Duke Energy 2013 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

174

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

CRC

On a revolving basis, CRC buys certain accounts receivable arising

from the sale of electricity and/or related services from Duke Energy Ohio

and Duke Energy Indiana. Receivables sold are securitized by CRC through a

facility managed by two unrelated third parties and are used as collateral for

commercial paper issued by the unrelated third parties. Proceeds Duke Energy

Ohio and Duke Energy Indiana receive from the sale of receivables to CRC are

typically 75 percent cash and 25 percent in the form of a subordinated note

from CRC. The subordinated note is a retained interest in the receivables sold.

Cash collections from the receivable are the sole source of funds to satisfy the

related debt obligation. Depending on experience with collections, additional

equity infusions to CRC may be required by Duke Energy to maintain a minimum

equity balance of $3 million. There were no infusions to CRC during the years

ended December 31, 2013 and 2012. For the year ended December 31,

2011, Duke Energy infused $6 million of equity to CRC to remedy net worth

deficiencies. Borrowings fluctuate based on the amount of receivables sold. The

credit facility expires in November 2016. The secured credit facility is reflected

on the Consolidated Balance Sheets as Long-term Debt. CRC is considered a

VIE because (i) equity capitalization is insufficient to support its operations,

(ii) power to direct the most significant activities that impact economic

performance of the entity are not performed by the equity holder, Cinergy, and

(iii) deficiencies in net worth of CRC are not funded by Cinergy, but by Duke

Energy. The most significant activity of CRC relates to the decisions made with

respect to the management of delinquent receivables. Duke Energy consolidates

CRC as it makes these decisions. Neither Duke Energy Ohio nor Duke Energy

Indiana consolidate CRC.

CinCap V

CinCap V was created to finance and execute a power sale agreement

with Central Maine Power Company for approximately 35 MW of capacity and

energy. This agreement expires in 2016. CinCap V is considered a VIE because

the equity capitalization is insufficient to support its operations. Duke Energy

consolidates CinCap V as it has power to direct the most significant activities

that impact the economic performance of the entity, which are the decisions to

hedge and finance the power sales agreement.

Renewables

Certain of Duke Energy’s renewable energy facilities are VIEs due to

power purchase agreements with terms that approximate the expected life of

the projects. These fixed price agreements effectively transfer commodity price

risk to the buyer of the power. Certain other of Duke Energy’s renewable energy

facilities are VIEs due to Duke Energy issuing guarantees for debt service and

operations and maintenance reserves in support of debt financings. Assets are

restricted and cannot be pledged as collateral or sold to third parties without prior

approval of debt holders. The most significant activities that impact the economic

performance of these renewable energy facilities were decisions associated with

siting, negotiating purchase power agreements, engineering, procurement and

construction, and decisions associated with ongoing operations and maintenance-

related activities. Duke Energy consolidated the entities as it makes all of these

decisions.

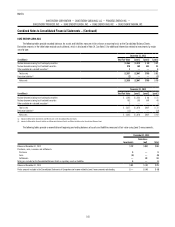

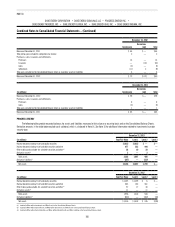

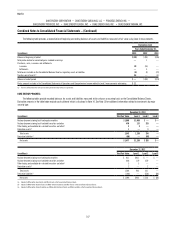

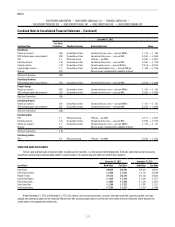

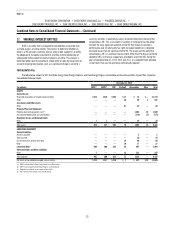

NON-CONSOLIDATED VIEs

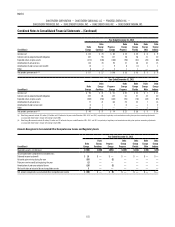

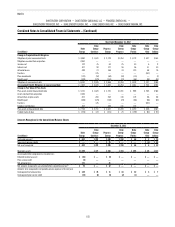

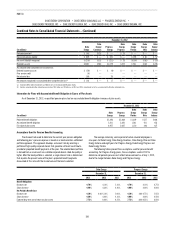

The tables below disclose VIEs the Duke Energy Registrants do not consolidate and how these entities impact the Duke Energy Registrants’ respective

Consolidated Balance Sheets.

December 31, 2013

Duke Energy

(in millions) Renewables Other Total

Duke

Energy

Ohio(a)

Duke

Energy

Indiana(b)

Receivables $ — $ — $ — $114 $143

Investments in equity method unconsolidated affiliates 153 60 213 — —

Intangibles — 96 96 96 —

Investments and other assets — 4 4 — —

Total assets 153 160 313 210 143

Other current liabilities — 3 3 ——

Deferred credits and other liabilities — 15 15 — —

Total liabilities — 18 18 — —

Net assets $ 153 $142 $295 $210 $143

(a) Reflects OVEC and retained interest in CRC.

(b) Reflects retained interest in CRC.