Duke Energy 2013 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

124

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

Coverage continues at 100 percent of the weekly limits for 52 weeks and

80 percent of the weekly limits for the next 110 weeks.

The Catawba units are insured for up to $4 million per week. The McGuire

units are insured for up to $4 million per week. The Oconee units are insured for

up to $3 million per week. The Brunswick units are insured for up to $3 million

per week. The Harris unit is insured for up to $3 million per week. The Robinson

unit is insured for up to $2 million per week. The accidental outage policy limit

is $490 million for McGuire and Catawba, $378 million for Oconee, $406 million

for Brunswick, $364 million for Harris, and $308 million for Robinson.

NEIL sublimits the accidental outage recovery to the rst 104 weeks

of coverage not to exceed $328 million from non-nuclear accidental

property damage.

Potential Retroactive Premium Assessments

In the event of NEIL losses, NEIL’s board of directors may assess member

companies retroactive premiums of amounts up to 10 times their annual

premiums for up to six years after a loss. The current potential maximum

assessments for Duke Energy Carolinas are $42 million for primary property

insurance, $36 million for excess property insurance and $29 million for

accidental outage insurance. The current potential maximum assessments

for Duke Energy Progress are $33 million for primary property insurance,

$32 million for excess property insurance and $14 million for accidental outage

insurance. The current potential maximum assessments for Duke Energy Florida

are $6 million for primary property insurance and $4 million for excess property

insurance.

The maximum assessment amounts include 100 percent of Duke

Energy Carolinas’, Duke Energy Progress’, and Duke Energy Florida’s potential

obligations to NEIL for their share of jointly owned reactors. However, the other

joint owners of the jointly owned reactors are obligated to assume their pro rata

share of liability for retrospective premiums and other premium assessments

resulting from the Price-Anderson Act’s excess secondary nancial protection

program of risk pooling, or from the NEIL policies.

ENVIRONMENTAL

Duke Energy is subject to international, federal, state, and local

regulations regarding air and water quality, hazardous and solid waste disposal,

and other environmental matters. The Subsidiary Registrants are subject to

federal, state, and local regulations regarding air and water quality, hazardous

and solid waste disposal and other environmental matters. These regulations

can be changed from time to time, imposing new obligations on the Duke Energy

Registrants.

The following environmental matters impact all of the Duke

Energy Registrants.

Remediation Activities

The Duke Energy Registrants are responsible for environmental

remediation at various contaminated sites. These include some properties

that are part of ongoing operations and sites formerly owned or used by Duke

Energy entities. These sites are in various stages of investigation, remediation,

and monitoring. Managed in conjunction with relevant federal, state, and

local agencies, activities vary with site conditions and locations, remediation

requirements, complexity, and sharing of responsibility. If remediation activities

involve joint and several liability provisions, strict liability, or cost recovery

or contribution actions, the Duke Energy Registrants could potentially be held

responsible for contamination caused by other potentially responsible parties,

and may also benet from insurance policies or contractual indemnities that

cover some or all cleanup costs. Liabilities are recorded when losses become

probable and are reasonably estimable. The total costs that may be incurred

cannot be estimated because the extent of environmental impact, allocation

among potentially responsible parties, remediation alternatives, and/or

regulatory decisions has not yet been determined. Additional costs associated

with remediation activities are likely to be incurred in the future and could be

signicant. Costs are typically expensed as Operation, maintenance and other

in the Consolidated Statements of Operations unless regulatory recovery of the

costs is deemed probable.

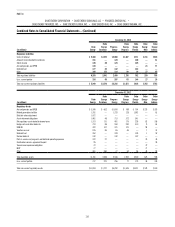

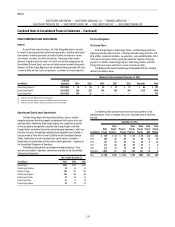

The following table contains information regarding reserves for probable

and estimable costs related to the various environmental sites. These reserves

are recorded in Other within Deferred Credits and Other Liabilities on the

Consolidated Balance Sheets.

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Balance at December 31, 2010 $ 88 $13 $ 35 $12 $ 23 $ 50 $11

Provisions / adjustments 6 — 10 1 9 5 1

Cash reductions (33) (1) (22) (2) (20) (27) (3)

Balance at December 31, 2011 61 12 23 11 12 28 9

Provisions / adjustments 39 1 19 5 14 5 3

Cash reductions (25) (1) (9) (2) (7) (18) (4)

Balance at December 31, 2012 75 12 33 14 19 15 8

Provisions / adjustments 26 — 4 (1) 5 20 1

Cash reductions (22) (1) (10) (5) (5) (8) (2)

Balance at December 31, 2013 $ 79 $ 11 $ 27 $ 8 $ 19 $ 27 $ 7