Duke Energy 2013 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

PART II

DUKE ENERGY PROGRESS

Introduction

Management’s Discussion and Analysis should be read in conjunction with

the accompanying Consolidated Financial Statements and Notes for the years

ended December 31, 2013, 2012, and 2011.

Basis of Presentation

The results of operations and variance discussion for Duke Energy

Progress is presented in a reduced disclosure format in accordance with General

Instruction (I)(2)(a) of Form 10-K.

Results of Operations

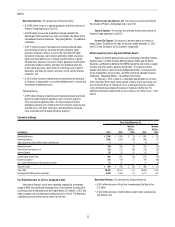

Years Ended December 31,

(in millions) 2013 2012 Variance

Operating Revenues $4,992 $4,706 $ 286

Operating Expenses 4,061 4,197 (136)

Gains on Sales of Other Asset and Other, net 11 —

Operating Income 932 510 422

Other Income and Expense, net 57 79 (22)

Interest Expense 201 207 (6)

Income Before Income Taxes 788 382 406

Income Tax Expense 288 110 178

Net Income 500 272 228

Preferred Stock Dividend Requirement —3 (3)

Net Income Attributable to Parent $ 500 $ 269 $ 231

The following table shows the percent changes in GWh sales and average number of customers for Duke Energy Progress. The below percentages for retail

customer classes represent billed sales only. Total sales includes billed and unbilled retail sales, and wholesale sales to incorporated municipalities and to public and

private utilities and power marketers. Amounts are not weather normalized.

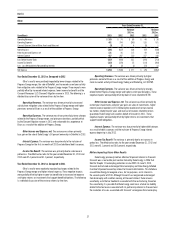

Increase (decrease) over prior year 2013 2012

Residential sales 4.0 % (8.2)%

General service sales — % (1.8)%

Industrial sales 1.1 % (1.0)%

Wholesale power sales 7.6 % 25.9 %

Total sales 3.1 % 3.9 %

Average number of customers 0.9 % 0.8 %

Year Ended December 31, 2013 as Compared to 2012

Operating Revenues. The variance was primarily due to:

• A $136 million increase in sales (excluding fuel revenues) to wholesale

customers primarily due to a new customer contract that began in

January 2013 and an amended capacity contract that began in May 2012;

• A $117 million increase due to revised rates in North Carolina; and

• A $24 million increase (net of fuel revenue) in GWh sales to retail customers

due to higher weather normal sales volumes to retail customers.

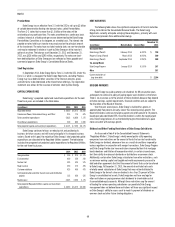

Operating Expenses. The variance was primarily due to:

• A $136 million decrease in operations and maintenance expenses

primarily due to lower costs associated with the merger with Duke

Energy and the levelization of nuclear outage costs; and

• A $32 million decrease in impairment charges primarily related to the

merger with Duke Energy. These charges relate to planned transmission

projects for which recovery is not expected, and certain costs associated

with mitigation sales pursuant to merger settlement agreements with the

FERC. These charges were partially offset by a current year impairment

charge resulting from the decision to suspend the application for two

proposed nuclear units at Harris.

Partially offset by:

• A $29 million increase in fuel expense (including purchased power)

primarily due to higher non-recoverable purchased power costs and

increased sales volumes, partially offset by lower fuel expense due to

generation mix as a result of retiring certain coal-fired plants and adding

one new natural gas-fired generating plant.

Other Income and Expense, net. The variance was primarily due to

lower AFUDC equity due to major projects that were placed into service in

late 2012.

Income Tax Expense. The variance was primarily due to an increase in

pretax income. The effective tax rates for the years ended December 31, 2013

and 2012 were 36.5 percent and 28.7 percent, respectively. The increase in the

effective tax rate was primarily due to the impact of lower AFUDC equity.

Matters Impacting Future Duke Energy Progress Results

An appeal of a recently approved rate case is pending at the North Carolina

Supreme Court. The NCAG and NC WARN dispute the rate of return, capital

structure and other matters approved by the NCUC. The outcome of this appeal

could have an adverse impact to Duke Energy Progress’s financial position,

results of operations and cash flows. See Note 4 to the Consolidated Financial

Statements, “Regulatory Matters,” for additional information.