Duke Energy 2013 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART I

7

Potential Plant Retirements

The Subsidiary Registrants periodically file Integrated Resource Plans

(IRP) with state regulatory commissions. The IRPs provide a view of forecasted

energy needs over a long term (15-20 years) and options being considered to

meet those needs. The IRPs filed by the Subsidiary Registrants in 2013 and

2012 included planning assumptions to potentially retire certain coal-fired

generating facilities earlier than their current estimated useful lives. These

facilities do not have the requisite emission control equipment, primarily to

meet U.S. Environmental Protection Agency (EPA) regulations that are not yet

effective. These facilities total approximately 2,447 MW at five sites. Duke

Energy continues to evaluate the potential need to retire these coal-fired

generating facilities earlier than the current estimated useful lives, and plans

to seek regulatory recovery for amounts that would not be otherwise recovered

when any assets are retired. For additional information related to potential plant

retirements see Note 4 to the Consolidated Financial Statements, “Regulatory

Matters.”

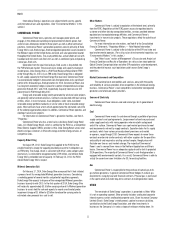

Sources of Electricity

Regulated Utilities relies principally on coal, natural gas and nuclear fuel for its generation of electricity. The following table lists sources of electricity and fuel

costs for the three years ended December 31, 2013.

Generation by Source(a)(e)

Cost of Delivered Fuel per Net

Kilowatt-hour Generated (Cents)(a)(e)

2013 2012 2011 2013 2012 2011

Coal(b) 35.7% 39.1% 52.6% 3.67 3.55 3.17

Nuclear(b) 28.7% 30.8% 33.0% 0.66 0.62 0.55

Oil and gas(b) 21.3% 14.0% 1.2% 4.18 4.03 5.89

All fuels (cost-based on weighted average)(b) 85.7% 83.9% 86.8% 2.79 2.55 2.21

Hydroelectric and solar(c) 1.5% 0.8% 0.9%

Total generation 87.2% 84.7% 87.7%

Purchased power and net interchange(d) 12.8% 15.3% 12.3%

Total sources of energy 100.0% 100.0% 100.0%

(a) Statistics include Duke Energy Progress and Duke Energy Florida beginning July 2, 2012.

(b) Statistics related to all fuels reflect Regulated Utilities’ ownership interest in jointly owned generation facilities.

(c) Generating figures are net of output required to replenish pumped storage facilities during off-peak periods.

(d) Purchased power includes renewable energy purchases.

(e) Includes the effect of the Joint Dispatch Agreement (JDA) and Mitigation Sales. Mitigation sales are excluded from the Regulated Utilities segment.

Coal

Regulated Utilities meets its coal demand through a portfolio of long-term

purchase contracts and short-term spot market purchase agreements. Large

amounts of coal are purchased under long-term contracts with mining operators

who mine both underground and at the surface. Regulated Utilities uses spot-

market purchases to meet coal requirements not met by long-term contracts.

Expiration dates for its long-term contracts, which have various price adjustment

provisions and market re-openers, range from 2014 to 2016 for Duke Energy

Carolinas, 2014 to 2018 for Duke Energy Progress, 2014 to 2016 for Duke Energy

Florida, and 2014 to 2025 for Duke Energy Indiana. Regulated Utilities expects

to renew these contracts or enter into similar contracts with other suppliers as

existing contracts expire, though prices will fluctuate over time as coal markets

change. Coal purchased for the Carolinas is primarily produced from mines in

Central Appalachia, Northern Appalachia and the Illinois Basin. Coal purchased

for Florida is primarily produced from mines in Central Appalachia and the

Illinois Basin. Coal purchased for Indiana is primarily produced in Indiana and

Illinois. Regulated Utilities has an adequate supply of coal under contract to

fuel its projected 2014 operations and a significant portion of supply to fuel its

projected 2015 operations. Coal inventory levels have begun to normalize during

the past year as weather patterns have trended closer to historical averages,

combined with improving economic indicators and higher natural gas prices,

which are resulting in higher coal-fired generation. Significantly colder than

normal temperatures in December 2013 and January 2014 continued the trend of

higher natural gas prices and increased coal-fired generation.

The current average sulfur content of coal purchased by Regulated Utilities

is between 1.5 percent and 2 percent for Duke Energy Carolinas, between

1.5 percent and 2 percent for Duke Energy Progress, between 1 percent and

2.5 percent for Duke Energy Florida, and between 2 percent and 3 percent for

Duke Energy Indiana. Regulated Utilities’ environmental controls, in combination

with the use of sulfur dioxide (SO2) emission allowances, enable Regulated

Utilities to satisfy current SO2 emission limitations for its existing facilities.

Nuclear

The industrial processes for producing nuclear generating fuel generally

involve the mining and milling of uranium ore to produce uranium concentrates,

and services to convert, enrich, and fabricate fuel assemblies.

Regulated Utilities has contracted for uranium materials and services

to fuel its nuclear reactors. Uranium concentrates, conversion services and

enrichment services are primarily met through a diversified portfolio of long-term

supply contracts. The contracts are diversified by supplier, country of origin

and pricing. Regulated Utilities staggers its contracting so that its portfolio of

long-term contracts covers the majority of its fuel requirements in the near-term

and decreasing portions of its fuel requirements over time thereafter. Near-term

requirements not met by long-term supply contracts have been and are expected

to be fulfilled with spot market purchases. Due to the technical complexities

of changing suppliers of fuel fabrication services, Regulated Utilities generally

sources these services to a single domestic supplier on a plant-by-plant basis

using multi-year contracts.

Regulated Utilities has entered into fuel contracts that cover 100 percent

of its uranium concentrates, conversion services, and enrichment services

requirements through at least 2014 and cover fabrication services requirements

for these plants through at least 2018. For future requirements not already

covered under long-term contracts, Regulated Utilities believes it will be able to

renew contracts as they expire, or enter into similar contractual arrangements

with other suppliers of nuclear fuel materials and services.

Oil and Gas

Oil and natural gas supply for Regulated Utilities’ generation fleet

is purchased under term and spot contracts from various suppliers. Duke

Energy Carolinas, Duke Energy Progress, Duke Energy Florida and Duke Energy

Indiana use derivative instruments to limit a portion of their exposure to price

fluctuations for natural gas. Regulated Utilities has dual-fuel generating facilities