Duke Energy 2013 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

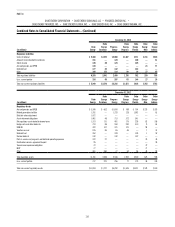

115

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

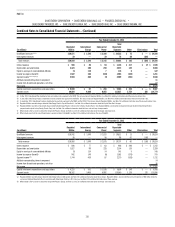

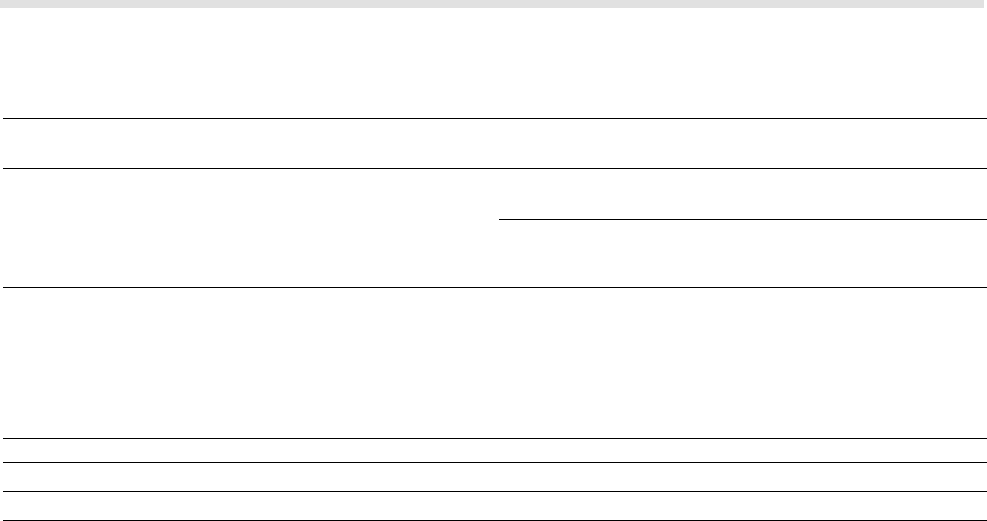

December 31, 2012

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Regulatory Liabilities

Costs of removal $4,827 $1,928 $2,048 $1,503 $ 401 $236 $624

Amounts to be refunded to customers 290 — 259 — 259 — 31

Storm reserve 125 — 125 — 125 — —

Accrued pension and OPEB 103 — — — — 18 68

Deferred fuel 55 45 10 10 — — —

Other 340 207 55 35 20 39 29

Total regulatory liabilities 5,740 2,180 2,497 1,548 805 293 752

Less: current portion 156 78 28 10 18 39 11

Total non-current regulatory liabilities $5,584 $2,102 $2,469 $1,538 $ 787 $254 $741

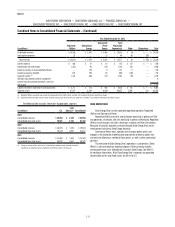

Descriptions of regulatory assets and liabilities, summarized in the tables

above, as well as their recovery and amortization periods follow. Items are

excluded from rate base unless otherwise noted.

Accrued pension and OPEB. Accrued pension and OPEB represent

regulatory assets and liabilities related to each of the Duke Energy Registrants’

respective shares of unrecognized actuarial gains and losses, unrecognized

prior service cost, and unrecognized transition obligation attributable to Duke

Energy’s pension plans and OPEB plans. The regulatory asset or liability is

amortized with the recognition of actuarial gains and losses, prior service cost,

and transition obligations to net periodic benet costs for pension and OPEB

plans. See Note 21 for additional detail.

Retired generation facilities. Duke Energy Florida earns a reduced

return on a substantial portion of the amount of regulatory asset associated with

the retirement of Crystal River Unit 3 not included in rate base and a full return

on a portion of the retired plant currently recovered in rates. Once included in

base rates the amount will be amortized over 20 years. Duke Energy Carolinas

and Duke Energy Progress earn a return on the outstanding balance with

recovery periods ranging from ve to 10 years. Duke Energy Indiana earns a

return on the outstanding balances and the costs are included in rate base.

