Duke Energy 2013 Annual Report Download - page 188

Download and view the complete annual report

Please find page 188 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

170

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

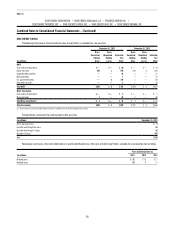

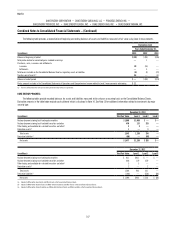

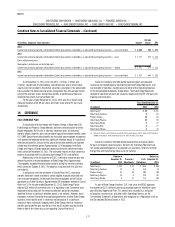

December 31, 2012

(in millions) Total Fair Value Level 1 Level 2 Level 3

Available-for-sale equity securities(a) $ 49 $ 49 $ — $—

Available-for-sale debt securities(a) 29 — 29 —

Derivative assets(b) 10 — — 10

Total assets 88 49 29 10

Derivative liabilities(c) (63) — (63) —

Net assets (liabilities) $ 25 $ 49 $ (34) $ 10

(a) Included in Other within Investments and Other Assets on the Consolidated Balance Sheets.

(b) Included in Other within Current Assets on the Consolidated Balance Sheets.

(c) Included in Other within Current Liabilities and Other within Deferred Credits and Other Liabilities on the Consolidated Balance Sheets.

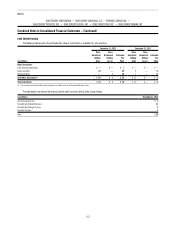

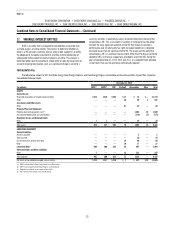

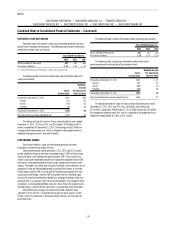

The following table provides a reconciliation of beginning and ending balances of assets and liabilities measured at fair value using Level 3 measurements.

Derivatives (net)

Years Ended December 31,

(in millions) 2013 2012 2011

Balance at beginning of period $ 10 $ 4 $ 4

Total pretax realized or unrealized gains included in earnings(a) 8 36 14

Purchases, sales, issuances and settlements:

Purchases 20 — 8

Sales — 22 —

Settlements (30) (52) (21)

Total losses included on the Consolidated Balance Sheet as regulatory assets or liabilities 4 — (1)

Balance at end of period $ 12 $ 10 $ 4

(a) Amounts in derivatives are primarily included in Operating Revenues.

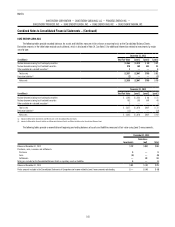

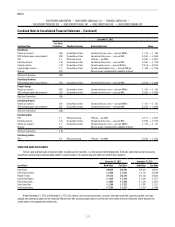

QUANTITATIVE INFORMATION ABOUT UNOBSERVABLE INPUTS

The following table provides quantitative information about the Duke Energy Registrants’ derivatives classified as Level 3.

December 31, 2013

Investment Type

Fair Value

(in millions) Valuation Technique Unobservable Input Range

Duke Energy

Natural gas contracts $ (2) Discounted cash flow Forward natural gas curves — price per MMBtu $ 3.07 —$ 5.37

FERC mitigation power sale agreements $ (2) Discounted cash flow Forward electricity curves — price per MWh $ 25.79 —$ 52.38

Financial transmission rights (FTRs) $ 12 RTO auction pricing FTR price — per Megawatt Hour (MWh) $ (0.30) —$ 13.80

Electricity contracts $ 23 Discounted cash flow Forward electricity curves — price per MWh $ 20.77 —$ 58.90

Commodity capacity option contracts $ 4 Discounted cash flow Forward capacity option curves — price per MW day $ 30.40 —$165.10

Reserves $(22) Bid-ask spreads, implied volatility, probability of default

Total Level 3 derivatives $ 13

Duke Energy Carolinas

FERC mitigation power sale agreements $ (2) Discounted cash flow Forward electricity curves — price per MWh $ 25.79 —$ 52.38

Duke Energy Ohio

Electricity contracts $ 18 Discounted cash flow Forward electricity curves — price per MWh $ 20.77 —$ 58.90

Natural gas contracts $ (2) Discounted cash flow Forward natural gas curves — price per MMBtu $ 3.07 —$ 5.37

Reserves $(20) Bid-ask spreads, implied volatility, probability of default

Total Level 3 derivatives $ (4)

Duke Energy Indiana

FTRs $ 12 RTO auction pricing FTR price — per MWh $ (0.30) —$ 13.80