Duke Energy 2013 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2013 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

132

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

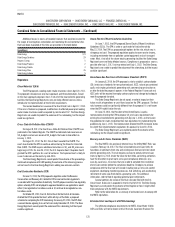

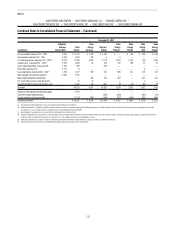

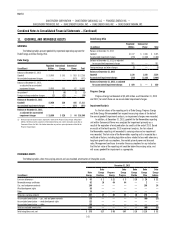

CURRENT MATURITIES OF LONG-TERM DEBT

The following table shows the signicant components of Current maturities of long-term debt on the respective Consolidated Balance Sheets. The Duke Energy

Registrants currently anticipate satisfying these obligations primarily with cash on hand and proceeds from additional borrowings.

(in millions) Maturity Date Interest Rate December 31, 2013

Unsecured Debt

Duke Energy (Parent) February 2014 6.300 %$ 750

Progress Energy (Parent) March 2014 6.050 % 300

Duke Energy (Parent) September 2014 3.950 % 500

Tax-exempt Bonds

Duke Energy Progress January 2014 0.105 % 167

Other 387

Current maturities of long-term debt $ 2,104

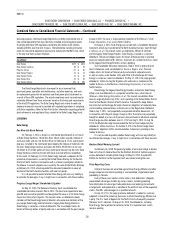

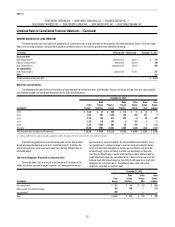

Maturities and Call Options

The following table shows the annual maturities of long-term debt for the next ve years and thereafter. Amounts presented exclude short-term notes payable

and commercial paper and money pool borrowings for the Subsidiary Registrants.

December 31, 2013

(in millions)

Duke

Energy(a)

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

2014 $ 2,104 $ 47 $ 485 $ 174 $ 11 $ 47 $ 5

2015 2,634 507 1,264 702 562 157 5

2016 2,975 756 614 302 12 56 480

2017 1,342 116 265 3 262 2 3

2018 3,235 1,505 603 59 544 3 153

Thereafter 25,899 5,505 10,884 3,995 3,495 1,923 3,150

Total long-term debt, including current maturities $ 38,189 $ 8,436 $ 14,115 $ 5,235 $ 4,886 $ 2,188 $ 3,796

(a) Excludes $2,067 million in purchase accounting adjustments related to the merger with Progress Energy. See Note 2 for additional information.

The Duke Energy Registrants have the ability under certain debt facilities

to call and repay the obligation prior to its scheduled maturity. Therefore, the

actual timing of future cash repayments could be materially different than as

presented above.