Asset retirement obligations. Represents future removal costs

associated with asset retirement obligations for nuclear facilities. No

return is earned on these balances. The recovery period runs through the

decommissioning period of each nuclear unit, the latest of which is estimated to

be 2097. See Note 9 for additional information.

Net regulatory asset related to income taxes. Regulatory assets

principally associated with the depreciation and recovery of AFUDC equity.

Amounts have no impact on rate base as regulatory assets are offset by

deferred tax liabilities. The recovery period is over the life of the associated

assets.

Hedge costs and other deferrals. Amounts relate to unrealized gains

and losses on derivatives recorded as a regulatory asset or liability, respectively,

until the contracts are settled. The recovery period varies for these costs, and

currently extends to 2027.

DSM/EE. The recovery period varies for these costs, with some

currently unknown. Duke Energy Carolinas, Duke Energy Progress, and

Duke Energy Florida are required to pay interest on the outstanding liability

balance. Duke Energy Progress and Duke Energy Florida collect a return on

the outstanding asset balance. Duke Energy Carolinas collects a return on the

outstanding balance in South Carolina.

Vacation accrual. Generally recovered within one year.

Deferred fuel. Deferred fuel costs represent certain energy costs that

are recoverable or refundable as approved by the applicable regulatory body.

Duke Energy Florida, Duke Energy Ohio, and Duke Energy Indiana earn a return

on under-recovered costs. Duke Energy Florida, Duke Energy Ohio and Duke

Energy Indiana pay interest on over-recovered costs. Duke Energy Carolinas and

Duke Energy Progress pay interest on over-recovered costs in North Carolina.

Recovery period is generally over one year. Duke Energy Florida amount includes

capacity costs.

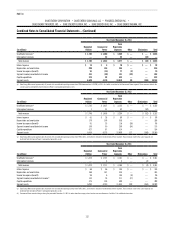

Nuclear deferral. Includes (i) amounts related to levelizing nuclear plant

outage costs at Duke Energy Carolinas in North Carolina and South Carolina,

and Duke Energy Progress in North Carolina, which allows for the recognition of

nuclear outage expenses over the refueling cycle rather than when the outage

occurs, resulting in the deferral of operations and maintenance costs associated

with refueling and (ii) certain deferred preconstruction and carrying costs at

Duke Energy Florida as approved by the FPSC associated with Levy, expected to

be recovered in revenues by the end of 2017.

Post-in-service carrying costs and deferred operating expenses.

Represents deferred depreciation and operating expenses as well as carrying

costs on the portion of capital expenditures placed in service but not yet

reected in retail rates as plant in service. Duke Energy Carolinas, Duke Energy

Progress, Duke Energy Ohio and Duke Energy Indiana earn a return on the

outstanding balance. Duke Energy Ohio amounts are included in rate base. For

Duke Energy Indiana, some amounts are included in rate base. Recovery is over

various lives, and the latest recovery period is 2067.

Gasification services agreement buyout. The IURC authorized

Duke Energy Indiana to recover costs incurred to buyout a gasication services

agreement, including carrying costs through 2018.

Transmission expansion obligation. Represents transmission

expansion obligations related to Duke Energy Ohio’s withdrawal from

Midcontinent Independent System Operator, Inc. (MISO).

MGP. Represents remediation costs for former MGP sites. In November

2013, the PUCO approved recovery of these costs through 2018. Duke Energy

Ohio does not earn a return on these costs. See Note 5, Commitments and

Contingencies, for additional information.

Debt fair value adjustment. Purchase accounting adjustment to restate

the carrying value of Progress Energy debt to fair value. Amount is amortized

over the life of the related debt.

Costs of removal. Represents funds received from customers to cover

the future removal of property, plant and equipment from retired or abandoned

sites as property is retired. Also includes unrealized gains on NDTF investments.

Amounts to be refunded to customers. Represents required refunds to

retail customers by the applicable regulatory body. The refund period is through

2016 for Duke Energy Florida and through 2017 for Duke Energy Indiana.