Duke Energy 2013 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

127

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

It is not possible to predict whether Duke Energy will incur any liability or

to estimate the damages, if any, it might incur in connection with the remaining

matters. However, based on Duke Energy’s past experiences with similar cases

of this nature, it does not believe its exposure under these remaining matters

is material.

Crescent Resources Litigation

On September 3, 2010, the Crescent Resources (Crescent) Litigation Trust

sued Duke Energy along with various afliates and several individuals, including

current and former employees of Duke Energy, in the U.S. Bankruptcy Court for

the Western District of Texas.

On November 15, 2013 the parties reached a settlement. Duke Energy

recorded a net pretax charge of $22 million to Operations, maintenance and

other in its Consolidated Statements of Operations related to the settlement

in 2013.

Brazil Expansion Lawsuit

On August 9, 2011, the State of São Paulo sued Duke Energy International

Geracao Paranapenema S.A. (DEIGP) in Brazilian state court. The lawsuit claims

DEIGP is under a continuing obligation to expand installed generation capacity

in the State of São Paulo by 15 percent pursuant to a stock purchase agreement

under which DEIGP purchased generation assets from the state. On August 10,

2011, a judge granted an ex parte injunction ordering DEIGP to present a

detailed expansion plan in satisfaction of the 15 percent obligation. DEIGP has

previously taken a position the expansion obligation is no longer viable given

changes that have occurred in the electric energy sector since privatization.

DEIGP submitted its proposed expansion plan on November 11, 2011, but

reserved objections regarding enforceability. No trial date has been set. It is not

possible to predict whether Duke Energy will incur any liability or to estimate the

damages, if any, it might incur in connection with this matter.

Duke Energy Carolinas

New Source Review (NSR)

In 1999-2000, the U.S. Department of Justice (DOJ) on behalf of the EPA

led a number of complaints and notices of violation against multiple utilities,

including Duke Energy Carolinas, for alleged violations of the NSR provisions of

the CAA. The government alleges the utilities violated the CAA by not obtaining

permits for certain projects undertaken at certain coal plants or installing

the best available emission controls for SO2, NOx and particulate matter. The

complaints seek the installation of pollution control technology on various

generating units that allegedly violated the CAA, and unspecied civil penalties

in amounts of up to $37,500 per day for each violation. Duke Energy Carolinas

asserts there were no CAA violations because the applicable regulations do

not require permitting in cases where the projects undertaken are “routine” or

otherwise do not result in a net increase in emissions.

In 2000, the government sued Duke Energy Carolinas in the U.S. District

Court in Greensboro, North Carolina. The EPA claims 29 projects performed at

25 of Duke Energy Carolinas’ coal-red units violate the NSR provisions. Duke

Energy Carolinas asserts the projects were routine or not projected to increase

emissions. The parties led a stipulation in which the United States dismissed

with prejudice 16 claims. In exchange, Duke Energy Carolinas dismissed certain

afrmative defenses. The parties led opposing motions for summary judgment

on the remaining claims. In November 2013, the Court denied Duke Energy’s

motion for summary judgment. A decision on the DOJ’s motion for summary

judgment remains pending. Duke Energy requested leave to le another motion

for summary judgment on alternative grounds. That motion for leave, as well as

the Plaintiff’s motion for summary judgment, remains pending.

It is not possible to predict whether Duke Energy Carolinas will incur any

liability or to estimate the damages, if any, it might incur in connection with this

matter. Ultimate resolution of these matters could have a material effect on the

results of operations, cash ows or nancial position of Duke Energy Carolinas.

However, the appropriate regulatory recovery will be pursued for costs incurred

in connection with such resolution.

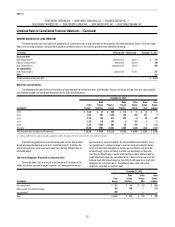

Asbestos-related Injuries and Damages Claims

Duke Energy Carolinas has experienced numerous claims for

indemnication and medical cost reimbursement related to asbestos exposure.

These claims relate to damages for bodily injuries alleged to have arisen from

exposure to or use of asbestos in connection with construction and maintenance

activities conducted on its electric generation plants prior to 1985. As of

December 31, 2013, there were 96 asserted claims for non-malignant cases

with the cumulative relief sought of up to $24 million, and 31 asserted claims

for malignant cases with the cumulative relief sought of up to $11 million.

Based on Duke Energy Carolinas’ experience, it is expected that the ultimate

resolution of most of these claims likely will be less than the amount claimed.

Duke Energy Carolinas has recognized asbestos-related reserves of

$616 million at December 31, 2013 and $751 million at December 31, 2012.

These reserves are classied in Other within Deferred Credits and Other Liabilities

and Other within Current Liabilities on the Consolidated Balance Sheets. These

reserves are based upon the minimum amount of the range of loss for current

and future asbestos claims through 2033, are recorded on an undiscounted basis

and incorporate anticipated ination. It is possible Duke Energy Carolinas may

incur asbestos liabilities in excess of the recorded reserves.

Duke Energy Carolinas has third-party insurance to cover certain

losses related to asbestos-related injuries and damages above an aggregate

self-insured retention of $476 million. Duke Energy Carolinas’ cumulative

payments began to exceed the self-insurance retention in 2008. Future

payments up to the policy limit will be reimbursed by the third-party insurance

carrier. The insurance policy limit for potential future insurance recoveries

indemnication and medical cost claim payments is $897 million in excess of the

self-insured retention. Receivables for insurance recoveries were $649 million

at December 31, 2013 and $781 million at December 31, 2012. These amounts

are classied in Other within Investments and Other Assets and Receivables

on the Consolidated Balance Sheets. Duke Energy Carolinas is not aware of any

uncertainties regarding the legal sufciency of insurance claims. Duke Energy

Carolinas believes the insurance recovery asset is probable of recovery as the

insurance carrier continues to have a strong nancial strength rating.

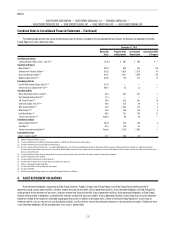

Progress Energy

Synthetic Fuels Matters

Progress Energy and a number of its subsidiaries and afliates are

defendants in lawsuits arising out of a 1999 Asset Purchase Agreement. Parties

to the Asset Purchase Agreement include U.S. Global, LLC (Global) and afliates

of Progress Energy.

In a case led in the Circuit Court for Broward County, Florida, in March

2003 (the Florida Global Case), Global requested an unspecied amount of

compensatory damages, as well as declaratory relief. In November 2009,

the court ruled in favor of Global. In December 2009, Progress Energy made