Duke Energy 2013 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

109

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

sales of other assets on Duke Energy Ohio’s Consolidated Statements of Cash

Flows. Cash paid to Duke Energy Ohio is included in Capital expenditures

on Duke Energy Indiana’s Consolidated Statements of Cash Flows. Duke

Energy Ohio and Duke Energy Indiana recognized non-cash equity transfers of

$28 million and $26 million, respectively, in their Consolidated Statements of

Common Stockholder’s Equity on the transaction representing the difference

between cash exchanged and the net book value of Vermillion. These amounts

are not reected in Duke Energy’s Consolidated Statements of Cash Flows

or Consolidated Statements of Equity as the transaction is eliminated in

consolidation.

Proceeds from WVPA are included in Net proceeds from the sales of other

assets, and sale of and collections on notes receivable on Duke Energy’s and

Duke Energy Ohio’s Consolidated Statements of Cash Flows. The sale of the

proportionate share of Vermillion to WVPA did not result in a signicant gain or

loss upon close of the transaction.

Wind Projects Joint Venture

In April 2012, Duke Energy executed a joint venture agreement with

Sumitomo Corporation of America (SCOA). Under terms of the agreement,

Duke Energy and SCOA each own a 50 percent interest in the joint venture (DS

Cornerstone, LLC), which owns two wind generation projects. Duke Energy and

SCOA also negotiated a $330 million, Construction and 12-year amortizing

Term Loan Facility, on behalf of the borrower, a wholly owned subsidiary of the

joint venture. The loan agreement is non-recourse to Duke Energy. Duke Energy

received proceeds of $319 million upon execution of the loan agreement. This

amount represents reimbursement of a signicant portion of Duke Energy’s

construction costs incurred as of the date of the agreement. DS Cornerstone,

LLC was initially consolidated with the sale to SCOA because of a guarantee

provided by an indirect wholly owned subsidiary of Duke Energy. With the

expiration of the guarantee in 2012, DS Cornerstone, LLC was deconsolidated.

SALES OF OTHER ASSETS

During 2012, Duke Energy received proceeds of $187 million from the sale

of non-core business assets within the Commercial Power segment for which no

material gain or loss was recognized.

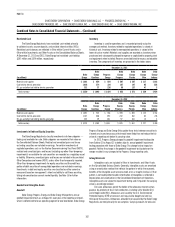

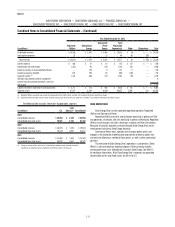

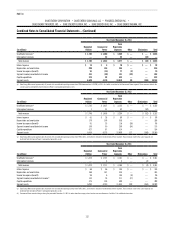

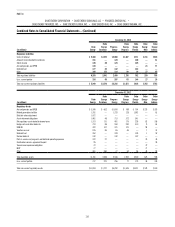

3. BUSINESS SEGMENTS

Duke Energy evaluates segment performance based on segment income.

Segment income is dened as income from continuing operations net of income

attributable to noncontrolling interests. Segment income, as discussed below,

includes intercompany revenues and expenses that are eliminated in the

Consolidated Financial Statements.

Operating segments are determined based on information used by the

chief operating decision maker in deciding how to allocate resources and

evaluate the performance.

Products and services are sold between afliate companies and reportable

segments of Duke Energy at cost. Segment assets as presented in the tables that

follow exclude all intercompany assets.

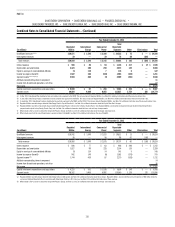

DUKE ENERGY

Duke Energy has the following reportable operating segments: Regulated

Utilities, International Energy and Commercial Power.

Regulated Utilities conducts operations primarily through Duke Energy

Carolinas, Progress Energy, Duke Energy Progress, Duke Energy Florida, Duke Energy

Indiana, and the regulated transmission and distribution operations of Duke Energy

Ohio. These electric and gas operations are subject to the rules and regulations

of the FERC, NCUC, PSCSC, FPSC, PUCO, IURC, and KPSC. Substantially all of

Regulated Utilities’ operations are regulated and, accordingly, these operations

qualify for regulatory accounting treatment.

International Energy principally operates and manages power generation

facilities and engages in sales and marketing of electric power, natural gas, and

natural gas liquids outside the U.S. Its activities principally target power generation

in Latin America. Additionally, International Energy owns a 25 percent interest in

National Methanol Company (NMC), a large regional producer of Methyl tertiary

butyl ether (MTBE) located in Saudi Arabia. The investment in NMC is accounted for

under the equity method of accounting.

Commercial Power owns, operates and manages power plants and

engages in the wholesale marketing and procurement of electric power, fuel and

emission allowances related to these plants as well as other contractual positions.

Commercial Power’s generation operations consist primarily of Duke Energy Ohio’s

coal-red and gas-red nonregulated generation assets located in the Midwest

region of the U.S. and wind and solar generation located throughout the U.S. The

asset portfolio has a diversied fuel mix with baseload and mid-merit coal-red

units as well as combined cycle and peaking natural gas-red units. In addition,

Commercial Power operates and develops transmission projects.

The remainder of Duke Energy’s operations is presented as Other. While

it is not an operating segment, Other primarily includes unallocated corporate

interest expense, certain unallocated corporate costs, Bison Insurance Company

Limited (Bison), Duke Energy’s wholly owned, captive insurance subsidiary, and

contributions to the Duke Energy Foundation. On December 31, 2013, Duke Energy

sold its interest in DukeNet Communications Holdings, LLC (DukeNet) to Time

Warner Cable, Inc. See Note 12 for further information.