Duke Energy 2013 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

108

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

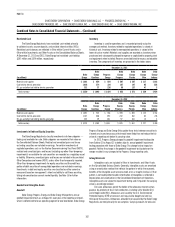

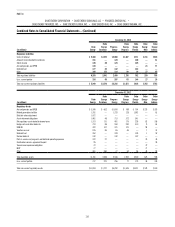

Accounting Charges Related to the Merger Consummation

The following pretax consummation charges were recognized upon closing

of the merger and are included in the Duke Energy Registrants’ Consolidated

Statements of Operations and Comprehensive Income for the year ended

December 31, 2012.

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

FERC Mitigation $117 $46 $71 $71 $— $— $—

Severance costs 196 63 82 55 27 21 18

Community support, charitable contributions and other 169 79 74 63 11 7 6

Total $482 $188 $227 $ 189 $ 38 $ 28 $ 24

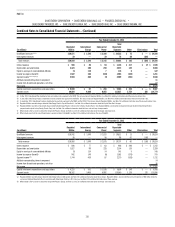

FERC Mitigation charges reect the portion of transmission project costs

probable of disallowance, impairment of the carrying value of the generation

assets serving Interim FERC Mitigation, and mark-to-market losses recognized

on power sale agreements upon closing of the merger. Charges related to

transmission projects and impairment of the carrying value of generation assets

were recorded within Impairment charges in the Consolidated Statements

of Operations. Mark-to-market losses on interim power sale agreements

was recorded in Regulated electric operating revenues in the Consolidated

Statements of Operations. Subsequent changes in fair value of interim

power sale agreements over the life of the contracts and realized gains or

losses on interim contract sales are also recorded within Regulated electric

operating revenues. The ability to successfully defend future recovery of a

portion of transmission projects in rates and any future changes to estimated

transmission project costs could impact the amount not expected to be

recovered.

In conjunction with the merger, in November 2011, Duke Energy and

Progress Energy each offered a voluntary severance plan (VSP) to certain eligible

employees. VSP and other severance costs incurred were recorded primarily

within Operation, maintenance and other in the Consolidated Statements of

Operations. See Note 19 for further information related to employee severance

expenses.

Community support, charitable contributions and other reect (i) the

unconditional obligation to provide funding at a level comparable to historic

practices over the next four years, and (ii) nancial and legal advisory costs

incurred upon the closing of the merger, retention and relocation costs paid to

certain employees. These charges were recorded within Operation, maintenance

and other in the Consolidated Statements of Operations.

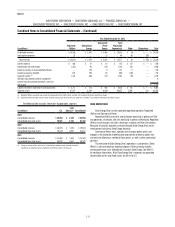

Impact of Merger

The impact of Progress Energy on Duke Energy’s revenues and net income

attributable to Duke Energy in the Consolidated Statements of Operations for

the year ended December 31, 2012 was an increase of $4,943 million and

$368 million, respectively.

Chilean Operations

In December 2012, Duke Energy acquired Iberoamericana de Energía

Ibener, S.A. (Ibener) of Santiago, Chile for cash consideration of $415 million.

This acquisition included the 140 Megawatt (MW) Duqueco hydroelectric

generation complex consisting of two run-of-the-river plants located in southern

Chile. Purchase price allocation consisted primarily of $383 million of property,

plant and equipment, $30 million of intangible assets, $57 million of deferred

income tax liabilities, $54 million of goodwill and $8 million of working capital.

In connection with the acquisition, a $190 million six-month bridge loan and

a $200 million revolving loan under a credit agreement were executed with a

commercial bank. Both loans were fully collateralized with cash deposits, and

therefore no net proceeds from the nancings existed as of December 31, 2012.

The $190 million bridge loan was classied in Current maturities of long-term

debt and the related cash collateral deposit was classied as Current Assets

on the Consolidated Balance Sheets as of December 31, 2012. The revolving

loan is classied as Long-term Debt and the related cash collateral deposit is

classied as Investments and Other Assets on the Consolidated Balance Sheets.

In April 2013, the six-month bridge loan executed in connection with the

acquisition was replaced with a nonrecourse secured credit facility with a term

of thirteen years, and the cash collateral related to the six-month bridge loan

was returned to Duke Energy. See Note 6 for additional discussion related to the

bridge loan conversion.

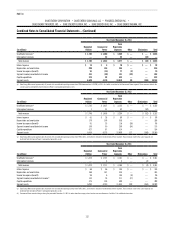

Midwest Generation Exit

On February 17, 2014, Duke Energy Ohio announced that it had initiated

a process to exit its nonregulated Midwest generation business. Considering

a marketing period of several months and potential regulatory approvals,

Duke Energy Ohio expects to dispose of the nonregulated Midwest generation

business by early to mid-2015. In the rst quarter of 2014, Duke Energy Ohio

will reclassify approximately $3.5 billion carrying value of its Midwest generation

business to assets held for sale and expects to record an estimated pretax

impairment charge of $1 billion to $2 billion to reduce the carrying value to

estimated sales proceeds less cost to sell.

Vermillion Generating Station

On January 12, 2012, after receiving approvals from the FERC and

IURC on August 12, 2011 and December 28, 2011, respectively, Duke Energy

Vermillion II, LLC (Duke Energy Vermillion), an indirect wholly owned subsidiary

of Duke Energy Ohio, completed the sale of its ownership interest in Vermillion

Generating Station (Vermillion) to Duke Energy Indiana and Wabash Valley

Power Association (WVPA). Upon closing of the sale, Duke Energy Indiana held

a 62.5 percent interest in Vermillion. Duke Energy Ohio received net proceeds of

$82 million, of which $68 million was paid by Duke Energy Indiana. Following

the transaction, Duke Energy Indiana retired Gallagher Units 1 and 3 effective

February 1, 2012.

As Duke Energy Indiana is an afliate of Duke Energy Vermillion, the

transaction was accounted for as a transfer between entities under common

control with no gain or loss recorded and did not have a signicant impact to

Duke Energy Ohio’s or Duke Energy Indiana’s results of operations. Proceeds

received from Duke Energy Indiana are included in Net proceeds from the