Duke Energy 2013 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART I

10

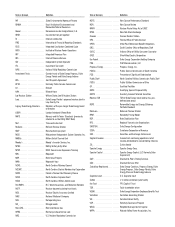

The following table summarizes base rate cases approved and effective in the past three years.

Annual

Increase

Return on

Equity

Equity

Component of

Capital Structure Effective Date Other

Duke Energy Carolinas 2013 North Carolina Rate Case(a) $ 234 10.2% 53% September 2013 (b)

Duke Energy Carolinas 2013 South Carolina Rate Case(a) 118 10.2% 53% September 2013 (c)

Duke Energy Carolinas 2011 North Carolina Rate Case 309 10.5% 53% February 2012

Duke Energy Carolinas 2011 South Carolina Rate Case 93 10.5% 53% February 2012

Duke Energy Progress 2012 North Carolina Rate Case(a) 178 10.2% 53% June 2013 (d)

Duke Energy Ohio 2012 Electric Rate Case 49 9.84% 53% May 2013

Duke Energy Ohio 2012 Natural Gas Rate Case – 9.84% 53% December 2013 (e)

Duke Energy Florida 2013 FPSC Settlement – 10.5% 49% October 2013 (f)(h)

Duke Energy Florida 2012 FPSC Settlement 150 10.5% 49% January 2013 (g)(h)

(a) Rates will increase over a two or three year period as approved by the NCUC and PSCSC. Annual increase amounts represent the total increase once effective.

(b) Terms of this rate case include (i) recognition of nuclear outage expenses over the refueling cycle rather than when the outage occurs, (ii) a $10 million shareholder contribution to agencies providing energy assistance to low-

income customers, (iii) an annual reduction in the regulatory liability for costs of removal of $30 million for each of the first two years, and (iv) no additional base rate increases to be effective before September 2015.

(c) Terms of this rate case include (i) recognition of nuclear outage expenses over the refueling cycle rather than when the outage occurs, (ii) an approximate $4 million shareholder contribution to agencies providing energy

assistance to low-income customers and for economic development, (iii) a reduction in the regulatory liability for costs of removal of $45 million for the first year, and (iv) no additional base rate increases to be effective

before September 2015.

(d) Terms of this rate case include (i) recognition of nuclear outage expenses over the refueling cycle rather than when the outage occurs, (ii) a $20 million shareholder contribution to agencies providing energy assistance to

low-income customers, and (iii) a reduction in the regulatory liability for costs of removal of $20 million for the first year.

(e) Although the PUCO approved no increase in base rates, more than half of the revenue request was approved to be recovered in various riders, including recovery of costs related to former manufactured gas plants (MGP).

Recovery of $56 million of MGP costs via a rider was approved in November 2013. The rider is effective in March 2014.

(f) Terms of this settlement include (i) no additional base rate increases until 2019, (ii) partial recovery of Crystal River Unit 3 beginning in 2014, and (iii) full recovery of Crystal River Unit 3, not to exceed $1,466 million, plus the

cost to build a dry cask storage facility, beginning no later than 2017.

(g) Terms of this settlement include the removal of Crystal River Unit 3 assets from rate base.

(h) Capital structure includes deferred income tax, customer deposits and investment tax credits.

For more information on rate matters and other regulatory proceedings, see

Note 4 to the Consolidated Financial Statements, “Regulatory Matters — Rate

Related Information.”

Federal

The FERC approves Regulated Utilities’ cost-based rates for electric

sales to certain wholesale customers, as well as sales of transmission service.

Regulations of FERC and the state utility commissions govern access to

regulated electric and gas customers and other data by nonregulated entities and

services provided between regulated and nonregulated energy affiliates. These

regulations affect the activities of nonregulated affiliates with Regulated Utilities.

Regional Transmission Organizations (RTO). PJM Interconnection,

LLC (PJM) and Midcontinent Independent Transmission System Operator, Inc.

(MISO) are the Independent System Operators (ISO) and FERC-approved RTOs

for the regions in which Duke Energy Ohio and Duke Energy Indiana operate.

PJM and MISO operate energy, capacity and other markets, and, through central

dispatch, control the day-to-day operations of bulk power systems.

Duke Energy Ohio is a member of PJM and Duke Energy Indiana is a

member of MISO. Transmission owners in these RTOs have turned over control of

their transmission facilities, and their transmission systems are currently under

the dispatch control of the RTOs. Transmission service is provided on a region-

wide, open-access basis using the transmission facilities of the RTO members at

rates based on the costs of transmission service.

Environmental. Regulated Utilities is subject to the jurisdiction of the EPA

and state and local environmental agencies. For a discussion of environmental

regulation, see “Environmental Matters” in this section.

See “Other Issues” section of Management’s Discussion and Analysis of

Financial Condition and Results of Operations for a discussion about potential

Global Climate Change legislation and other EPA regulations under development

and the potential impacts such legislation and regulation could have on Duke

Energy’s operations.

INTERNATIONAL ENERGY

International Energy principally operates and manages power generation

facilities and engages in sales and marketing of electric power, natural gas,

and natural gas liquids outside the U.S. Its activities principally target power

generation in Latin America. Additionally, International Energy owns a

25 percent interest in National Methanol Company (NMC), a large regional

producer of methanol and methyl tertiary butyl ether (MTBE) located in Saudi

Arabia. International Energy’s ownership interest will decrease to 17.5 percent

by the end of 2016. The investment in NMC is accounted for under the equity

method of accounting.

International Energy’s customers include retail distributors, electric utilities,

independent power producers, marketers, and industrial and commercial companies.

International Energy’s current strategy is focused on optimizing the value of its current

Latin American portfolio and expanding the portfolio through investment in generation

opportunities in Latin America.

For information on International Energy’s generation facilities, see Item 2,

“Properties.”

Competition and Regulation

International Energy’s sales and marketing of electric power and natural

gas competes directly with other generators and marketers serving its market

areas. Competitors are country and region-specific but include government-

owned electric generating companies, local distribution companies with

self-generation capability and other privately owned electric generating and

marketing companies. The principal elements of competition are price and

availability, terms of service, flexibility and reliability of service.

A high percentage of International Energy’s portfolio consists of baseload

hydroelectric generation facilities, which compete with other forms of electric

generation available to International Energy’s customers and end-users,

including natural gas and fuel oils. Economic activity, conservation, legislation,

governmental regulations, weather, additional generation capacities and other

factors affect the supply and demand for electricity in the regions served by

International Energy.