Duke Energy 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

PART II

Partially offset by:

• A $42 million decrease in regulated fuel expense driven primarily by

lower purchased power expense and reduced volumes, partially offset by

higher fuel costs.

Other Income and Expenses, net. The decrease was primarily due to

lower AFUDC equity and lower interest income.

Interest Expense. The decrease was primarily due to lower average debt

balances in 2013 compared to 2012.

Income Tax Expense. The variance was primarily due to a decrease

in pretax income. The effective tax rates for the years ended December 31,

2013 and 2012 were 42.2 percent and 36 percent, respectively. The change in

the effective tax rate was primarily due to a decrease in pretax income and a

decrease in the manufacturing deduction in 2013.

Matters Impacting Future Duke Energy Ohio Results

On February 17, 2014, Duke Energy Ohio announced that it had initiated

a process to exit its nonregulated Midwest generation business. Considering

a marketing period of several months and potential regulatory approvals,

Duke Energy Ohio expects to dispose of the nonregulated Midwest generation

business by early to mid-2015. In the first quarter of 2014, Duke Energy Ohio

will reclassify approximately $3.5 billion carrying value of its Midwest generation

business to assets held for sale and expects to record an estimated pretax

impairment charge of $1 billion to $2 billion to reduce the carrying value to

estimated sales proceeds less cost to sell.

In 2013, a FERC Administrative Law Judge issued an initial decision

holding that Duke Energy Ohio is responsible for certain MVP costs, a type of

MTEP cost, approved by MISO prior to the date of Duke Energy Ohio’s withdrawal.

The initial decision will be reviewed by FERC. If FERC upholds the initial decision,

Duke Energy Ohio intends to file an appeal in federal court. If Duke Energy Ohio

ultimately is found to be responsible for these costs, a portion of these costs

may not be eligible for recovery, resulting in an adverse impact to its financial

position, results of operations and cash flows. See Note 4 to the Consolidated

Financial Statements, “Regulatory Matters,” for additional information.

DUKE ENERGY INDIANA

Introduction

Management’s Discussion and Analysis should be read in conjunction with

the accompanying Consolidated Financial Statements and Notes for the years

ended December 31, 2013, 2012, and 2011.

Basis of Presentation

The results of operations and variance discussion for Duke Energy

Indiana is presented in a reduced disclosure format in accordance with General

Instruction (I)(2)(a) of Form 10-K.

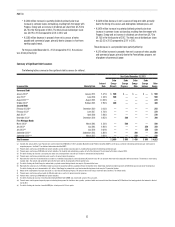

Results of Operations

Years Ended December 31,

(in millions) 2013 2012 Variance

Operating Revenues $2,926 $ 2,717 $ 209

Operating Expenses 2,193 2,792 (599)

Operating Income (Loss) 733 (75) 808

Other Income and Expense, net 18 90 (72)

Interest Expense 170 138 32

Income (Loss) Before Income Taxes 581 (123) 704

Income Tax Expense (Benefit) 223 (73) 296

Net Income (Loss) $ 358 $ (50) $ 408

The following table shows the percent changes in GWh sales and average number of customers for Duke Energy Indiana. The below percentages for retail

customer classes represent billed sales only. Total sales includes billed and unbilled retail sales, and wholesale sales to incorporated municipalities and to public and

private utilities and power marketers. Amounts are not weather normalized.

Increase (decrease) over prior year 2013 2012

Residential sales 3.2 % (4.8)%

General service sales 0.5 % (0.5)%

Industrial sales (0.3)% 1.7 %

Wholesale power sales (1.4)% 7.9 %

Total sales 0.4 % 1.2 %

Average number of customers 0.7 % 0.6 %