Duke Energy 2013 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

142

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

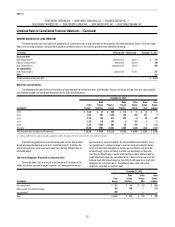

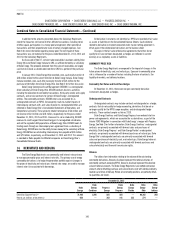

December 31, 2012

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Emission allowances $ 80 $— $ 26 $ 4 $ 22 $ 24 $ 29

Renewable energy certificates 18 14 2 1 — — —

Gas, coal and power contracts 295 — — — — 272 24

Wind development rights 111 — — — — — —

Other 91 — — — — 10 —

Total gross carrying amounts 595 14 28 5 22 306 53

Accumulated amortization — gas, coal and power contracts (180) — — — — (168) (12)

Accumulated amortization — wind development rights (9) — — — — — —

Accumulated amortization — other (34) — — — — (9) —

Total accumulated amortization (223) — — — — (177) (12)

Total intangible assets, net $ 372 $ 14 $ 28 $ 5 $ 22 $ 129 $ 41

Impairment of Emission Allowances

On August 8, 2011, the EPA’s final rule to replace CAIR was published in

the Federal Register. As further discussed in Note 5, CSAPR established state-

level annual SO2 and NOx caps that were required to take effect on January 1,

2012, and state-level ozone-season NOx caps that were to take effect on

May 1, 2012. CSAPR did not utilize CAA emission allowances as the original

CAIR provided. Under CSAPR, the EPA was expected to issue new emission

allowances to be used exclusively for purposes of complying with CSAPR

cap-and-trade program. After this ruling was published in 2011, Duke Energy

evaluated the effect of CSAPR on the carrying value of emission allowances

recorded at its Regulated Utilities and Commercial Power segments. Based on

the provisions of CSAPR, Duke Energy Ohio had more SO2 allowances than were

needed to comply with the continuing CAA acid rain cap-and-trade program

(excess emission allowances). Duke Energy Ohio incurred a pretax impairment

of $79 million in 2011 to write down the carrying value of excess emission

allowances held by Commercial Power to fair value. The charge is recorded in

Goodwill and other impairment charges on Duke Energy Ohio’s Consolidated

Statements of Operations. This amount was based on the fair value of excess

allowances held by Commercial Power for compliance under the continuing CAA

acid rain cap-and-trade program as of September 30, 2011.

Amortization Expense

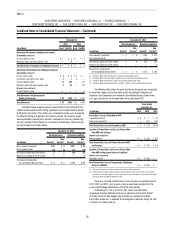

The following table presents amortization expense for gas, coal and power

contracts, wind development rights and other intangible assets.

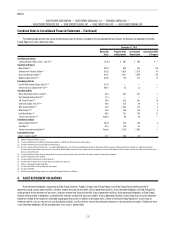

December 31,

(in millions) 2013 2012 2011

Duke Energy $13 $14 $ 10

Duke Energy Ohio 8 12 8

Duke Energy Indiana 1 1 1

The table below shows the expected amortization expense for the

next five years for intangible assets as of December 31, 2013. The expected

amortization expense includes estimates of emission allowances consumption

and estimates of consumption of commodities such as gas and coal under

existing contracts, as well as estimated amortization related to the wind

development projects. The amortization amounts discussed below are estimates

and actual amounts may differ from these estimates due to such factors as

changes in consumption patterns, sales or impairments of emission allowances

or other intangible assets, delays in the in-service dates of wind assets,

additional intangible acquisitions and other events.

(in millions) 2014 2015 2016 2017 2018

Duke Energy $43 $ 19 $ 17 $ 16 $ 16

Progress Energy 4 3 2 1 1

Duke Energy Progress 1 — — — —

Duke Energy Florida 3 3 2 1 1

Duke Energy Ohio 11 9 9 9 9

Duke Energy Indiana 22 1 1 1 1

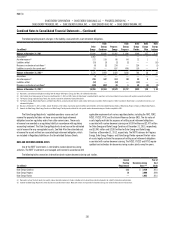

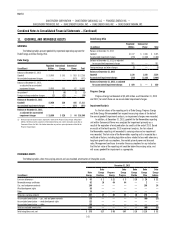

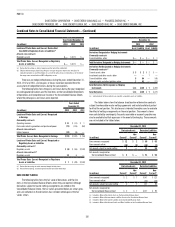

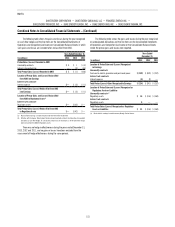

12. INVESTMENTS IN UNCONSOLIDATED AFFILIATES

EQUITY METHOD INVESTMENTS

Investments in domestic and international affiliates that are not controlled

by Duke Energy, but over which it has significant influence, are accounted for

using the equity method. As of December 31, 2013 and 2012, the carrying

amount of investments in affiliates with carrying amounts greater than zero

approximated the amount of underlying equity in net assets.