Duke Energy 2013 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

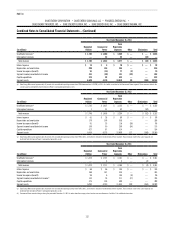

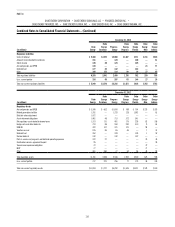

Combined Notes to Consolidated Financial Statements – (Continued)

Duke Energy, through its captive insurance entities, also has reinsurance

coverage with third parties for certain losses above a per occurrence and/or

aggregate retention. Receivables for reinsurance coverage are recognized when

realization is deemed probable.

Unamortized Debt Premium, Discount and Expense

Premiums, discounts and expenses incurred with the issuance of

outstanding long-term debt are amortized over the term of the debt issue. Call

premiums and unamortized expenses associated with renancing higher-cost

debt obligations used to nance regulated assets are amortized. Amortization

expense is recorded as Interest Expense in the Consolidated Statements of

Operations and is reected as Depreciation, amortization and accretion within

Net cash provided by operating activities on the Consolidated Statements of

Cash Flows.

Loss Contingencies and Environmental Liabilities

Contingent losses are recorded when it is probable a loss has occurred

and can be reasonably estimated. When a range of the probable loss exists and

no amount within the range is a better estimate than any other amount, the

minimum amount in the range is recorded. Unless otherwise required by GAAP,

legal fees are expensed as incurred.

Environmental liabilities are recorded on an undiscounted basis when

environmental remediation or other liabilities becomes probable and can be

reasonably estimated. Environmental expenditures related to past operations

that do not generate current or future revenues are expensed. Environmental

expenditures related to operations that generate current or future revenues are

expensed or capitalized, as appropriate. Certain environmental expenditures

receive regulatory accounting treatment and are recorded as regulatory assets.

See Notes 4 and 5 for further information.

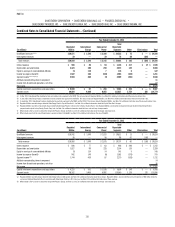

Pension and Other Post-Retirement Benefit Plans

Duke Energy maintains qualied, non-qualied and other post-retirement

benet plans. Eligible employees of the Subsidiary Registrants participate in the

respective qualied, non-qualied and other post-retirement benet plans and

are allocated their proportionate share of benet costs. See Note 21 for further

information, including signicant accounting policies associated with these

plans.

Severance and Special Termination Benefits

Duke Energy has an ongoing severance plan under which, in general,

the longer a terminated employee worked prior to termination the greater the

amount of severance benets. A liability for involuntary severance is recorded

once an involuntary severance plan is committed to by management, or sooner,

if involuntary severances are probable and can be reasonably estimated. For

involuntary severance benets incremental to its ongoing severance plan

benets, the fair value of the obligation is expensed at the communication date

if there are no future service requirements, or over the required future service

period. From time to time, Duke Energy offers special termination benets

under voluntary severance programs. Special termination benets are recorded

immediately upon employee acceptance absent a signicant retention period.

Otherwise, the cost is recorded over the remaining service period. Employee

acceptance of voluntary severance benets is determined by management

based on the facts and circumstances of the benets being offered. See Note 19

for further information.

Guarantees

Liabilities are recognized at the time of issuance or material modication

of a guarantee for the estimated fair value of the obligation it assumes. Fair

value is estimated using a probability-weighted approach. The obligation is

reduced over the term of the guarantee or related contract in a systematic and

rational method as risk is reduced. Any additional contingent loss for guarantee

contracts subsequent to the initial recognition of a liability is accounted for and

recognized at the time a loss is probable and can be reasonably estimated. See

Note 7 for further information.

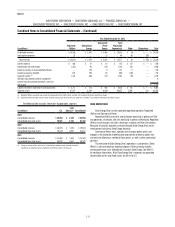

Stock-Based Compensation

Stock-based compensation represents costs related to stock-based

awards granted to employees. Duke Energy recognizes stock-based

compensation based upon the estimated fair value of awards, net of estimated

forfeitures at the date of issuance. The recognition period for these costs begin

at either the applicable service inception date or grant date and continues

throughout the requisite service period, or for certain share-based awards

until the employee becomes retirement eligible, if earlier. Compensation cost

is recognized as expense or capitalized as a component of property, plant and

equipment. See Note 20 for further information.

Income Taxes

Duke Energy and its subsidiaries le a consolidated federal income

tax return and other state and foreign jurisdictional returns. The Subsidiary

Registrants entered into a tax-sharing agreement with Duke Energy and income

taxes recorded represent amounts the Subsidiary Registrants would incur

as separate C-Corporations. Deferred income taxes have been provided for

temporary differences between GAAP and tax bases of assets and liabilities

because the differences create taxable or tax-deductible amounts for future

periods. Deferred taxes are not provided on translation gains and losses when

earnings of a foreign operation are expected to be indenitely reinvested.

Investment tax credits (ITC) associated with regulated operations are deferred

and amortized as a reduction of income tax expense over the estimated useful

lives of the related properties.

Positions taken or expected to be taken on tax returns, including the

decision to exclude certain income or transactions from a return, are recognized

in the nancial statements when it is more likely than not the tax position can

be sustained based solely on the technical merits of the position. The largest

amount of tax benet that is greater than 50 percent likely of being effectively

settled is recorded. Management considers a tax position effectively settled

when: (i) the taxing authority has completed its examination procedures,

including all appeals and administrative reviews; (ii) the Duke Energy

Registrants do not intend to appeal or litigate the tax position included in the

completed examination; and (iii) it is remote the taxing authority would examine

or re-examine the tax position. The amount of a tax return position that is not

recognized in the nancial statements is disclosed as an unrecognized tax

benet. These unrecognized tax benets may impact the nancial statements