Duke Energy 2013 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

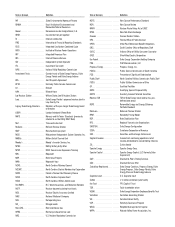

Management evaluates segment performance based on segment income.

Segment income is defined as income from continuing operations net of income

attributable to noncontrolling interests. Segment income, as discussed below,

includes intercompany revenues and expenses that are eliminated in the

Consolidated Financial Statements. Management also uses adjusted segment

income as a measure of historical and anticipated future segment performance.

Adjusted segment income is a non-GAAP financial measure, as it is based

upon segment income adjusted for special items and mark-to-market impacts

of economic hedges in the Commercial Power segment. Management believes

the presentation of adjusted segment income provides useful information to

investors, as it provides them with an additional relevant comparison of a

segment’s performance across periods. The most directly comparable GAAP

measure for adjusted segment income is segment income, which represents

segment income from continuing operations, including any special items and

mark-to-market impacts of economic hedges in the Commercial Power segment.

The following is a reconciliation of segment income, net income and diluted EPS to adjusted segment income, adjusted income and adjusted diluted EPS for

2013, 2012 and 2011:

Year Ended December 31, 2013

(in millions, except per share amounts)

Regulated

Utilities

International

Energy

Commercial

Power

Total

Reportable

Segments Other

Duke

Energy

Per

Diluted

Share

Adjusted segment income $ 2,776 $ 408 $ 15 $ 3,199 $ (128) $ 3,071 $ 4.35

Crystal River Unit 3 charges (215) — — (215) — (215) (0.31)

Costs to achieve Progress Energy merger — — — — (184) (184) (0.26)

Nuclear development charges (57) — — (57) — (57) (0.08)

Litigation reserve — — — — (14) (14) (0.02)

Economic hedges (Mark-to-market) — — (3) (3) — (3) (0.01)

Asset sales — — (15) (15) 65 50 0.07

Segment income (loss) $ 2,504 $ 408 $ (3) $ 2,909 $ (261) $ 2,648

Income from Discontinued Operations 17 0.02

Net Income Attributable to Duke Energy $ 2,665 $ 3.76

Year Ended December 31, 2012

(in millions, except per share amounts)

Regulated

Utilities

International

Energy

Commercial

Power

Total

Reportable

Segments Other

Duke

Energy

Per

Diluted

Share

Adjusted segment income $ 2,086 $ 439 $ 93 $2,618 $ (135) $ 2,483 $ 4.32

Edwardsport impairment and other charges (402) — — (402) — (402) (0.70)

Costs to achieve Progress Energy merger — — — — (397) (397) (0.70)

Economic hedges (Mark-to-market) — — (6) (6) — (6) (0.01)

Democratic National Convention Host Committee support — — — — (6) (6) (0.01)

Employee severance and office consolidation 60 — — 60 — 60 0.11

Segment income $ 1,744 $ 439 $ 87 $2,270 $ (538) 1,732

Income from Discontinued Operations 36 0.06

Net Income Attributable to Duke Energy $ 1,768 $ 3.07

Year Ended December 31, 2011

(in millions, except per share amounts)

Regulated

Utilities

International

Energy

Commercial

Power

Total

Reportable

Segments Other

Duke

Energy

Per

Diluted

Share

Adjusted segment income $ 1,316 $ 466 $186 $1,968 $ (25) $ 1,943 $ 4.38

Edwardsport impairment and other charges (135) — — (135) — (135) (0.30)

Emission allowance impairment — — (51) (51) — (51) (0.12)

Costs to achieve Progress Energy merger — — — — (51) (51) (0.12)

Economic hedges (Mark-to-market) — — (1) (1) — (1) (0.01)

Segment income $ 1,181 $ 466 $134 $1,781 $ (76) 1,705

Income from Discontinued Operations 1 —

Net Income Attributable to Duke Energy $ 1,706 $ 3.83