Duke Energy 2013 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

141

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

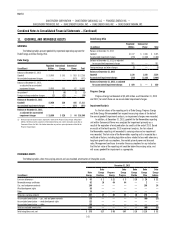

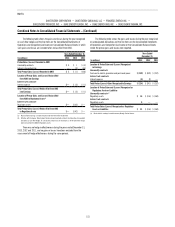

11. GOODWILL AND INTANGIBLE ASSETS

GOODWILL

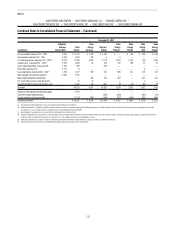

The following tables present goodwill by reportable operating segment for

Duke Energy and Duke Energy Ohio.

Duke Energy

(in millions)

Regulated

Utilities

International

Energy

Commercial

Power Total

Balance at December 31, 2012

Goodwill $ 15,950 $ 353 $ 933 $17,236

Accumulated impairment charges — — (871) (871)

Balance at December 31, 2012,

as adjusted for accumulated

impairment charges 15,950 353 62 16,365

Acquisitions(a) 2 (5) 2 (1)

Foreign exchange and other changes (2) (22) — (24)

Balance at December 31, 2013

Goodwill 15,950 326 935 17,211

Accumulated impairment charges — — (871) (871)

Balance at December 31, 2013,

as adjusted for accumulated

impairment charges $ 15,950 $ 326 $ 64 $16,340

(a) Amounts represent purchase price adjustments related to the Progress Energy merger at Regulated

Utilities, the Chilean hydro acquisition at International Energy and a minor renewables acquisition at

Commercial Power. See Note 2 for further information on purchase price adjustments related to the

Progress Energy merger.

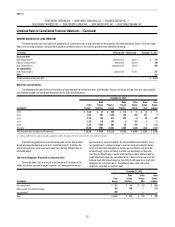

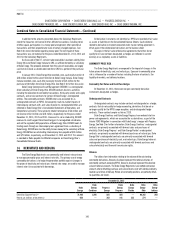

Duke Energy Ohio

(in millions)

Regulated

Utilities

Commercial

Power Total

Balance at December 31, 2012

Goodwill $1,137 $ 1,188 $ 2,325

Accumulated impairment charges (216) (1,188) (1,404)

Balance at December 31, 2012, as adjusted

for accumulated impairment charges 921 — 921

Foreign exchange and other changes (1) — (1)

Balance at December 31, 2013

Goodwill 1,136 1,188 2,324

Accumulated impairment charges (216) (1,188) (1,404)

Balance at December 31, 2013, as adjusted

for accumulated impairment charges $ 920 $ — $ 920

Progress Energy

Progress Energy had Goodwill of $3,655 million as of December 31, 2013

and 2012, for which there are no accumulated impairment charges.

Impairment Analysis

As the fair values of the reporting units of Duke Energy, Progress Energy

and Duke Energy Ohio exceeded their respective carrying values at the date of

the annual goodwill impairment analysis, no impairment charges were recorded.

In addition, at December 31, 2013, goodwill for the Renewables reporting

unit within Commercial Power was analyzed for impairment primarily as a

result of the expiration of wind production tax credits at the end of 2013. Based

on results of the fourth quarter 2013 impairment analysis, the fair value of

the Renewables reporting unit exceeded its carrying value and no impairment

was recorded. The fair value of the Renewables reporting unit is impacted by a

multitude of factors, including legislative actions related to tax credit extensions,

long-term growth rate assumptions, the market price of power and discount

rates. Management continues to monitor these assumptions for any indicators

that the fair value of the reporting unit could be below the carrying value, and

will assess goodwill for impairment as appropriate.

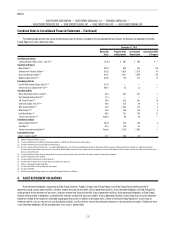

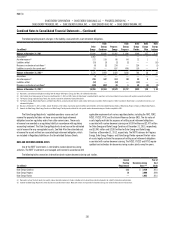

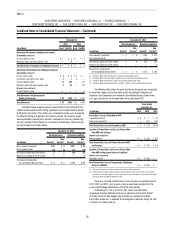

INTANGIBLE ASSETS

The following tables show the carrying amount and accumulated amortization of intangible assets.

December 31, 2013

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Emission allowances $ 63 $ 1 $ 21 $ 3 $ 18 $ 20 $ 21

Renewable energy certificates 82 16 64 64 — 2 —

Gas, coal and power contracts 180 — — — — 156 24

Wind development rights 86 — — — — — —

Other 76 — — — — — —

Total gross carrying amounts 487 17 85 67 18 178 45

Accumulated amortization — gas, coal and power contracts (73) — — — — (60) (13)

Accumulated amortization — wind development rights (12) — — — — — —

Accumulated amortization — other (24) — — — — — —

Total accumulated amortization (109) — — — — (60) (13)

Total intangible assets, net $ 378 $ 17 $ 85 $ 67 $ 18 $ 118 $ 32