Duke Energy 2013 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

175

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

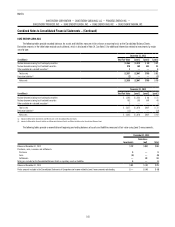

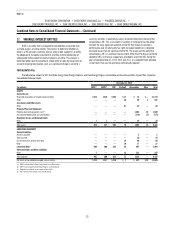

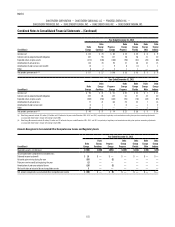

December 31, 2012

Duke Energy

(in millions) DukeNet Renewables

FPC

Capital I

Trust(c) Other Total

Duke

Energy

Ohio(a)

Duke

Energy

Indiana(b)

Receivables $ — $ — $ — $ — $ — $ 97 $116

Investments in equity method unconsolidated affiliates 118 147 — 27 292 — —

Intangibles — — — 104 104 104 —

Investments and other assets — — 9 2 11 —

Total assets 118 147 9 133 407 201 116

Other current liabilities — — — 3 3 — —

Deferred credits and other liabilities — — 319 17 336 — —

Total liabilities — — 319 20 339 — —

Net assets (liabilities) $ 118 $147 $ (310) $ 113 $ 68 $201 $116

(a) Reflects OVEC and retained interest in CRC.

(b) Reflects retained interest in CRC.

(c) The entire balance of Investments and other assets and $274 million of the Deferred Credits and Other Liabilities balance applies to Progress Energy.

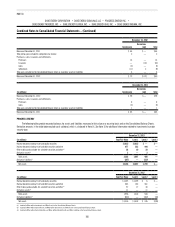

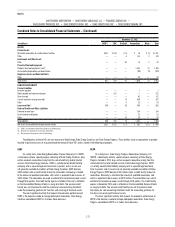

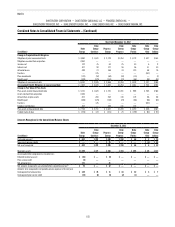

The Duke Energy Registrants are not aware of any situations where the

maximum exposure to loss significantly exceeds the carrying values shown

above except for the power purchase agreement with the Ohio Valley Electric

Corporation (OVEC), which is discussed below, and various guarantees,

reflected in the table above as Deferred credits and other liabilities.

DukeNet

Until December 31, 2013, Duke Energy owned a 50 percent ownership

interest in DukeNet. DukeNet was considered a VIE because it has entered

into certain contractual arrangements that provide it with additional forms of

subordinated financial support. The most significant activities that impacted

DukeNet’s economic performance relate to its business development and fiber

optic capacity marketing and management activities. The power to direct these

activities was jointly and equally shared by Duke Energy and the other joint

venture partner.

On December 31, 2013, Duke Energy completed the sale of its ownership

interest in DukeNet to Time Warner Cable, Inc. For more information on the sale

of DukeNet, refer to Note 12.

Renewables

Duke Energy has investments in various renewable energy project entities.

Some of these entities are VIEs due to power purchase agreements with terms

that approximate the expected life of the project. These fixed price agreements

effectively transfer commodity price risk to the buyer of the power. Duke Energy

does not consolidate these VIEs because power to direct and control key

activities is shared jointly by Duke Energy and other owners.

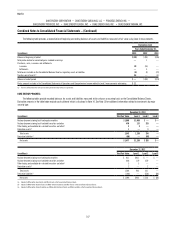

FPC Capital I Trust

At December 31, 2012, Progress Energy had variable interests in the

FPC Capital I Trust (the Trust). The Trust, a finance subsidiary, was established

for the sole purpose of issuing $300 million of 7.10% Cumulative QUIPS due

2039, and using the proceeds thereof to purchase $300 million of 7.10% Junior

Subordinated Deferrable Interest Notes due 2039 from Florida Progress Funding

Corporation (Funding Corp.). Funding Corp. was formed for the sole purpose of

providing financing to Duke Energy Florida. On February 1, 2013, Duke Energy

redeemed the QUIPS and subsequently terminated the Trust.

Other

The most significant of the Other non-consolidated VIEs is Duke Energy

Ohio’s 9 percent ownership interest in OVEC. Through its ownership interest

in OVEC, Duke Energy Ohio has a contractual arrangement to buy power from

OVEC’s power plants through June 2040. Proceeds from the sale of power

by OVEC to its power purchase agreement counterparties are designed to be

sufficient to meet its operating expenses, fixed costs, debt amortization and,

interest expense, as well as earn a return on equity. Accordingly, the value

of this contract is subject to variability due to fluctuations in power prices

and changes in OVEC’s costs of business, including costs associated with its

2,256 MW of coal-fired generation capacity. As discussed in Note 5, proposed

environmental rulemaking could increase the costs of OVEC, which would be

passed through to Duke Energy Ohio. The initial carrying value of this contract

was recorded as an intangible asset when Duke Energy acquired Cinergy in April

2006. This amount is included in the table above for Duke Energy and Duke

Energy Ohio.

In addition, Duke Energy has guaranteed performance of certain entities in

which it no longer has an equity interest.

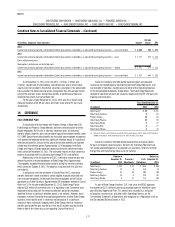

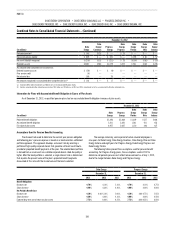

CRC

See discussion under Consolidated VIEs for additional information related

to CRC.

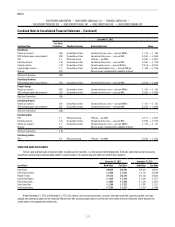

The subordinated notes held by Duke Energy Ohio and Duke Energy

Indiana are stated at fair value and are classified within Receivables in

their Consolidated Balance Sheets. Carrying values of retained interests are

determined by allocating carrying value of the receivables between assets sold

and interests retained based on relative fair value. The allocated basis of the

subordinated notes are not materially different than their face value because

(i) the receivables generally turnover in less than two months, (ii) credit losses are

reasonably predictable due to the broad customer base and lack of significant

concentration, and (iii) the equity in CRC is subordinate to all retained interests

and thus would absorb losses first. The hypothetical effect on fair value of the

retained interests assuming both a 10 percent and a 20 percent unfavorable

variation in credit losses or discount rates is not material due to the short

turnover of receivables and historically low credit loss history. Interest accrues

to Duke Energy Ohio and Duke Energy Indiana on the retained interests using the

acceptable yield method. This method generally approximates the stated rate