Duke Energy 2013 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

135

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

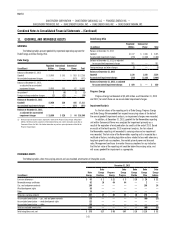

OTHER DEBT MATTERS

In September 2013, Duke Energy led a registration statement (Form S-3)

with the SEC. Under this Form S-3, which is uncapped, the Duke Energy

Registrants, excluding Progress Energy, may issue debt and other securities

in the future at amounts, prices and with terms to be determined at the time

of future offerings. The registration statement also allows for the issuance of

common stock by Duke Energy.

Duke Energy has an effective Form S-3 with the SEC to sell up to

$3 billion of variable denomination oating-rate demand notes, called

PremierNotes. The Form S-3 states that no more than $1.5 billion of the notes

will be outstanding at any particular time. The notes are offered on a continuous

basis and bear interest at a oating rate per annum determined by the Duke

Energy PremierNotes Committee, or its designee, on a weekly basis. The interest

rate payable on notes held by an investor may vary based on the principal

amount of the investment. The notes have no stated maturity date, are non-

transferable and may be redeemed in whole or in part by Duke Energy or at the

investor’s option at any time. The balance as of December 31, 2013 and 2012

was $836 million and $395 million, respectively. The notes are short-term debt

obligations of Duke Energy and are reected as Notes payable and commercial

paper on Duke Energy’s Consolidated Balance Sheets.

At December 31, 2013 and 2012, $811 million and $734 million,

respectively, of debt issued by Duke Energy Carolinas was guaranteed by Duke

Energy.

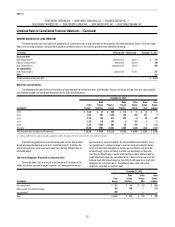

Money Pool

The Subsidiary Registrants, excluding Progress Energy receive support for

their short-term borrowing needs through participation with Duke Energy and

certain of its subsidiaries in a money pool arrangement. Under this arrangement,

those companies with short-term funds may provide short-term loans to

afliates participating in this arrangement. The money pool is structured such

that the Subsidiary Registrants, excluding Progress Energy separately manage

their cash needs and working capital requirements. Accordingly, there is no net

settlement of receivables and payables between money pool participants. Duke

Energy (Parent), may loan funds to its participating subsidiaries, but may not

borrow funds through the money pool. Accordingly, as the money pool activity

is between Duke Energy and its wholly owned subsidiaries, all money pool

balances are eliminated within Duke Energy’s Consolidated Balance Sheets.

Money pool receivable balances are reected within Notes receivable from

afliated companies on the respective Subsidiary Registrants’ Consolidated

Balance Sheets. Money pool payable balances are reected within either

Notes payable to afliated companies or Long-term debt payable to afliated

companies on the respective Consolidated Balance Sheets.

Restrictive Debt Covenants

The Duke Energy Registrants’ debt and credit agreements contain various

nancial and other covenants. The master credit facility contains a covenant

requiring the debt-to-total capitalization ratio not exceed 65 percent for each

borrower. Failure to meet those covenants beyond applicable grace periods

could result in accelerated due dates and/or termination of the agreements. As

of December 31, 2013, each of the Duke Energy Registrants was in compliance

with all covenants related to its signicant debt agreements. In addition, some

credit agreements may allow for acceleration of payments or termination

of the agreements due to nonpayment, or acceleration of other signicant

indebtedness of the borrower or some of its subsidiaries. None of the signicant

debt or credit agreements contain material adverse change clauses.

Other Loans

During 2013 and 2012, Duke Energy and Duke Energy Progress had

loans outstanding against the cash surrender value of life insurance policies

it owns on the lives of its executives. The amounts outstanding were $571

million, including $48 million at Duke Energy Progress and $496 million as of

December 31, 2013 and 2012, respectively. The amounts outstanding were

carried as a reduction of the related cash surrender value that is included in

Other within Investments and Other Assets on the Consolidated Balance Sheets.

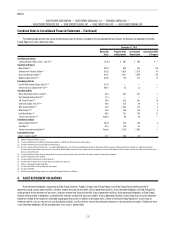

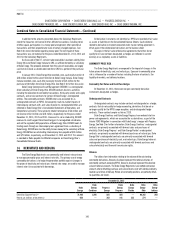

7. GUARANTEES AND INDEMNIFICATIONS

Duke Energy and Progress Energy have various nancial and performance

guarantees and indemnications, which are issued in the normal course of

business. As discussed below, these contracts include performance guarantees,

stand-by letters of credit, debt guarantees, surety bonds and indemnications.

Duke Energy and Progress Energy enter into these arrangements to facilitate

commercial transactions with third parties by enhancing the value of the

transaction to the third party. At December 31, 2013, Duke Energy and

Progress Energy do not believe conditions are likely for signicant performance

under these guarantees. To the extent liabilities are incurred as a result of

the activities covered by the guarantees, such liabilities are included on the

accompanying Consolidated Balance Sheets.

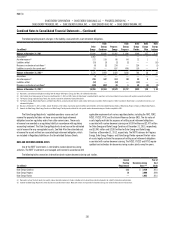

On January 2, 2007, Duke Energy completed the spin-off of its natural gas

businesses to shareholders. Guarantees issued by Duke Energy or its afliates,

or assigned to Duke Energy prior to the spin-off, remained with Duke Energy

subsequent to the spin-off. Guarantees issued by Spectra Energy Capital,

LLC, formerly known as Duke Capital LLC, (Spectra Capital) or its afliates

prior to the spin-off remained with Spectra Capital subsequent to the spin-off,

except for guarantees that were later assigned to Duke Energy. Duke Energy

has indemnied Spectra Capital against any losses incurred under certain of

the guarantee obligations that remain with Spectra Capital. At December 31,

2013, the maximum potential amount of future payments associated with these

guarantees was $205 million, the majority of which expires by 2028.

Duke Energy has issued performance guarantees to customers and other

third parties that guarantee the payment and performance of other parties,

including certain non-wholly owned entities, as well as guarantees of debt of

certain non-consolidated entities and less than wholly owned consolidated

entities. If such entities were to default on payments or performance, Duke

Energy would be required under the guarantees to make payments on the

obligations of the less than wholly owned entity. The maximum potential amount

of future payments required under these guarantees as of December 31, 2013,

was $285 million. Of this amount, $15 million relates to guarantees issued

on behalf of less than wholly owned consolidated entities, with the remainder

related to guarantees issued on behalf of third parties and unconsolidated

afliates of Duke Energy. Of the guarantees noted above, $102 million of the

guarantees expire between 2015 and 2033, with the remaining performance

guarantees having no contractual expiration.