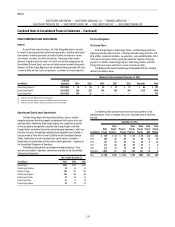

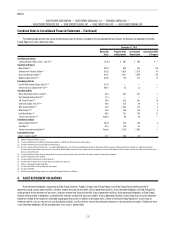

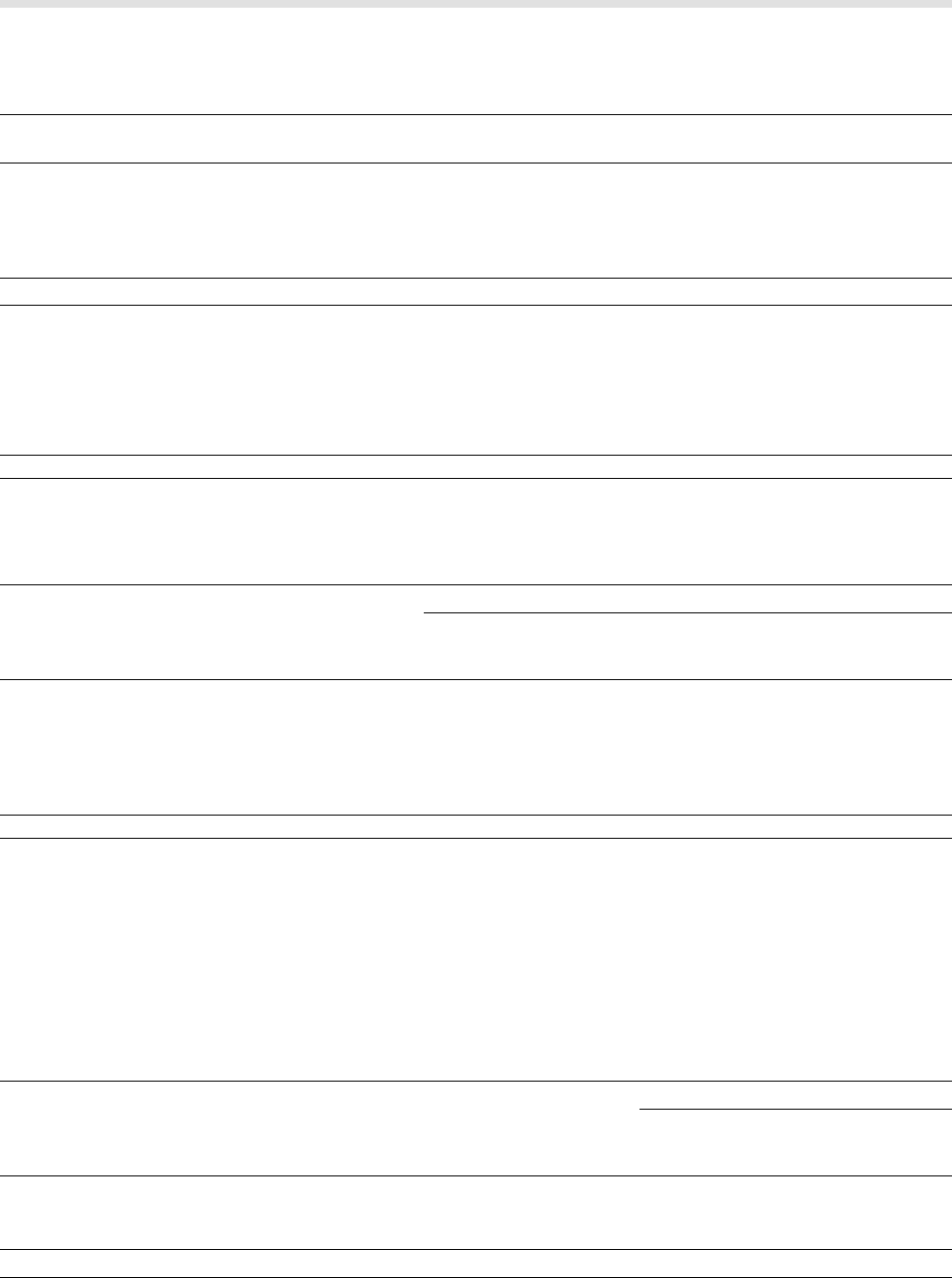

Short-term Obligations Classified as Long-term Debt

Tax-exempt bonds that may be put to the Company at the option of the

holder and certain commercial paper issuances and money pool borrowings

are classied as Long-term debt on the Consolidated Balance Sheets. These

tax-exempt bonds, commercial paper issuances and money pool borrowings,

which are short-term obligations by nature, are classied as long term due

to Duke Energy’s intent and ability to utilize such borrowings as long-term

nancing. As Duke Energy’s master credit facility and other bilateral letter of

credit agreements have non-cancelable terms in excess of one year as of the

balance sheet date, Duke Energy has the ability to renance these short-term

obligations on a long-term basis. The following tables show short-term

obligations classied as long-term debt.

December 31, 2013

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Duke

Energy

Ohio

Duke

Energy

Indiana

Tax-exempt bonds $ 471 $ 75 $ 111 $ 285

Notes payable and commercial paper 450 300 — 150

Secured debt(a) 200 — — —

Total $ 1,121 $ 375 $ 111 $ 435