

structure and other matters approved by the NCUC. The outcome of this appeal

could have an adverse impact to Progress Energy’s financial position, results of

operations and cash flows. See Note 4 to the Consolidated Financial Statements,

“Regulatory Matters,” for additional information.