Duke Energy 2013 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

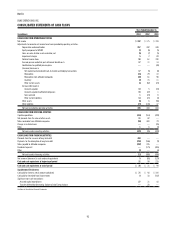

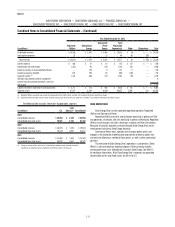

Sheets of the Duke Energy Registrants at December 31, 2013 and 2012. The

amounts presented exceeded 5 percent of current assets or 5 percent of current

liabilities unless otherwise noted.

December 31,

(in millions) Location 2013 2012

Duke Energy

Accrued compensation Current Liabilities $ 621 $ 725

Duke Energy Carolinas

Accrued compensation Current Liabilities $ 198 $ 203

Collateral liabilities Current Liabilities 120 105

Progress Energy

Customer deposits Current Liabilities $ 349 $342

Accrued compensation Current Liabilities 214 304

Derivative liabilities Current Liabilities — 221

Duke Energy Progress

Customer deposits Current Liabilities $ 129 $ 120

Accrued compensation Current Liabilities 121 160

Duke Energy Florida

Customer deposits Current Liabilities $ 220 $ 222

Accrued compensation Current Liabilities 65 95

Derivative liabilities Current Liabilities — 127

Duke Energy Ohio

Collateral assets Current Assets $ 122 $ 99

Duke Energy Indiana

Federal income taxes receivable Current Assets $ 56 $ —

Accrued compensation(a) Current Liabilities 25 23

Collateral liabilities(a) Current Liabilities 40 37

Derivative liabilities Current Liabilities — 63

(a) Does not exceed 5 percent of Total current liabilities on the Consolidated Balance Sheets at

December 31, 2012.

Preferred Stock

In March 2013, Duke Energy Progress and Duke Energy Florida redeemed

all series of their outstanding preferred stock at prices ranging from $101.00

to $110.00 per share for Duke Energy Progress and $101.00 to $104.25 per

share for Duke Energy Florida plus accrued dividends for all series. Duke Energy

Progress and Duke Energy Florida redeemed the shares for $62 million and

$34 million, respectively.

Discontinued Operations

For the year ended December 31, 2013, Duke Energy’s and Progress

Energy’s Income From Discontinued Operations, net of tax was primarily due

to tax benets related to prior sales of diversied businesses. For the year

ended December 31, 2012, Duke Energy’s and Progress Energy’s Income

From Discontinued Operations, net of tax was primarily related to resolution of

litigation associated with Progress Energy’s former synthetic fuel operations

and reversal of certain environmental indemnication liabilities for which the

indemnication period expired during 2012. See Note 5 for more information

regarding the former synthetic fuel operations.

Amounts Attributable to Controlling Interests

Income From Discontinued Operations, net of tax presented on the

respective Consolidated Statements of Operations for Duke Energy and

Progress Energy is attributable to controlling interests for all periods presented.

Other comprehensive income presented on Progress Energy’s Consolidated

Statements of Operations and Comprehensive Income are attributable to

controlling interests for all periods presented.

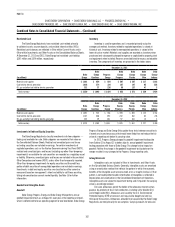

SIGNIFICANT ACCOUNTING POLICIES

Use of Estimates

In preparing nancial statements that conform to generally accepted

accounting principles (GAAP) in the U.S., the Duke Energy Registrants must

make estimates and assumptions that affect the reported amounts of assets

and liabilities, the reported amounts of revenues and expenses, and the

disclosure of contingent assets and liabilities at the date of the nancial

statements. Actual results could differ from those estimates.

Regulatory Accounting

The majority of the Duke Energy Registrants’ operations are subject to

price regulation for the sale of electricity and gas by state utility commissions

or FERC. When prices are set on the basis of specic costs of the regulated

operations and an effective franchise is in place such that sufcient gas or

electric services can be sold to recover those costs, the Duke Energy Registrants

apply regulatory accounting. Regulatory accounting changes the timing of the

recognition of costs or revenues relative to a company that does not apply

regulatory accounting. As a result, Regulatory assets and Regulatory liabilities

are recognized on the Consolidated Balance Sheets. Regulatory assets and

liabilities are amortized consistent with the treatment of the related cost in the

ratemaking process. See Note 4 for further information.

Regulated Fuel Costs and Purchased Power

The Duke Energy Registrants utilize cost-tracking mechanisms, commonly

referred to as fuel adjustment clauses. These clauses allow for the recovery

of fuel and fuel-related costs and portions of purchased power costs through

surcharges on customer rates. The difference between the costs incurred and

the surcharge revenues is recorded as an adjustment to Fuel used in electric

generation and purchased power — regulated or Operating Revenues –

Regulated electric on the Consolidated Statements of Operations with an

off-setting impact on regulatory assets or liabilities.

Cash and Cash Equivalents

All highly liquid investments with maturities of three months or less at

the date of acquisition are considered cash equivalents. At December 31, 2013,

$1,086 million of Duke Energy’s total cash and cash equivalents is held by

entities domiciled in foreign jurisdictions and is forecasted to be used to fund

international operations and investments.