Duke Energy 2013 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

116

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

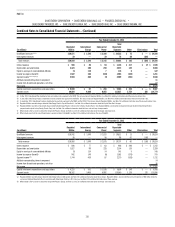

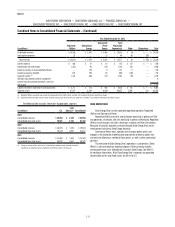

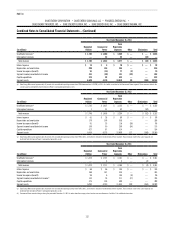

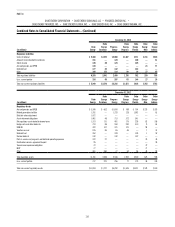

Combined Notes to Consolidated Financial Statements – (Continued)

Storm reserve. Duke Energy Carolinas and Duke Energy Florida are

allowed to petition the PSCSC and FPSC, respectively, to seek recovery of named

storms. Funds are used to offset future incurred costs.

RESTRICTIONS ON THE ABILITY OF CERTAIN SUBSIDIARIES TO MAKE

DIVIDENDS, ADVANCES AND LOANS TO DUKE ENERGY

As a condition to the approval of merger transactions, the NCUC, PSCSC,

PUCO, KPSC, and IURC imposed conditions on the ability of Duke Energy

Carolinas, Duke Energy Progress, Duke Energy Ohio, Duke Energy Kentucky

and Duke Energy Indiana to transfer funds to Duke Energy through loans

or advances, as well as restricted amounts available to pay dividends to

Duke Energy. Certain subsidiaries may transfer funds to the parent by obtaining

approval of the respective state regulatory commissions. These conditions

imposed restrictions on the ability of the public utility subsidiaries to pay cash

dividends as discussed below.

Duke Energy Progress and Duke Energy Florida also have restrictions

imposed by their rst mortgage bond indentures and Articles of Incorporation

which, in certain circumstances, limited their ability to make cash dividends

or distributions on common stock. Amounts restricted as a result of these

provisions were not material at December 31, 2013.

Additionally, certain other subsidiaries of Duke Energy have restrictions

on their ability to dividend, loan or advance funds to Duke Energy due to specic

legal or regulatory restrictions, including, but not limited to, minimum working

capital and tangible net worth requirements.

Duke Energy Carolinas

Duke Energy Carolinas must limit cumulative distributions subsequent to

mergers to (i) the amount of retained earnings on the day prior to the closing of

the mergers, plus (ii) any future earnings recorded.

Duke Energy Progress

Duke Energy Progress must limit cumulative distributions subsequent

to the merger between Duke Energy and Progress Energy to (i) the amount of

retained earnings on the day prior to the closing of the merger, plus (ii) any

future earnings recorded.

Duke Energy Ohio

Duke Energy Ohio will not declare and pay dividends out of capital or

unearned surplus without the prior authorization of the PUCO. Duke Energy Ohio

received FERC and PUCO approval to pay dividends from its equity accounts

that are reective of the amount that it would have in its retained earnings

account had push-down accounting for the Cinergy Corp. (Cinergy) merger not

been applied to Duke Energy Ohio’s balance sheet. The conditions include a

commitment from Duke Energy Ohio that equity, adjusted to remove the impacts

of push-down accounting, will not fall below 30 percent of total capital.

Duke Energy Kentucky is required to pay dividends solely out of retained

earnings and to maintain a minimum of 35 percent equity in its capital

structure.

Duke Energy Indiana

Duke Energy Indiana must limit cumulative distributions subsequent

to the merger between Duke Energy and Cinergy to (i) the amount of retained

earnings on the day prior to the closing of the merger, plus (ii) any future

earnings recorded. In addition, Duke Energy Indiana will not declare and pay

dividends out of capital or unearned surplus without prior authorization of the

IURC.

The restrictions discussed above were less than 25 percent of Duke

Energy’s net assets at December 31, 2013.

RATE RELATED INFORMATION

The NCUC, PSCSC, FPSC, IURC, PUCO and KPSC approve rates for retail

electric and gas services within their states. Nonregulated sellers of gas and

electric generation are also allowed to operate in Ohio once certied by the

PUCO. The FERC approves rates for electric sales to wholesale customers

served under cost-based rates (excluding Ohio and Indiana), as well as sales of

transmission service.

Duke Energy Carolinas

2013 North Carolina Rate Case

On September 24, 2013, the NCUC approved a settlement agreement

related to Duke Energy Carolinas’ request for a rate increase with minor

modications. The North Carolina Utilities Commission Public Staff (Public

Staff) was a party to the settlement agreement. The parties agreed to a three-

year step-in rate increase, with the rst two years providing for $204 million, or

a 4.5 percent average increase in rates, and the third year providing for rates

to be increased by an additional $30 million, or 0.6 percent. The agreement

is based upon a return on equity of 10.2 percent and an equity component of

the capital structure of 53 percent. The settlement agreement (i) allows for

the recognition of nuclear outage expenses over the refueling cycle rather than

when the outage occurs, (ii) a $10 million shareholder contribution to agencies

that provide energy assistance to low-income customers, and (iii) an annual

reduction in the regulatory liability for costs of removal of $30 million for each of

the rst two years. Duke Energy Carolinas also agreed not to request additional

base rate increases to be effective before September 2015. New rates went into

effect on September 25, 2013.

On October 23, 2013, the North Carolina Attorney General (NCAG)

appealed the rate of return and capital structure approved in the agreement. On

October 24, 2013, the NC Waste Awareness and Reduction Network (NC WARN)

also appealed various matters in the settlement. On December 11, 2013, Duke

Energy Carolinas and Duke Energy Progress, along with the Public Staff, led a

Motion to Consolidate this appeal with other North Carolina rate case appeals

involving Duke Energy Carolinas and Duke Energy Progress. Both the NCAG

and NC WARN led responses with the North Carolina Supreme Court (NCSC)

contesting consolidation. All parties are awaiting a ruling from the NCSC. Duke

Energy Carolinas cannot predict the outcome of this matter.

2013 South Carolina Rate Case

On September 11, 2013, the PSCSC approved a settlement agreement

related to Duke Energy Carolinas’ request for a rate increase. Parties to the

settlement agreement were the Ofce of Regulatory Staff, Wal-Mart Stores East,

LP and Sam’s East, Incorporated, the South Carolina Energy Users Committee,

Public Works of the City of Spartanburg, South Carolina and the South Carolina

Small Business Chamber of Commerce. The parties agreed to a two-year step-in

rate increase, with the rst year providing for approximately $80 million, or a

5.5 percent average increase in rates, and the second year providing for rates

to be increased by an additional $38 million, or 2.6 percent. The settlement

agreement is based upon a return on equity of 10.2 percent and a 53 percent

equity component of the capital structure. The settlement agreement (i) allows

for the recognition of nuclear outage expenses over the refueling cycle rather