Duke Energy 2013 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

145

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

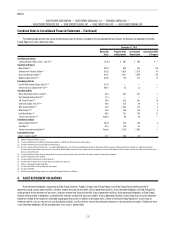

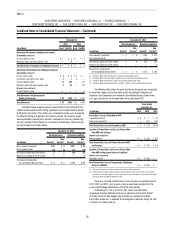

December 31, 2012

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Electricity (Gigawatt-hours)(a) 52,104 2,028 1,850 1,850 — 51,215 97

Natural gas (millions of decatherms) 528 — 348 118 230 180 —

(a) Amounts at Duke Energy Ohio include intercompany positions that eliminate at Duke Energy.

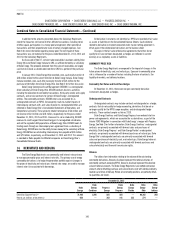

INTEREST RATE RISK

The Duke Energy Registrants are exposed to changes in interest rates

as a result of their issuance or anticipated issuance of variable-rate and

fixed-rate debt and commercial paper. Interest rate risk is managed by limiting

variable-rate exposures to a percentage of total debt and by monitoring

changes in interest rates. To manage risk associated with changes in interest

rates, the Duke Energy Registrants may enter into interest rate swaps,

U.S. Treasury lock agreements, and other financial contracts. In anticipation

of certain fixed-rate debt issuances, a series of forward starting interest rate

swaps may be executed to lock in components of current market interest

rates. These instruments are later terminated prior to or upon the issuance of

the corresponding debt. Pretax gains or losses recognized from inception to

termination of the hedges are amortized as a component of interest expense

over the life of the debt.

Duke Energy has a combination foreign exchange, pay fixed-receive

floating interest rate swap to fix the US dollar equivalent payments on a

floating-rate Chilean debt issue.

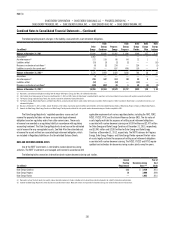

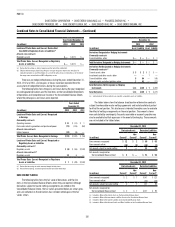

The following tables show notional amounts for derivatives related to interest rate risk.

December 31, 2013 December 31, 2012

(in millions)

Duke

Energy

Duke

Energy

Ohio

Duke

Energy

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Ohio

Duke

Energy

Indiana

Cash flow hedges(a) $ 798 $ — $ 1,047 $ — $ — $ — $ —

Undesignated contracts 34 27 290 50 50 27 200

Fair value hedges — — 250 — — 250 —

Total notional amount $ 832 $ 27 $ 1,587 $ 50 $ 50 $ 277 $ 200

(a) Duke Energy includes amounts related to non-recourse variable rate long-term debt of VIEs of $584 million at December 31, 2013 and $620 million at December 31, 2012.

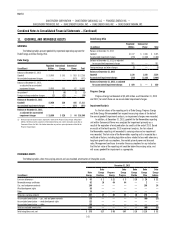

DUKE ENERGY

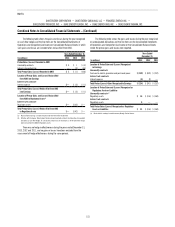

The following table shows the fair value of derivatives and the line

items in the Consolidated Balance Sheets where they are reported. Although

derivatives subject to master netting arrangements are netted on the

Consolidated Balance Sheets, the fair values presented below are shown gross

and cash collateral on the derivatives has not been netted against the fair

values shown.

December 31,

2013 2012

(in millions) Asset Liability Asset Liability

Derivatives Designated as Hedging Instruments

Commodity contracts

Current liabilities: other $ — $ 1 $ — $ 2

Deferred credits and other liabilities: other — — — 1

Interest rate contracts

Current assets: other — — 2 —

Investments and other assets: other 27 — 7 —

Current liabilities: Other — 18 — 81

Deferred credits and other liabilities: other — 4 — 35

Total Derivatives Designated as Hedging Instruments $ 27 $ 23 $ 9 $ 119

Derivatives Not Designated as Hedging Instruments

Commodity contracts

Current assets: other $ 201 $158 $ 41 $ 2

Investments and other assets: other 215 131 106 50

Current liabilities: other 13 153 106 407

Deferred credits and other liabilities: other 5 166 2 255

Interest rate contracts

Current liabilities: other — 1 — 76

Deferred credits and other liabilities: other — 4 — 8

Total Derivatives Not Designated as Hedging

Instruments $ 434 $613 $ 255 $ 798

Total Derivatives $ 461 $636 $ 264 $ 917