Duke Energy 2013 Annual Report Download - page 206

Download and view the complete annual report

Please find page 206 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

188

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

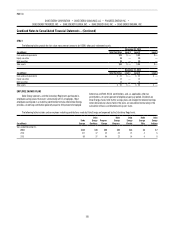

Combined Notes to Consolidated Financial Statements – (Continued)

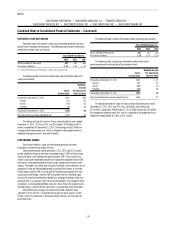

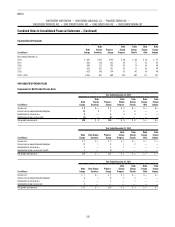

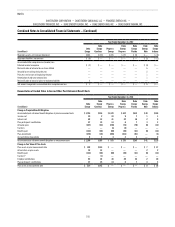

December 31, 2012

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Current pension liability(a) $ 30 $ 3 $ 11 $ 2 $ 3 $ — $—

Noncurrent pension liability 305 13 165 36 42 4 5

Total accrued pension liability $ 335 $ 16 $176 $ 38 $ 45 $ 4 $ 5

Regulatory assets $ 59 $ 3 $ 34 $ 7 $ 9 $ — $ 2

Regulatory liabilities $ 2 $ — $ — $— $ — $ — $—

Accumulated other comprehensive (income) loss

Deferred income tax asset $ — $ — $ (4) $— $ — $ — $ —

Net actuarial (gain) loss (1) — 12 — — — —

Net amounts recognized in accumulated other comprehensive (income) loss $ (1) $ — $ 8 $— $ — $ — $—

(a) Included in Other within Current Liabilities on the Consolidated Balance Sheets.

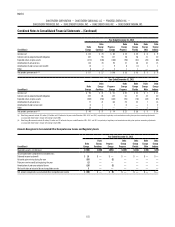

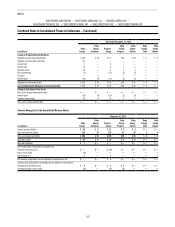

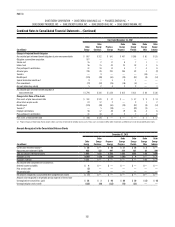

Information for Plans with Accumulated Benefit Obligation in Excess of Plan Assets

December 31, 2013

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Projected benefit obligation $ 304 $ 15 $ 140 $ 34 $ 39 $ 3 $5

Accumulated benefit obligation 302 15 140 34 39 3 5

December 31, 2012

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Projected benefit obligation $335 $16 $176 $38 $ 45 $ 4 $ 5

Accumulated benefit obligation 332 16 175 36 44 4 5

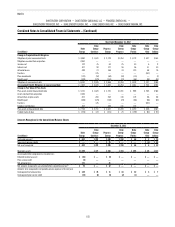

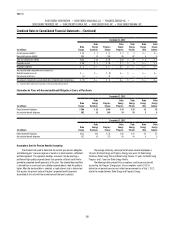

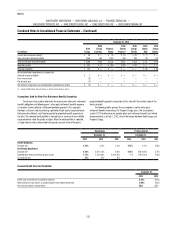

Assumptions Used for Pension Benefits Accounting

The discount rate used to determine the current year pension obligation

and following year’s pension expense is based on a bond selection-settlement

portfolio approach. This approach develops a discount rate by selecting a

portfolio of high quality corporate bonds that generate sufficient cash flow to

provide for projected benefit payments of the plan. The selected bond portfolio

is derived from a universe of non-callable corporate bonds rated Aa quality or

higher. After the bond portfolio is selected, a single interest rate is determined

that equates the present value of the plan’s projected benefit payments

discounted at this rate with the market value of the bonds selected.

The average remaining service period of active covered employees is

13 years for Duke Energy and Progress Energy, nine years for Duke Energy

Carolinas, Duke Energy Ohio and Duke Energy Indiana, 12 years for Duke Energy

Progress and 17 years for Duke Energy Florida.

The following tables present the assumptions used for pension benefit

accounting. For Progress Energy plans, the assumptions used in 2012 to

determine net periodic pension cost reflect remeasurement as of July 1, 2012,

due to the merger between Duke Energy and Progress Energy.