Duke Energy 2013 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

PART II

to classify the Midwest generation business as held for sale and record an

estimated pretax impairment charge of $1 billion to $2 billion in the first

quarter of 2014. As discussed further in Note 2 to the Consolidated Financial

Statements, “Acquisitions, Dispositions, and Sales of Other Assets,” in the third

quarter of 2012, Duke Energy Carolinas and Duke Energy Progress recorded

certain impairment charges in conjunction with the merger between Duke

Energy and Progress Energy. As discussed further in Note 11 to the Consolidated

Financial Statements, “Goodwill and Intangible Assets,” in the third quarter of

2011, Commercial Power recorded $79 million of pretax impairment charges

related to CAA emission allowances that were no longer expected to be used

as a result of the issuance of the final CSAPR. These impairment charges

are recorded in Goodwill and Other Impairment Charges on Duke Energy’s

Consolidated Statement of Operations.

Accounting for Loss Contingencies

Preparation of financial statements and related disclosures require

judgments regarding the future outcome of contingent events. Duke Energy is

involved in certain legal and environmental matters arising in the normal course

of business. Estimating probable losses requires analysis of multiple forecasts

and scenarios that often depend on judgments about potential actions by third

parties, such as federal, state and local courts and other regulators. Contingent

liabilities are often resolved over long periods of time. Amounts recorded in the

consolidated financial statements may differ from the actual outcome once the

contingency is resolved, which could have a material impact on future results of

operations, financial position and cash flows of Duke Energy.

For further information, see Note 5 to the Consolidated Financial

Statements, “Commitments and Contingencies.”

Pension and Other Post-Retirement Benefits

The calculation of pension expense, other post-retirement benefit expense

and net pension and other post-retirement assets or liabilities require the use

of assumptions and election of permissible accounting alternatives. Changes in

assumptions can result in different expense and reported asset or liability amounts,

and future actual experience can differ from the assumptions. Duke Energy believes

the most critical assumptions for pension and other post-retirement benefits are

the expected long-term rate of return on plan assets and the assumed discount

rate. Additionally, medical and prescription drug cost trend rate assumptions are

critical to Duke Energy’s estimates of other post-retirement benefits.

Duke Energy elects to amortize net actuarial gains or losses in excess

of the corridor of 10 percent of the greater of the market-related value of plan

assets or plan projected benefit obligation, into net pension or other post-

retirement benefit expense over the average remaining service period of active

covered employees. Prior service cost or credit, which represents the effect on

plan liabilities due to plan amendments, is amortized over the average remaining

service period of active covered employees.

Duke Energy maintains non-contributory defined benefit retirement

plans. The plans cover most U.S. employees using a cash balance formula.

Under a cash balance formula, a plan participant accumulates a retirement

benefit consisting of pay credits based upon a percentage of current eligible

earnings based on age and years of service and current interest credits. Certain

employees are covered under plans that use a final average earnings formula.

Duke Energy provides some health care and life insurance benefits

for retired employees on a contributory and non-contributory basis. Certain

employees are eligible for these benefits if they have met age and service

requirements at retirement, as defined in the plans.

For both pension and other post-retirement plans, Duke Energy assumes

its plan’s assets will generate a long-term rate of return of 6.75 percent as

of December 31, 2013. The expected long-term rate of return was developed

using a weighted average calculation of expected returns based primarily on

future expected returns across asset classes considering the use of active asset

managers, where applicable. U.S. equities are held for their high expected return.

Non-U.S. equities, debt securities, hedge funds, real estate and other global

securities are held for diversification. Investments within asset classes are to

be diversified to achieve broad market participation and reduce the impact of

individual managers on investments. In September 2013, Duke Energy adopted a

de-risking investment strategy for its pension plan assets. As the funded status

of the Duke Energy and Progress Energy pension plans increase, over time the

allocation to return-seeking assets will be reduced and the allocation to fixed-

income assets will be increased to better manage Duke Energy’s pension liability

and reduce funded status volatility. Based on the current funded status of the

plans, the asset allocation for the Duke Energy pension plans has been adjusted

to 60 percent fixed-income assets and 40 percent return-seeking assets and the

asset allocation for the Progress Energy pension plans has been adjusted to

55 percent fixed-income assets and 45 percent return-seeking assets.

The assets for Duke Energy’s pension and other post-retirement plans are

maintained in a master trust. Duke Energy also invests other post-retirement

assets in the Duke Energy Corporation Employee Benefits Trust (VEBA I). The

investment objective of VEBA I is to achieve sufficient returns, subject to a

prudent level of portfolio risk, for the purpose of promoting the security of plan

benefits for participants. VEBA I is passively managed.

Duke Energy discounted its future U.S. pension and other post-retirement

obligations using a rate of 4.7 percent as of December 31, 2013. Discount rates

used to measure benefit plan obligations for financial reporting purposes reflect

rates at which pension benefits could be effectively settled. As of December 31,

2013, Duke Energy determined its discount rate for U.S. pension and other

post-retirement obligations using a bond selection-settlement portfolio

approach. This approach develops a discount rate by selecting a portfolio of high

quality corporate bonds that generate sufficient cash flow to match the timing

of projected benefit payments. The selected bond portfolio is derived from a

universe of non-callable corporate bonds rated Aa quality or higher. After the

bond portfolio is selected, a single interest rate is determined that equates the

present value of the plan’s projected benefit payments discounted at this rate

with the market value of the bonds selected.

Future changes in plan asset returns, assumed discount rates and

various other factors related to the participants in Duke Energy’s pension and

post-retirement plans will impact future pension expense and liabilities. Duke

Energy cannot predict with certainty what these factors will be in the future. The

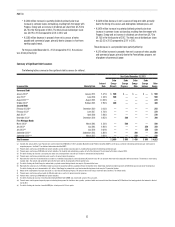

following table presents the approximate effect on Duke Energy’s 2013 pretax

pension expense, pension obligation and other post-retirement benefit obligation

if a 0.25 percent change in rates were to occur.

Qualified and Non-

Qualified Pension Plans Other Post-retirement Plans

(in millions) +0.25% -0.25% +0.25% -0.25%

Effect on 2013 pretax pension expense

Expected long-term rate of return $ (18)$ 18 $ (1) $ 1

Discount rate (16) 16 (4) 4

Effect on benefit obligation at December 31, 2013

Discount rate $ (194)$ 200 $ (23)$ 24