Duke Energy 2013 Annual Report Download - page 214

Download and view the complete annual report

Please find page 214 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259

|

|

196

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

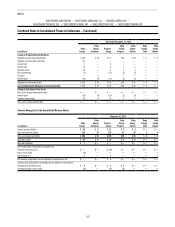

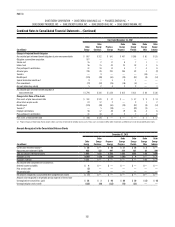

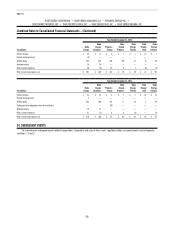

Duke Energy Master Retirement Trust

The following table provides the fair value measurement amounts for the Duke Energy Master Retirement Trust qualified pension and other post-retirement

assets.

December 31, 2013

(in millions) Total Fair Value Level 1 Level 2 Level 3

Equity securities $2,877 $1,801 $1,022 $ 54

Corporate debt securities 2,604 — 2,601 3

Short-term investment funds 1,158 254 904 —

Partnership interests 307 — — 307

Hedge funds 164 — 111 53

Real estate trusts 95 — — 95

U.S. government securities 927 — 927 —

Guaranteed investment contracts 33 — — 33

Governments bonds – foreign 19 — 18 1

Cash 58 58 — —

Government and commercial mortgage backed securities 7 — 7 —

Net pending transactions and other investments 12 7 5 —

Total assets(a) $8,261 $2,120 $5,595 $546

(a) Duke Energy Carolinas, Progress Energy, Duke Energy Progress, Duke Energy Florida, Duke Energy Ohio and Duke Energy Indiana were allocated approximately 28 percent, 35 percent, 16 percent, 16 percent, 5 percent and

8 percent, respectively, of the Duke Energy Master Retirement Trust assets at December 31, 2013. Accordingly, all Level 1, 2 and 3 amounts included in the table above are allocable to the Subsidiary Registrants using these

percentages.

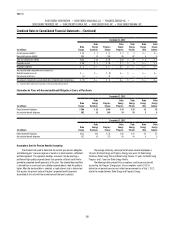

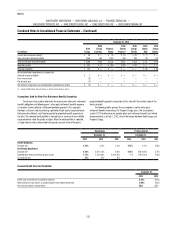

(in millions)

December 31, 2012

Total Fair Value Level 1 Level 2 Level 3

Equity securities $ 2,993 $1,415 $1,575 $ 3

Corporate debt securities 1,391 — 1,388 3

Short-term investment funds 100 23 77 —

Partnership interests 141 — — 141

Hedge funds 97 — 97 —

Real estate trusts 167 — — 167

U.S. government securities 237 — 237 —

Guarantees investment contracts 37 — — 37

Governments bonds – foreign 65 — 64 1

Cash 4 4 — —

Asset backed securities 14 — 14 —

Net pending transactions and other investments (16) (21) 5 —

Total assets(a) $ 5,230 $1,421 $3,457 $ 352

(a) Duke Energy Carolinas, Duke Energy Ohio and Duke Energy Indiana were allocated approximately 43 percent, 9 percent and 12 percent, respectively, of the Duke Energy Master Retirement Trust assets at December 31, 2012.

Accordingly, all Level 1, 2 and 3 amounts included in the table above are allocable to Duke Energy Carolinas, Duke Energy Ohio and Duke Energy Indiana using these percentages.