Duke Energy 2013 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

122

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

Over the course of construction of the project, Duke Energy Indiana

recorded pretax charges of approximately $897 million related to the

Edwardsport project, including the settlement agreement discussed above.

Of this amount, pretax impairment and other charges of $631 million were

recorded during the year ended December 31, 2012. These charges were

recorded in Impairment charges and Operations, maintenance and other

on Duke Energy Indiana’s Consolidated Statements of Operations and

Comprehensive Income.

The Joint Intervenors appealed the IURC order approving the 2012

Edwardsport settlement and other related regulatory orders to the Indiana Court

of Appeals. A nal decision is anticipated mid-2014.

The project was placed in commercial operation in June 2013. Costs for

the Edwardsport IGCC plant are recovered from retail electric customers via a

tracking mechanism, the IGCC Rider.

OTHER REGULATORY MATTERS

Merger Appeals

On January 9, 2013, the City of Orangeburg and NC WARN appealed the

NCUC’s approval of the merger between Duke Energy and Progress Energy.

On April 29, 2013, the NCUC granted Duke Energy’s motion to dismiss certain

exceptions contained in NC WARN’s appeal. On November 6, 2013, the North

Carolina Court of Appeals heard oral arguments on the appeals. A decision from

the North Carolina Court of Appeals is pending.

Progress Energy Merger FERC Mitigation

In June 2012, the FERC approved the merger with Progress Energy,

including Duke Energy and Progress Energy’s revised market power mitigation

plan, the Joint Dispatch Agreement (JDA) and the joint Open Access

Transmission Tariff. The revised market power mitigation plan provides for the

acceleration of one transmission project and the completion of seven other

transmission projects (Long-term FERC Mitigation) and interim rm power sale

agreements during the completion of the transmission projects (Interim FERC

Mitigation). The Long-term FERC Mitigation is expected to increase power

imported into the Duke Energy Carolinas and Duke Energy Progress service

areas and enhance competitive power supply options in the service areas.

These projects are expected to be completed in 2014. On August 8, 2012, FERC

granted certain intervenors’ request for rehearing for further consideration.

Following the closing of the merger, outside counsel reviewed Duke

Energy’s mitigation plan and discovered a technical error in the calculations.

On December 6, 2013, Duke Energy submitted a ling with the FERC disclosing

the error and arguing that no additional mitigation is necessary. On February 4,

2014, The City of New Bern, North Carolina led comments to Duke Energy’s

ling. Duke Energy’s response to New Bern was led on February 19, 2014.

Duke Energy cannot predict the outcome of this matter.

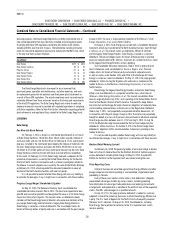

Planned and Potential Coal Plant Retirements

The Subsidiary Registrants periodically le Integrated Resource Plans

(IRP) with their state regulatory commissions. The IRPs provide a view of

forecasted energy needs over a 10-20 year period, and options being considered

to meet those needs. The IRPs led by the Subsidiary Registrants in 2013, 2012

and 2011 included planning assumptions to potentially retire certain coal-red

generating facilities in South Carolina, Florida, Indiana and Ohio earlier than

their current estimated useful lives. The facilities do not have the requisite

emission control equipment, primarily to meet EPA regulations that are not

yet effective.

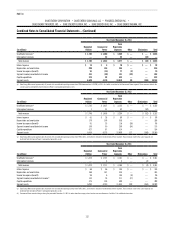

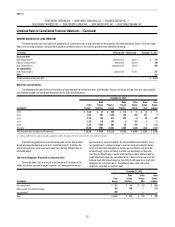

The table below contains the net carrying value of generating facilities

planned for early retirement or being evaluated for potential retirement included

in Property, plant and equipment, net on the Consolidated Balance Sheets.

December 31, 2013

Duke

Energy

Duke

Energy

Carolinas(b)

Progress

Energy(c)

Duke

Energy

Florida(c)

Duke

Energy

Ohio(d)

Duke

Energy

Indiana(e)

Capacity (in MW) 2,447 200 873 873 706 668

Remaining net

book value

(in millions)(a) $ 260 $ 14 $ 113 $ 113 $ 10 $ 123

(a) Included in Property, plant and equipment, net as of December 31, 2013, on the Consolidated Balance

Sheets.

(b) Includes Lee Units 1 and 2. Excludes 170 MW Lee Unit 3 that is expected to be converted to gas in 2014.

Duke Energy Carolinas expects to retire or convert these units by December 2020 in conjunction with a

settlement agreement associated with the Cliffside Unit 6 air permit.

(c) Includes Crystal River Units 1 and 2.

(d) Includes Beckjord Units 4 through 6 and Miami Fort Unit 6. 150 MW Beckjord Station Unit 4 was retired

on February 17, 2014. Beckjord units have no remaining book value.

(e) Includes Wabash River Units 2 through 6. Wabash River Unit 6 is being evaluated for potential conversion

to gas. Duke Energy Indiana committed to retire or convert these units by June 2018 in conjunction with a

settlement agreement associated with the Edwardsport air permit.

Duke Energy continues to evaluate the potential need to retire these

coal-red generating facilities earlier than the current estimated useful lives,

and plans to seek regulatory recovery for amounts that would not be otherwise

recovered when any of these assets are retired. However, such recovery,

including recovery of carrying costs on remaining book values, could be subject

to future regulatory approvals and therefore cannot be assured.

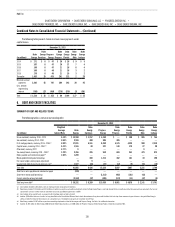

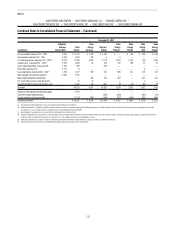

5. COMMITMENTS AND CONTINGENCIES

GENERAL INSURANCE

The Duke Energy Registrants have insurance and reinsurance coverage

either directly or through indemnication from Duke Energy’s captive insurance

company, Bison, and its afliates, consistent with companies engaged in

similar commercial operations with similar type properties. The Duke Energy

Registrants’ coverage includes (i) commercial general liability coverage

for liabilities arising to third parties for bodily injury and property damage;

(ii) workers’ compensation; (iii) automobile liability coverage; and (iv) property

coverage for all real and personal property damage. Real and personal property

damage coverage excludes electric transmission and distribution lines, but

includes damages arising from boiler and machinery breakdowns, earthquakes,

ood damage and extra expense, but not outage or replacement power

coverage. All coverage is subject to certain deductibles or retentions, sublimits,

exclusions, terms and conditions common for companies with similar types of

operations.

The Duke Energy Registrants self-insure their electric transmission and

distribution lines against loss due to storm damage and other natural disasters.

As discussed further in Note 4, Duke Energy Florida maintains a storm damage

reserve and has a regulatory mechanism to recover the cost of named storms

on an expedited basis.