Duke Energy 2013 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

137

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

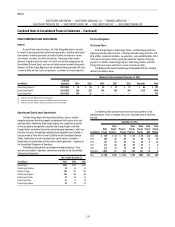

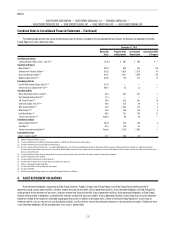

The following table presents the share of jointly owned plant or facilities included on the Consolidated Balance Sheets. All facilities are operated by the Duke

Energy Registrants unless otherwise noted.

December 31, 2013

Ownership

Share

Property, Plant

and Equipment

Accumulated

Depreciation

Construction Work

in Progress

Duke Energy Carolinas

Catawba Nuclear Station (Units 1 and 2)(a)(b) 19.25% $ 887 $498 $ —

Duke Energy Progress

Mayo Station(a)(c) 83.83 856 303 104

Shearon Harris Nuclear Station(a)(c) 83.83 3,620 2,018 67

Brunswick Nuclear Station(a)(c) 81.67 1,921 1,005 176

Roxboro Station (Unit 4)(a)(c) 87.06 754 473 13

Duke Energy Florida

Crystal River Nuclear Station (Unit 3)(a)(d) 91.78 — — —

Intercession City Station (Unit P11)(a)(e) 66.67 25 13 —

Duke Energy Ohio

Miami Fort Station (Units 7 and 8)(f)(g) 64.0 624 232 1

W.C. Beckjord Station (Unit 6)(f)(h) 37.5 — — —

J.M. Stuart Station(f)(h)(i) 39.0 823 281 16

Conesville Station (Unit 4)(f)(h)(i) 40.0 318 49 3

W.M. Zimmer Station(f)(h) 46.5 1,358 574 4

Killen Station(f)(g)(i) 33.0 308 139 2

East Bend Station(a)(g) 69.0 447 240 13

Transmission facilities(a)(h) Various 96 49 —

Duke Energy Indiana

Gibson Station (Unit 5)(a)(j) 50.05 308 160 2

Vermillion(a)(k) 62.5 154 61 —

Transmission and local facilities(a)(j) Various 3,726 1,582 —

International Energy

Brazil - Canoas I and II(l) 47.2 266 83 —

(a) Included in Regulated Utilities segment.

(b) Co-owned with North Carolina Municipal Power Agency Number 1, NCEMC and Piedmont Municipal Power Agency.

(c) Co-owned with North Carolina Eastern Municipal Power Agency.

(d) All costs associated with Crystal River Unit 3 are included within Regulatory assets on the Consolidated Balance Sheets of Duke Energy, Progress Energy and Duke Energy Florida. See Note 4 for additional information.

Co-owned with Seminole Electric Cooperative, Inc., City of Ocala, Orlando Utilities Commission, City of Gainesville, City of Leesburg, Kissimmee Utility Authority, Utilities Commission of the City of New Smyrna Beach, City of

Alachua and City of Bushnell.

(e) Co-owned with Georgia Power Company. Georgia Power Company has exclusive rights to the output of the unit during the months of June through September.

(f) Included in Commercial Power segment.

(g) Co-owned with The Dayton Power and Light Company.

(h) Co-owned with The Dayton Power and Light Company and Ohio Power Company.

(i) Station is not operated by Duke Energy Ohio.

(j) Co-owned with WVPA and Indiana Municipal Power Agency.

(k) Co-owned with WVPA.

(l) Included in International Energy segment. Co-owned with Companhia Brasileira de Aluminio.

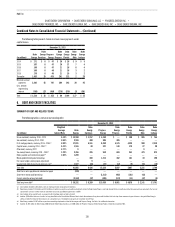

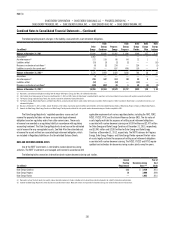

9. ASSET RETIREMENT OBLIGATIONS

Asset retirement obligations recognized by Duke Energy Carolinas, Progress Energy, Duke Energy Progress and Duke Energy Florida relate primarily to

decommissioning nuclear power facilities, asbestos removal and closure of landlls at fossil generation facilities. Asset retirement obligations at Duke Energy Ohio

relate primarily to the retirement of gas mains, asbestos removal and closure of landlls at fossil generation facilities. Asset retirement obligations at Duke Energy

Indiana relate primarily to obligations associated with asbestos removal and closure of landlls at fossil generation facilities. Duke Energy also has asset retirement

obligations related to the removal of renewable energy generation assets in addition to the above items. Certain of the Duke Energy Registrants’ assets have an

indeterminate life, such as transmission and distribution facilities, and thus the fair value of the retirement obligation is not reasonably estimable. A liability for these

asset retirement obligations will be recorded when a fair value is determinable.