Duke Energy 2013 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

PART II

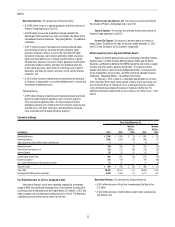

Other

Years Ended December 31,

(in millions) 2013 2012

Variance

2013 vs.

2012 2011

Variance

2012 vs.

2011

Operating Revenues $ 163 $ 74 $ 89 $ 44 $ 30

Operating Expenses 461 704 (243) 133 571

(Losses) Gains on Sales of Other Assets and Other, net (3) (7) 4 (8) 1

Operating Loss (301) (637) 336 (97) (540)

Other Income and Expense, net 131 16 115 49 (33)

Interest Expense 417 297 120 157 140

Loss Before Income Taxes (587) (918) 331 (205) (713)

Income Tax Benefit (323) (378) 55 (114) (264)

Less: Loss Attributable to Noncontrolling Interests (3) (2) (1) (15) 13

Net Expense $ (261) $ (538) $ 277 $ (76) $(462)

Year Ended December 31, 2013 as Compared to 2012

Other’s results were positively impacted by lower charges related to the

Progress Energy merger, the sale of DukeNet, and increased current year activity

from mitigation sales related to the Progress Energy merger. These impacts were

partially offset by increased interest expense, lower income tax benefit and the

Crescent Resources LLC (Crescent) litigation reserve in 2013. The following is a

detailed discussion of the variance drivers by line item.

Operating Revenues. The variance was driven primarily by increased

activity from mitigation sales related to the Progress Energy merger and higher

premiums earned at Bison as a result of the addition of Progress Energy.

Operating Expenses. The variance was driven primarily by lower charges

related to the Progress Energy merger, and prior year donations, partially offset

by the Crescent litigation reserve in 2013 and unfavorable loss experience at

Bison as a result of the addition of Progress Energy.

Other Income and Expense, net. The variance was driven primarily

by a gain on the sale of Duke Energy’s 50 percent ownership in DukeNet in 2013.

Interest Expense. The variance was due primarily to the inclusion of

Progress Energy for the first six months of 2013 and additional debt issuances.

Income Tax Benefit. The variance was primarily due to a decrease in

pretax loss. The effective tax rates for the years ended December 31, 2013 and

2012 were 55.1 percent and 41.1 percent, respectively.

Year Ended December 31, 2012 as Compared to 2011

Other’s results were negatively impacted by charges related to the

Progress Energy merger and higher interest expense. These negative impacts

were partially offset by higher income tax benefit due to increased net expense

and higher returns on investments that support benefit obligations. The following

is a detailed discussion of the variance drivers by line item.

Operating Revenues. The variance was driven primarily by higher

premiums earned at Bison as a result of the addition of Progress Energy and

mark-to-market activity at Duke Energy Trading and Marketing, LLC (DETM).

Operating Expenses. The variance was driven primarily by charges

related to the Progress Energy merger and higher current year donations. These

negative impacts were partially offset by lower JV costs related to DETM.

Other Income and Expense, net. The variance was driven primarily by

current year impairments and prior year gains on sales of investments, higher

interest income recorded in 2011 following the resolution of certain income

tax matters related to prior years and reversal of reserves related to certain

guarantees Duke Energy had issued on behalf of Crescent in 2011. These

negative impacts were partially offset by higher returns on investments that

support benefit obligations.

Interest Expense. The variance was due primarily to higher debt balances

as a result of debt issuances and the inclusion of Progress Energy interest

expense beginning in July 2012.

Income Tax Benefit. The variance is primarily due to an increase in

pretax loss. The effective tax rates for the years ended December 31, 2012 and

2011 were 41.1 percent and 56.0 percent, respectively.

Matters Impacting Future Other Results

Duke Energy previously held an effective 50 percent interest in Crescent.

Crescent was a real estate joint venture formed by Duke Energy in 2006 that

filed for Chapter 11 bankruptcy protection in June 2009. On June 9, 2010,

Crescent restructured and emerged from bankruptcy and Duke Energy forfeited

its entire 50 percent ownership interest to Crescent debt holders. This forfeiture

caused Duke Energy to recognize a loss, for tax purposes, on its interest in

the second quarter of 2010. Although Crescent has reorganized and emerged

from bankruptcy with creditors owning all Crescent interest, there remains

uncertainty as to the tax treatment associated with the restructuring. Based on

this uncertainty, it is possible that Duke Energy could incur a future tax liability

related to the tax losses associated with its partnership interest in Crescent and

the resolution of issues associated with Crescent’s emergence from bankruptcy.