Duke Energy 2013 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

146

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

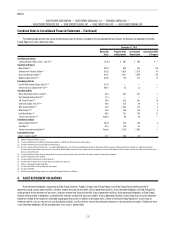

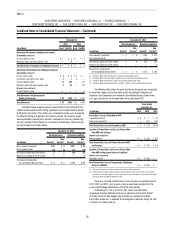

The tables below show the balance sheet location of derivative contracts

subject to enforceable master netting agreements and include collateral posted

to offset the net position. This disclosure is intended to enable users to evaluate

the effect of netting arrangements on financial position. The amounts shown

were calculated by counterparty. Accounts receivable or accounts payable may

also be available to offset exposures in the event of bankruptcy. These amounts

are not included in the tables below.

December 31, 2013

Derivative Assets Derivative Liabilities

(in millions) Current(a)

Non-

Current(b) Current(c)

Non-

Current(d)

Gross amounts recognized $ 214 $ 233 $ 322 $ 299

Gross amounts offset (179) (138) (192) (155)

Net amount subject to master netting 35 95 130 144

Amounts not subject to master netting — 14 4 11

Net amounts recognized on

the Consolidated Balance Sheet $ 35 $ 109 $ 134 $ 155

December 31, 2012

Derivative Assets Derivative Liabilities

(in millions) Current(a)

Non-

Current(b) Current(c)

Non-

Current(d)

Gross amounts recognized $ 127 $ 96 $ 402 $ 295

Gross amounts offset (114) (54) (151) (90)

Net amounts subject to master netting 13 42 251 205

Amounts not subject to master netting 22 19 166 54

Net amounts recognized on

the Consolidated Balance Sheet $ 35 $ 61 $ 417 $ 259

(a) Included in Other within Current Assets on the Consolidated Balance Sheet.

(b) Included in Other within Investments and Other Assets on the Consolidated Balance Sheet.

(c) Included in Other within Current Liabilities on the Consolidated Balance Sheet.

(d) Included in Other within Deferred Credits and Other Liabilities on the Consolidated Balance Sheet.

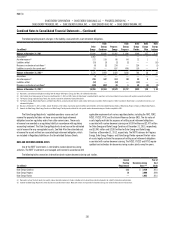

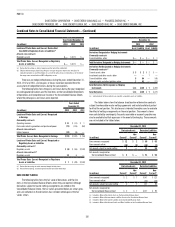

The following table shows the gains and losses during the year recognized

on cash flow hedges and the line items on the Consolidated Statements

of Operations where such gains and losses are included when reclassified

from AOCI.

Years Ended December 31,

(in millions) 2013 2012 2011

Pretax Gains (Losses) Recorded in AOCI

Interest rate contracts(a) $ 79 $ (23) $ (88)

Commodity contracts 1 1 —

Total Pretax Gains (Losses) Recorded in AOCI $ 80 $ (22) $ (88)

Location of Pretax Gains and (Losses) Reclassified

from AOCI into Earnings

Interest rate contracts

Interest expense $ (2) $ 2 $ (5)

Total Pretax Gains (Losses) Reclassified

from AOCI into Earnings $ (2) $ 2 $ (5)

(a) Reclassified to earnings as interest expense over the term of the related debt.

There was no hedge ineffectiveness during the years ended December 31,

2013, 2012 and 2011, and no gains or losses were excluded from the

assessment of hedge effectiveness during the same periods.

At December 31, 2013, and December 31, 2012, $59 million and

$151 million, respectively, of pretax deferred net losses interest rate cash

flow hedges were included in AOCI. A $4 million pretax gain is expected to be

recognized in earnings during the next 12 months as interest expense.

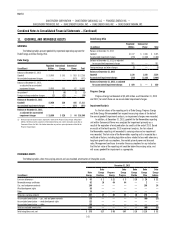

The following table shows the gains and losses during the year recognized

on undesignated derivatives and the line items on the Consolidated Statements

of Operations or the Consolidated Balance Sheets where the pretax gains and

losses were reported.

Years Ended

December 31,

(in millions) 2013 2012 2011

Location of Pretax Gains and (Losses) Recognized

in Earnings

Commodity contracts

Revenue: Regulated electric $ 11 $ (23) $ —

Revenue: Nonregulated electric, natural gas and other 43 38 (59)

Other income and expenses — (2) —

Fuel used in electric generation and purchased

power-regulated (200) (194) —

Fuel used in electric generation and purchased

power — nonregulated (100) 2 (1)

Interest rate contracts

Interest expense (18) (8) —

Total Pretax (Losses) Gains Recognized in Earnings $ (264) $ (187) $ (60)

Location of Pretax Gains and (Losses) Recognized

as Regulatory Assets or Liabilities

Commodity contracts(a)

Regulatory assets $ 10 $ (2) $ (1)

Regulatory liabilities 15 36 17

Interest rate contracts(b)

Regulatory assets 55 10 (165)

Regulatory liabilities — — (60)

Total Pretax Gains (Losses) Recognized as Regulatory

Assets or Liabilities $ 80 $ 44 $ (209)

(a) Reclassified to earnings to match recovery through the fuel clause.

(b) Reclassified to earnings as interest expense over the term of the related debt.

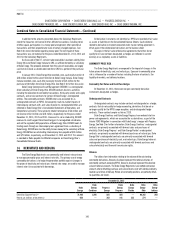

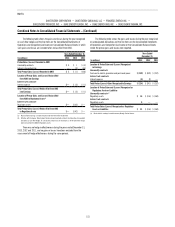

DUKE ENERGY CAROLINAS

The following table shows the fair value of derivatives and the line

items in the Consolidated Balance Sheets where they are reported. Although

derivatives subject to master netting arrangements are netted on the

Consolidated Balance Sheets, the fair values presented below are shown gross

and cash collateral on the derivatives has not been netted against the fair

values shown.