Duke Energy 2013 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

177

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

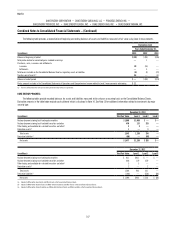

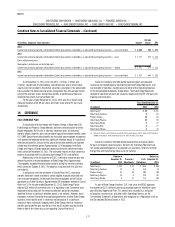

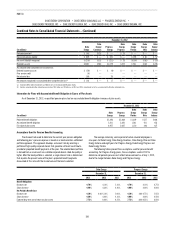

(In millions, except per-share amounts) Income

Average

Shares EPS

2013

Income from continuing operations attributable to Duke Energy common shareholders, as adjusted for participating securities — basic and diluted $ 2,640 706 $ 3.74

2012

Income from continuing operations attributable to Duke Energy common shareholders, as adjusted for participating securities — basic $ 1,727 574 $ 3.01

Effect of dilutive securities:

Stock options, performance and restricted stock 1

Income from continuing operations attributable to Duke Energy common shareholders, as adjusted for participating securities — diluted $ 1,727 575 $ 3.01

2011

Income from continuing operations attributable to Duke Energy common shareholders, as adjusted for participating securities — basic and diluted $ 1,702 444 $ 3.83

As of December 31, 2013, 2012 and 2011, 2 million, 1 million and

3 million, respectively, of stock options and performance and unvested stock

awards were not included in the dilutive securities calculation in the above table

because either the option exercise prices were greater than the average market

price of the common shares during those periods, or performance measures

related to the awards had not yet been met.

For the years ended December 31, 2013, 2012 and 2011, Duke Energy

declared dividends of $3.09 per share, $3.03 per share and $2.97 per share,

respectively.

19. SEVERANCE

2011 SEVERANCE PLAN

In conjunction with the merger with Progress Energy, in November 2011

Duke Energy and Progress Energy offered a voluntary severance plan to certain

eligible employees. As this was a voluntary severance plan, all severance

benefits offered under this plan are considered special termination benefits under

U.S. GAAP. Special termination benefits are measured upon employee acceptance

and recorded immediately absent any significant retention period. If a significant

retention period exists, the cost of the special termination benefits are recorded

ratably over the retention period. Approximately 1,100 employees from Duke

Energy and Progress Energy requested severance during the voluntary window,

which closed on November 30, 2011. The estimated amount of future severance

expense associated with this voluntary plan through 2014 is not material.

Additionally, in the third quarter of 2012, a voluntary severance plan was

offered to certain unionized employees of Duke Energy Ohio. Approximately

75 employees accepted the termination benefits during the voluntary window,

which closed on October 8, 2012. The expense associated with this plan was

not material.

In conjunction with the retirement of Crystal River Unit 3, severance

benefits have been made available to certain eligible impacted unionized and

non-unionized employees, to the extent that those employees do not find job

opportunities at other locations. Approximately 600 employees worked at Crystal

River Unit 3. For the year ended December 31, 2013, Duke Energy Florida

deferred $26 million of severance costs as a regulatory asset. Severance costs

expected to be accrued over the remaining retention period for employees

identified to have a significant retention period is not material. However, these

employees maintain the ability to accept job opportunities at other Duke Energy

locations, which would result in severance not being paid. If a significant

amount of these individuals redeploy within Duke Energy, the final severance

benefits paid under the plan may be less than what has been accrued to date.

Refer to Note 4 for further discussion regarding Crystal River Unit 3.

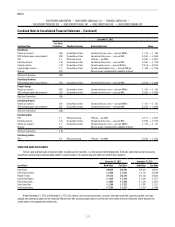

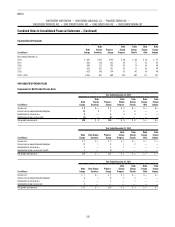

Amounts included in the table below represent direct and allocated

severance and related expense recorded by the Duke Energy Registrants, and

are recorded in Operation, maintenance and other within Operating Expenses

on the Consolidated Statements of Operations. The Duke Energy Registrants

recorded insignificant amounts for severance expense during 2011 for past and

ongoing severance plans.

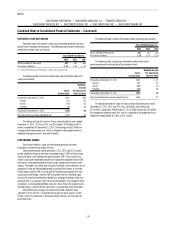

Years Ended December 31,

(in millions) 2013 2012

Duke Energy(a) $ 34 $ 201

Duke Energy Carolinas 8 63

Progress Energy 19 82

Duke Energy Progress 14 55

Duke Energy Florida 5 27

Duke Energy Ohio 2 21

Duke Energy Indiana 2 18

(a) Includes $5 million and $14 million of accelerated stock award expense and $2 million and $19 million of

COBRA and healthcare reimbursement expenses for 2013 and 2012, respectively.

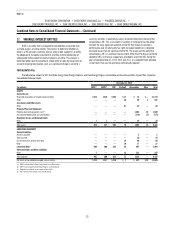

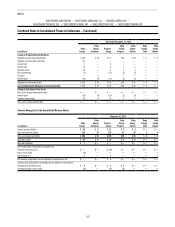

Amounts included in the table below represent the severance liability

for past and ongoing severance plans. Amounts for Subsidiary Registrants do

not include allocated expense or associated cash payments. Amounts for Duke

Energy Ohio and Duke Energy Indiana are not material.

(in millions)

Balance at

December 31,

2012

Provision /

Adjustments

Cash

Reductions

Balance at

December 31,

2013

Duke Energy $ 135 $ 52 $ (123) $ 64

Duke Energy Carolinas 12 6 (13) 5

Progress Energy 43 49 (48) 44

Duke Energy Progress 23 8 (20) 11

Duke Energy Florida 6 31 (13) 24

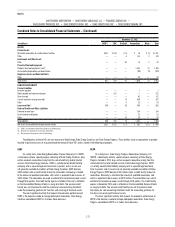

As part of Duke Energy Carolinas’ 2011 rate case, the NCUC approved

the recovery of $101 million of previously recorded expenses related to a prior

year Voluntary Opportunity Plan. This amount was recorded as a reduction

to Operation, maintenance, and other within Operating Expenses on the

Consolidated Statements of Operations and recognized as a Regulatory asset on

the Consolidated Balance Sheets in 2012.