Duke Energy 2013 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

126

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

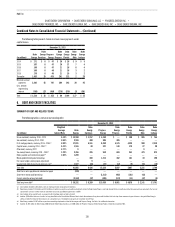

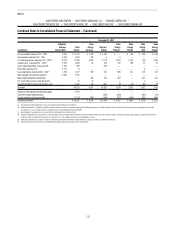

planning purposes, the Duke Energy Registrants currently estimate the cost of

new control equipment that may need to be installed on existing power plants

to comply with these EPA regulations could total $4.5 billion to $5.5 billion,

excluding AFUDC, over the next 10 years. The table below includes estimated

costs for new control equipment necessary to comply with the MATS rule, which

is the only rule that has been nalized.

(in millions)

Duke Energy $525 to $625

Duke Energy Carolinas 40 to 50

Progress Energy 25 to 40

Duke Energy Progress 10 to 15

Duke Energy Florida 15 to 25

Duke Energy Ohio 35 to 50

Duke Energy Indiana 425 to 485

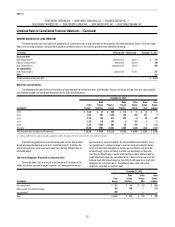

The Duke Energy Registrants also expect to incur increased fuel,

purchased power, operation and maintenance, and other expenses, and costs

for replacement generation for potential coal-red power plant retirements as

a result of these EPA regulations. The actual compliance costs incurred may be

materially different from these estimates based on the timing and requirements

of the nal EPA regulations. The Duke Energy Registrants intend to seek rate

recovery of amounts incurred associated with regulated operations in complying

with these regulations. Refer to Note 4 for further information regarding potential

plant retirements and regulatory lings related to the Duke Energy Registrants.

LITIGATION

Duke Energy

Dan River Ash Basin Release

On February 2, 2014, a break in a stormwater pipe beneath an ash basin

at Duke Energy Carolinas’ retired Dan River steam station caused a release of

ash basin water and ash into the Dan River. On February 8, 2014, a permanent

plug was installed in the stormwater pipe stopping the release of materials into

the river. Duke Energy Carolinas estimates 30,000 to 39,000 tons of ash and

24 million to 27 million gallons of basin water were released into the river. Duke

Energy Carolinas continues to work with local and state ofcials responding

to this event. On February 10, 2014, Duke Energy received a subpoena for the

production of documents, issued by the United States Attorney for the Eastern

District of North Carolina in connection with a criminal investigation related to

the release. A second subpoena was issued by the same United States Attorney

on February 18, 2014, which expanded the document production to cover all

fourteen of the North Carolina facilities with coal ash ponds.

It is not possible to predict whether Duke Energy will incur any liability or

to estimate the damages, if any, it might incur in connection with these matters.

Progress Energy Merger Shareholder Litigation

On May 31, 2013, the Delaware Chancery Court consolidated four

shareholder derivative lawsuits led in 2012. The Court also appointed a lead

plaintiff and counsel for plaintiffs and designated the case as In Re Duke Energy

Corporation Derivative Litigation. The lawsuit names as defendants eleven

members of the Duke Energy board of directors who were also members of the

pre-merger Duke Energy board of directors (Legacy Duke Energy Directors).

Duke Energy is named as a nominal defendant. The case alleges claims for

breach of duciary duties of loyalty and care in connection with the post-merger

change in CEO. The case is stayed pending resolution of the Nieman v. Duke

Energy Corporation, et al. case in North Carolina.

On August 3, 2012, Duke Energy was served with a shareholder Derivative

Complaint, which was transferred to the North Carolina Business Court (Krieger

v. Johnson, et al.). The lawsuit names as defendants, William D. Johnson

and the Legacy Duke Energy Directors. Duke Energy is named as a nominal

defendant. The lawsuit alleges claims for breach of duciary duty in granting

excessive compensation to Mr. Johnson. A decision on a motion to dismiss made

by the Legacy Duke Energy Directors remains pending.

Two shareholder Derivative Complaints, led in 2012 in federal district

court in Delaware, were consolidated as Tansey v. Rogers, et al. The case

alleges claims for breach of duciary duty and waste of corporate assets,

as well as claims under Section 14(a) and 20(a) of the Exchange Act. Duke

Energy is named as a nominal defendant. On May 17, 2013, the judge granted

defendants’ motion to stay the litigation until a decision is rendered on the

motion to dismiss in the Nieman v. Duke Energy Corporation, et al. case in

North Carolina.

Duke Energy, the Legacy Duke Energy Directors and certain Duke Energy

ofcers are also defendants in a purported securities class action lawsuit

(Nieman v. Duke Energy Corporation, et al). This lawsuit consolidates three

lawsuits originally led in July 2012, and is pending in the United States District

Court for the Western District of North Carolina. The plaintiffs allege federal

Securities Act and Exchange Act claims based on allegations of materially false

and misleading representations and omissions in the Registration Statement

led on July 7, 2011, and purportedly incorporated into other documents, all

in connection with the post-merger change in CEO. The claims are purportedly

brought on behalf of a class of all persons who purchased or otherwise acquired

Duke Energy securities between June 11, 2012 and July 9, 2012. On July 26,

2013, the Magistrate Judge recommended the District Court Judge deny the

defendants’ motion to dismiss. On October 2, 2013, the District Judge heard

defendants’ objections to this recommendation. A decision is pending on the

motion to dismiss.

It is not possible to predict whether Duke Energy will incur any liability or

to estimate the damages, if any, it might incur in connection with these lawsuits.

Alaskan Global Warming Lawsuit

On February 26, 2008, the governing bodies of an Inupiat village in Alaska,

led suit in the U.S. Federal Court for the Northern District of California against

various defendants including Duke Energy. On May 20, 2013, the plaintiffs’

Petition for Certiorari to the Supreme Court was denied, ending the case.

Price Reporting Cases

A total of ve lawsuits were led against Duke Energy afliates and other

energy companies and remain pending in a consolidated, single federal court

proceeding in Nevada.

Each of these cases contain similar claims, that defendants’ allegedly

manipulated natural gas markets by various means, including providing

false information to natural gas trade publications and entering into unlawful

arrangements and agreements in violation of the antitrust laws of the respective

states. Plaintiffs seek damages in unspecied amounts.

On July 19, 2011, the judge granted a defendant’s motion for summary

judgment in two of the remaining ve cases to which Duke Energy afliates are

a party. The U.S. Court of Appeals for the Ninth Circuit subsequently reversed

the lower court’s decision. On August 26, 2013, the defendants, including

Duke Energy, led a petition for certiorari to the U.S. Supreme Court, which

remains pending.