Duke Energy 2013 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

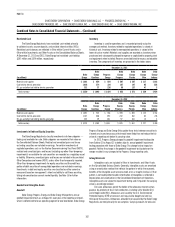

Restricted Cash

The Duke Energy Registrants have restricted cash related primarily

to collateral assets, escrow deposits, and variable interest entities (VIEs).

Restricted cash balances are reected in Other within Current Assets and in

Other within Investments and Other Assets on the Consolidated Balance Sheets.

At December 31, 2013 and 2012, Duke Energy had restricted cash totaling

$307 million and $574 million, respectively.

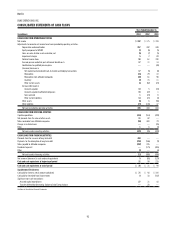

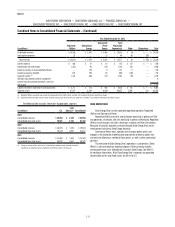

Inventory

Inventory is used for operations and is recorded primarily using the

average cost method. Inventory related to regulated operations is valued at

historical cost. Inventory related to nonregulated operations is valued at the

lower of cost or market. Materials and supplies are recorded as inventory when

purchased and subsequently charged to expense or capitalized to property, plant

and equipment when installed. Reserves are established for excess and obsolete

inventory. The components of inventory are presented in the tables below.

December 31, 2013

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Materials and supplies $ 1,901 $ 654 $ 854 $ 567 $ 287 $ 117 $ 193

Coal held for electric generation 1,018 374 334 187 147 65 238

Oil, gas and other fuel held for electric generation 331 37 236 99 137 47 3

Total inventory $ 3,250 $ 1,065 $ 1,424 $ 853 $ 571 $ 229 $ 434

December 31, 2012

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Materials and supplies $ 1,691 $ 535 $ 768 $ 499 $ 269 $ 135 $ 161

Coal held for electric generation 1,187 488 392 232 160 82 216

Oil, gas and other fuel held for electric generation 345 39 281 97 184 10 3

Total inventory $ 3,223 $ 1,062 $ 1,441 $ 828 $ 613 $ 227 $ 380

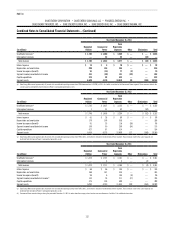

Investments in Debt and Equity Securities

The Duke Energy Registrants classify investments into two categories —

trading and available-for-sale. Both categories are recorded at fair value on

the Consolidated Balance Sheets. Realized and unrealized gains and losses

on trading securities are included in earnings. For certain investments of

regulated operations such as the Nuclear Decommissioning Trust Fund (NDTF),

realized and unrealized gains and losses (including any other-than-temporary

impairments) on available-for-sale securities are recorded as a regulatory asset

or liability. Otherwise, unrealized gains and losses are included in Accumulated

Other Comprehensive Income (AOCI), unless other-than-temporarily impaired.

Other-than-temporary impairments for equity securities and the credit loss

portion of debt securities of nonregulated operations are included in earnings.

Investments in debt and equity securities are classied as either current or

noncurrent based on management’s intent and ability to sell these securities,

taking into consideration current market liquidity. See Note 15 for further

information.

Goodwill and Intangible Assets

Goodwill

Duke Energy, Progress Energy and Duke Energy Ohio perform annual

goodwill impairment tests as of August 31 each year at the reporting unit level,

which is determined to be an operating segment or one level below. Duke Energy,

Progress Energy and Duke Energy Ohio update these tests between annual tests

if events or circumstances occur that would more likely than not reduce the fair

value of a reporting unit below its carrying value.

In 2012, Progress Energy changed its goodwill impairment testing date

from October 31 to August 31 to better align its annual goodwill impairment

testing procedure with those of Duke Energy. The change had no impact on

goodwill. Neither the change in the goodwill impairment testing date nor the

merger resulted in any changes to the Progress Energy reporting units.

Intangible Assets

Intangible assets are included in Other in Investments and Other Assets

on the Consolidated Balance Sheets. Generally, intangible assets are amortized

using an amortization method that reects the pattern in which the economic

benets of the intangible asset are consumed, or on a straight-line basis if that

pattern is not readily determinable. Amortization of intangibles is reected in

Depreciation and amortization in the Consolidated Statements of Operations.

Intangible assets are subject to impairment testing and if impaired, the carrying

value is accordingly reduced.

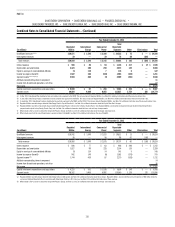

Emission allowances permit the holder of the allowance to emit certain

gaseous by-products of fossil fuel combustion, including sulfur dioxide (SO2)

and nitrogen oxide (NOx). Allowances are issued by the U.S. Environmental

Protection Agency (EPA) at zero cost and may also be bought and sold via

third-party transactions. Allowances allocated to or acquired by the Duke Energy

Registrants are held primarily for consumption. Carrying amounts for emission