Duke Energy 2013 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

PART II

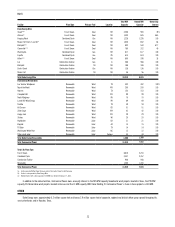

ITEM 6. SELECTED FINANCIAL DATA

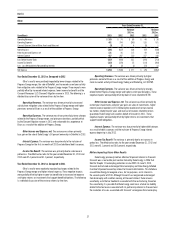

(in millions, except per-share amounts) 2013 2012 2011 2010 2009

Statement of Operations(a)

Total operating revenues $ 24,598 $ 19,624 $14,529 $14,272 $12,731

Operating income 4,982 3,126 2,777 2,461 2,249

Income from continuing operations 2,659 1,746 1,713 1,320 1,073

Net income 2,676 1,782 1,714 1,323 1,085

Net income attributable to Duke Energy Corporation 2,665 1,768 1,706 1,320 1,075

Common Stock Data

Income from continuing operations attributable to Duke Energy Corporation common shareholders(b)

Basic $ 3.74 $ 3.01 $ 3.83 $ 2.99 $ 2.46

Diluted 3.74 3.01 3.83 2.99 2.46

Net income attributable to Duke Energy Corporation common shareholders(b)

Basic $ 3.77 $ 3.07 $ 3.83 $ 3.00 $ 2.49

Diluted 3.76 3.07 3.83 3.00 2.49

Dividends declared per share(b) 3.09 3.03 2.97 2.91 2.82

Balance Sheet

Total assets $114,779 $113,856 $62,526 $59,090 $57,040

Long-term debt including capital leases and redeemable preferred stock of subsidiaries, less current maturities 38,152 36,444 18,679 17,935 16,113

(a) Significant transactions reflected in the results above include: (i) 2013 charges related to Crystal River Unit 3 and nuclear development costs (see Note 4 to the Consolidated Financial Statements, “Regulatory Matters”);

(ii) the 2012 merger with Progress Energy (see Note 2 to the Consolidated Financial Statements, “Acquisitions, Dispositions and Sales of Other Assets”); (iii) 2012 and 2011 charges related to the Edwardsport Integrated

Gasification Combined Cycle (IGCC) project (see Note 4 to the Consolidated Financial Statements); and (iv) 2010 impairment of goodwill and other assets.

(b) On July 2, 2012, immediately prior to the merger with Progress Energy, Duke Energy executed a one-for-three reverse stock split. All share and earnings per share amounts are presented as if the one-for-three reverse stock

split had been effective at the beginning of the earliest period presented.

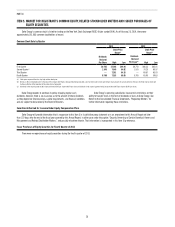

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Management’s Discussion and Analysis includes financial information

prepared in accordance with generally accepted accounting principles (GAAP)

in the U.S., as well as certain non-GAAP financial measures such as adjusted

earnings, adjusted earnings per share and adjusted segment income, discussed

below. Generally, a non-GAAP financial measure is a numerical measure

of financial performance, financial position or cash flows that excludes (or

includes) amounts that are included in (or excluded from) the most directly

comparable measure calculated and presented in accordance with GAAP. The

non-GAAP financial measures should be viewed as a supplement to, and not

a substitute for, financial measures presented in accordance with GAAP. Non-

GAAP measures as presented herein may not be comparable to similarly titled

measures used by other companies.

The following combined Management’s Discussion and Analysis of

Financial Condition and Results of Operations is separately filed by Duke Energy,

Duke Energy Carolinas, Progress Energy, Duke Energy Progress, Duke Energy

Florida, Duke Energy Ohio and Duke Energy Indiana. However, none of the

registrants makes any representation as to information related solely to Duke

Energy or the Subsidiary Registrants of Duke Energy other than itself.

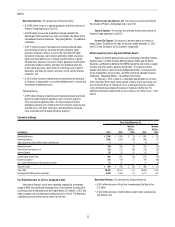

DUKE ENERGY

Duke Energy Corporation (collectively with its subsidiaries, Duke Energy)

is an energy company headquartered in Charlotte, North Carolina. Duke Energy

operates in the U.S. primarily through its wholly owned subsidiaries, Duke Energy

Carolinas, Duke Energy Progress, Duke Energy Florida, Duke Energy Ohio, and

Duke Energy Indiana, as well as in Latin America.

When discussing Duke Energy’s consolidated financial information, it

necessarily includes the results of the Subsidiary Registrants, which, along with

Duke Energy, are collectively referred to as the Duke Energy Registrants.

Management’s Discussion and Analysis should be read in conjunction

with the Consolidated Financial Statements and Notes for the years ended

December 31, 2013, 2012, and 2011.

Executive Overview

MERGER WITH PROGRESS ENERGY

On July 2, 2012, Duke Energy merged with Progress Energy, with Duke

Energy continuing as the surviving corporation, and Progress Energy becoming

a wholly owned subsidiary of Duke Energy. Duke Energy Progress and Duke

Energy Florida, Progress Energy’s regulated utility subsidiaries, are now indirect

wholly owned subsidiaries of Duke Energy. Duke Energy’s consolidated financial

statements include Progress Energy, Duke Energy Progress and Duke Energy

Florida activity beginning July 2, 2012.

Immediately preceding the merger, Duke Energy completed a one-for-three

reverse stock split with respect to the issued and outstanding shares of Duke

Energy common stock. All share and per share amounts presented herein reflect

the impact of the one-for-three reverse stock split.

For additional information on the details of this transaction including

regulatory conditions and accounting implications, see Note 2 to the

Consolidated Financial Statements, “Acquisitions and Dispositions of Businesses

and Sales of Other Assets.”