Duke Energy 2013 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

PART II

DUKE ENERGY FLORIDA

Introduction

Management’s Discussion and Analysis should be read in conjunction with

the accompanying Consolidated Financial Statements and Notes for the years

ended December 31, 2013, 2012, and 2011.

Basis of Presentation

The results of operations and variance discussion for Duke Energy

Florida is presented in a reduced disclosure format in accordance with General

Instruction (I)(2)(a) of Form 10-K.

Results of Operations

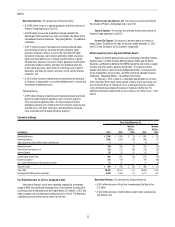

Years Ended December 31,

(in millions) 2013 2012 Variance

Operating Revenues $4,527 $4,689 $ (162)

Operating Expenses 3,840 4,062 (222)

Gains on Sales of Other Asset and Other, net 12 (1)

Operating Income 688 629 59

Other Income and Expense, net 30 39 (9)

Interest Expense 180 255 (75)

Income Before Income Taxes 538 413 125

Income Tax Expense 213 147 66

Net Income 325 266 59

Preferred Stock Dividend Requirement –2 (2)

Net Income Attributable to Parent $ 325 $ 264 $ 61

The following table shows the percent changes in GWh sales and average number of customers for Duke Energy Florida. The below percentages for retail

customer classes represent billed sales only. Wholesale power sales include both billed and unbilled sales. Total sales includes billed and unbilled retail sales, and

wholesale sales to incorporated municipalities and to public and private utilities and power marketers. Amounts are not weather normalized.

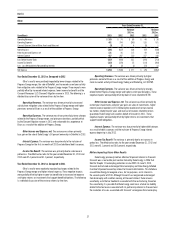

Increase (decrease) over prior year 2013 2012

Residential sales 1.4% (5.1)%

General service sales (0.5)% (1.0)%

Industrial sales 1.5% (2.5)%

Wholesale power sales (13.8)% (34.2)%

Total sales (1.2)% (2.9)%

Average number of customers 1.1% 0.8%

Year Ended December 31, 2013 as Compared to 2012

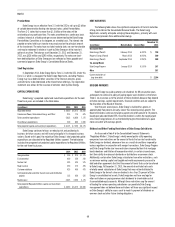

Operating Revenues. The variance was primarily due to:

• A $387 million decrease in retail fuel revenues primarily due to the

impact of lower residential fuel rates and a decrease in GWh retail sales

due to weather and lower usage.

Partially offset by:

• A $167 million increase in base revenues as allowed by the 2012

Settlement, and

• A $57 million increase in nuclear cost-recovery clause revenue due to

an increase in recovery rates primarily related to the Crystal River Unit 3

uprate project, a prior period true-up and Levy as allowed by the 2012

Settlement.

Operating Expenses. The variance was primarily due to:

• A $482 million decrease in retail fuel expense primarily due to the

application of the NEIL settlement proceeds including amortization

associated with the 2012 Settlement, lower system requirements, and

the prior year establishment of a regulatory liability for replacement

power in accordance with the 2012 Settlement, and

• A $71 million decrease in operations and maintenance expenses

primarily due to the deferral of Crystal River Unit 3-related expenses

in accordance with the 2012 Settlement, lower costs associated with

the merger with Duke Energy, and the prior year write-off of previously

deferred costs related to the vendor not selected for the Crystal River

Unit 3 containment repair. These were partially offset by the prior

year reversal of accruals in conjunction with the placement of Crystal

River Unit 3 into extended cold shutdown in accordance with the 2012

Settlement and higher charges associated with related settlement

matters.

Partially offset by:

• A $212 million increase in impairment and other charges. In 2013, Duke

Energy Florida recorded impairment and other charges primarily related

to Crystal River Unit 3 and Levy. In 2012, Duke Energy Florida recorded

impairment and other charges related to the decision to retire Crystal

River Unit 3. See Note 4 to the Consolidated Financial Statements,

“Regulatory Matters,” for additional information; and

• A $138 million increase in depreciation and amortization primarily

due to higher nuclear cost-recovery amortization related to Levy and

a decrease in the reduction of the cost of removal component of

amortization expense as allowed under the 2012 Settlement.